Answered step by step

Verified Expert Solution

Question

1 Approved Answer

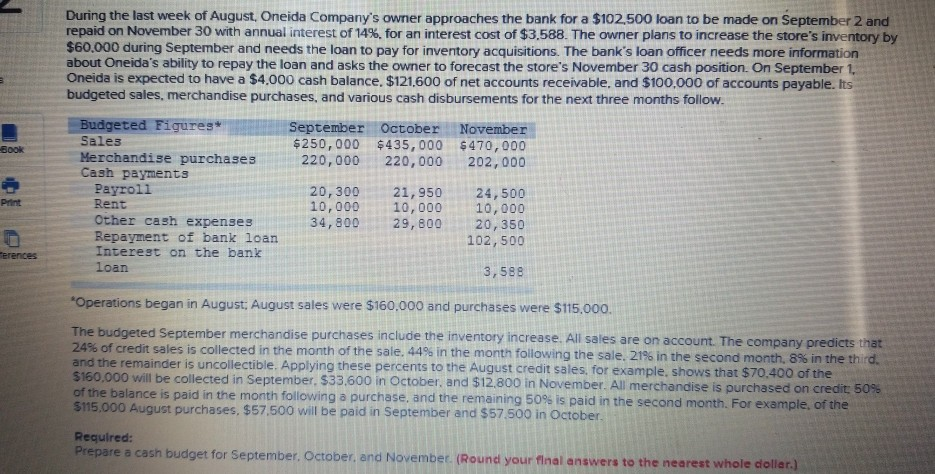

During the last week of August, Oneida Company's owner approaches the bank for a $102,500 loan to be made on September 2 and repaid on

