Answered step by step

Verified Expert Solution

Question

1 Approved Answer

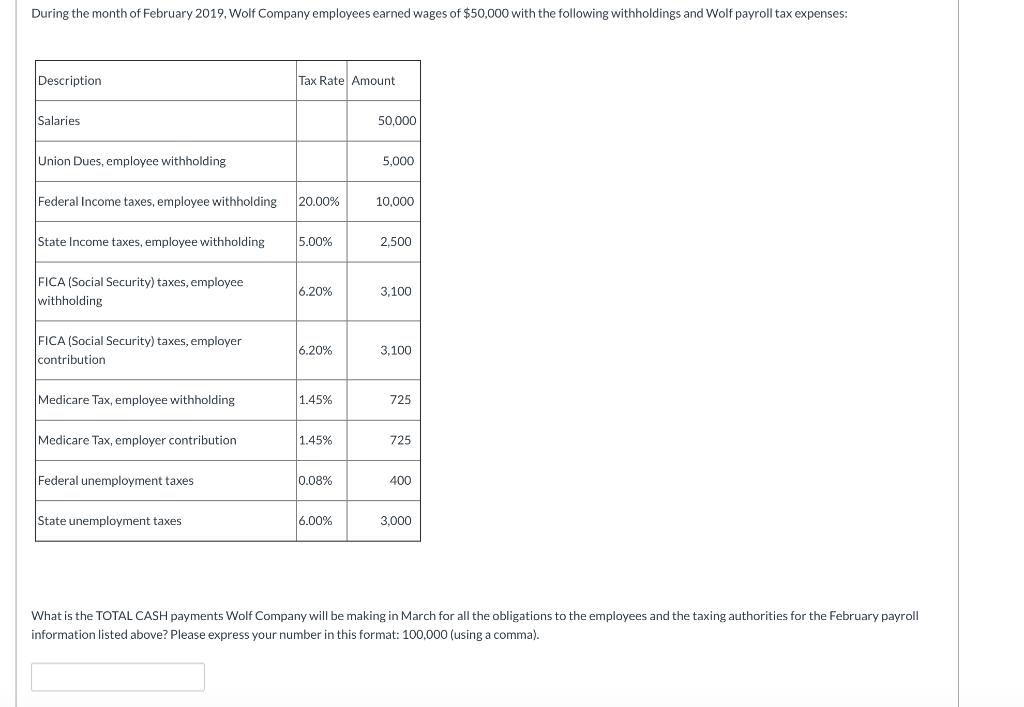

During the month of February 2019. Wolf Company employees earned wages of $50,000 with the following withholdings and Wolf payroll tax expenses: Description Tax

During the month of February 2019. Wolf Company employees earned wages of $50,000 with the following withholdings and Wolf payroll tax expenses: Description Tax Rate Amount Salaries 50,000 Union Dues, employee withholding 5,000 Federal Income taxes, employee withholding 20.00% 10,000 State Income taxes, employee withholding 5.00% 2,500 FICA (Social Security) taxes, employee withholding 6.20% 3,100 FICA (Social Security) taxes, employer contribution 6.20% 3,100 Medicare Tax, employee withholding 1.45% 725 Medicare Tax, employer contribution 1.45% 725 Federal unemployment taxes 0.08% 400 State unemployment taxes 6.00% 3,000 What is the TOTAL CASH payments Wolf Company will be making in March for all the obligations to the employees and the taxing authorities for the February payroll information listed above? Please express your number in this format: 100,000 (using a comma).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Wolf Company will be making a total cash payment of 3554000 in March for a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started