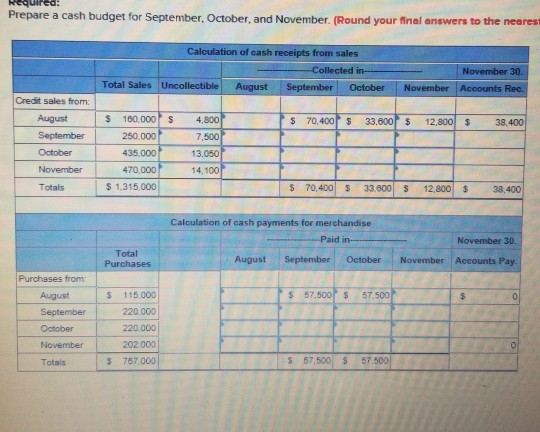

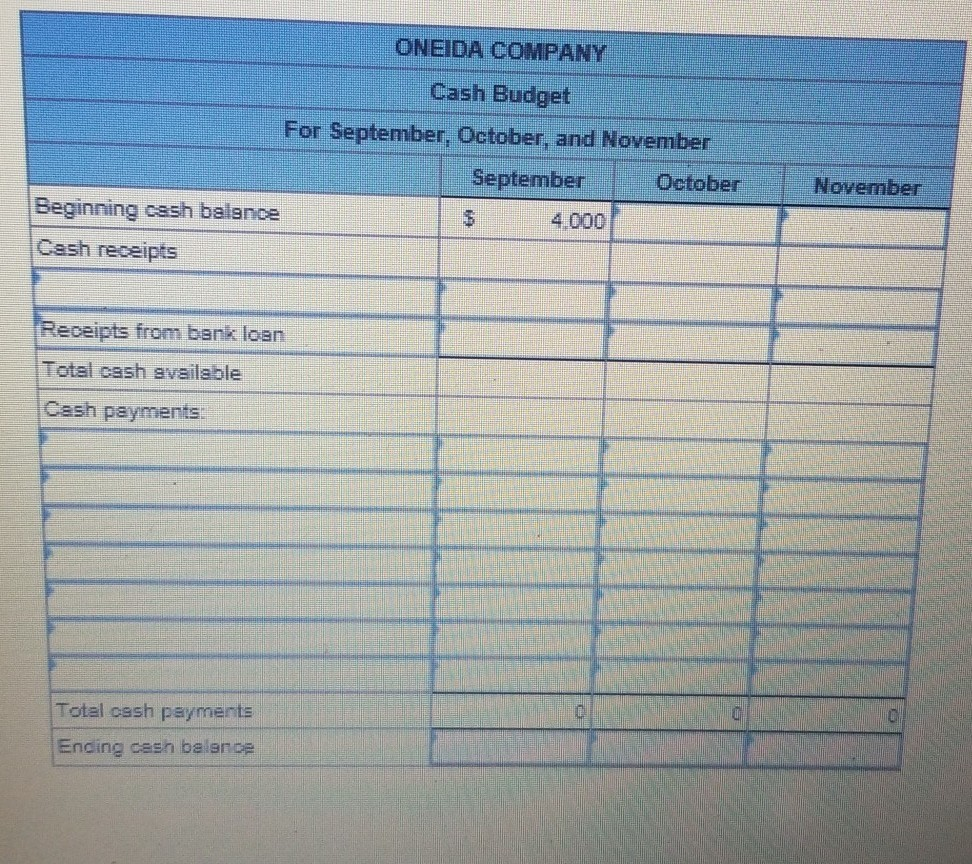

During the last week of August, Oneida Company's owner approaches the bank for a $102,500 loan to be made on September 2 and repaid on November 30 with annual interest of 14%, for an interest cost of $3,588. The owner plans to increase the store's inventory by $60.000 during September and needs the loan to pay for inventory acquisitions. The bank's loan officer needs more information about Oneida's ability to repay the loan and asks the owner to forecast the store's November 30 cash position. On September 1 Oneida is expected to have a $4.000 cash balance, $121,600 of net accounts receivable, and $100,000 of accounts payable. Its budgeted sales, merchandise purchases, and various cash disbursements for the next three months follow. September October November $250,000 $435,000 $470,000 220,000 220,000 202,000 BOOK Budgeted Figur Sales Merchandise purchases Cash payments Payroll Rent Other cash expenses Repayment of bank loan Interest on the bank loan D 20,300 10,000 34,800 21,950 10,000 29,800 24,500 10,000 20, 350 102,500 o 3,58 "Operations began in August, August sales were $160.000 and purchases were $115.000. The budgeted September merchandise purchases include the inventory increase. All sales are on account. The company predicts that 24% of credit sales is collected in the month of the sale, 44% in the month following the sale, 2196 in the second month, 8% in the third and the remainder is uncollectible. Applying these percents to the August credit sales, for example, shows that $70.400 of the $160.000 will be collected in September, 533,600 in October, and $12.800 in November. All merchandise is purchased on credit: 50% of the balance is paid in the month following a purchase, and the remaining 50% is paid in the second month. For example of the $115.000 August purchases, $57,500 will be paid in September and $57.500 in October Required: Prepare a cash budget for September October, and November. (Round your final answers to the nearest whole dollar.) requirea: Prepare a cash budget for September October, and November. (Round your final answers to the neares Calculation of cash receipts from sales - Collected in- Total Sales Uncollectible August September October November 30. November Accounts Rec. $ $ 70,400 $ 33,800 $ 12,800 $ 38,400 Credit sales from: August September October November $ 160,000 250,000 435.000 470.000 S 1.315.000 4,800 7,500 13.050 14,100 Totals $ 70,400 $ 33,800 12,800 $ 38.400 Calculation of cash payments for merchandise Paid August September October Total Purchases November 30. November Accounts Pay. Purchases from August $ $57.500 $ 57.500 September October November 115.000 220.000 220.000 202000 757.000 Totals 5 ONEIDA COMPANY Cash Budget For September, October, and November September October Beginning ossh balance | $ 4.000 Cash receipts November Receipts from bank loan Total cash available Cash payments od_ Total oesh payments Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started