Answered step by step

Verified Expert Solution

Question

1 Approved Answer

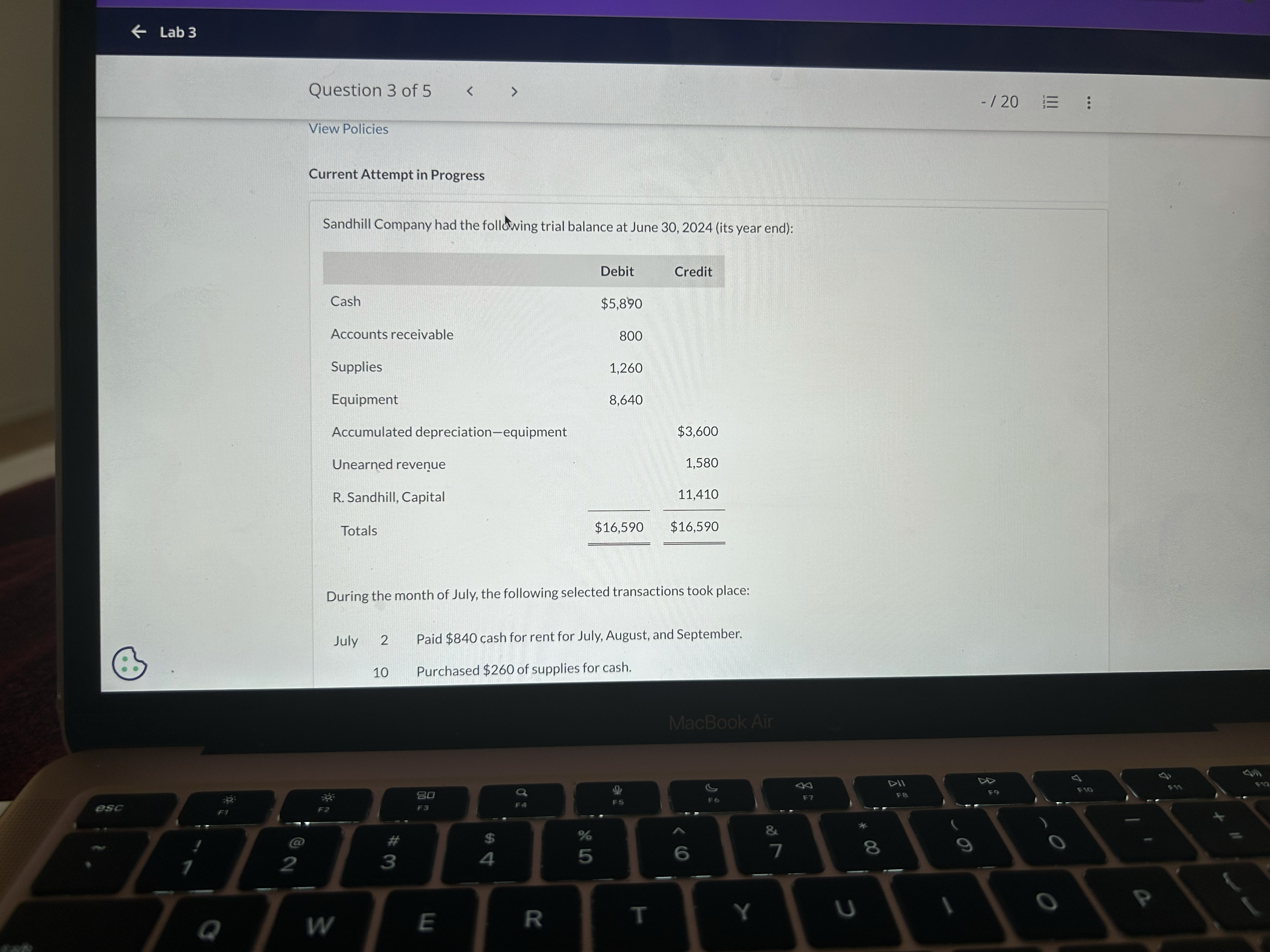

During the month of July, the following selected transactions took place: July 2 Paid $840 cash for rent for July, August, and September. 10

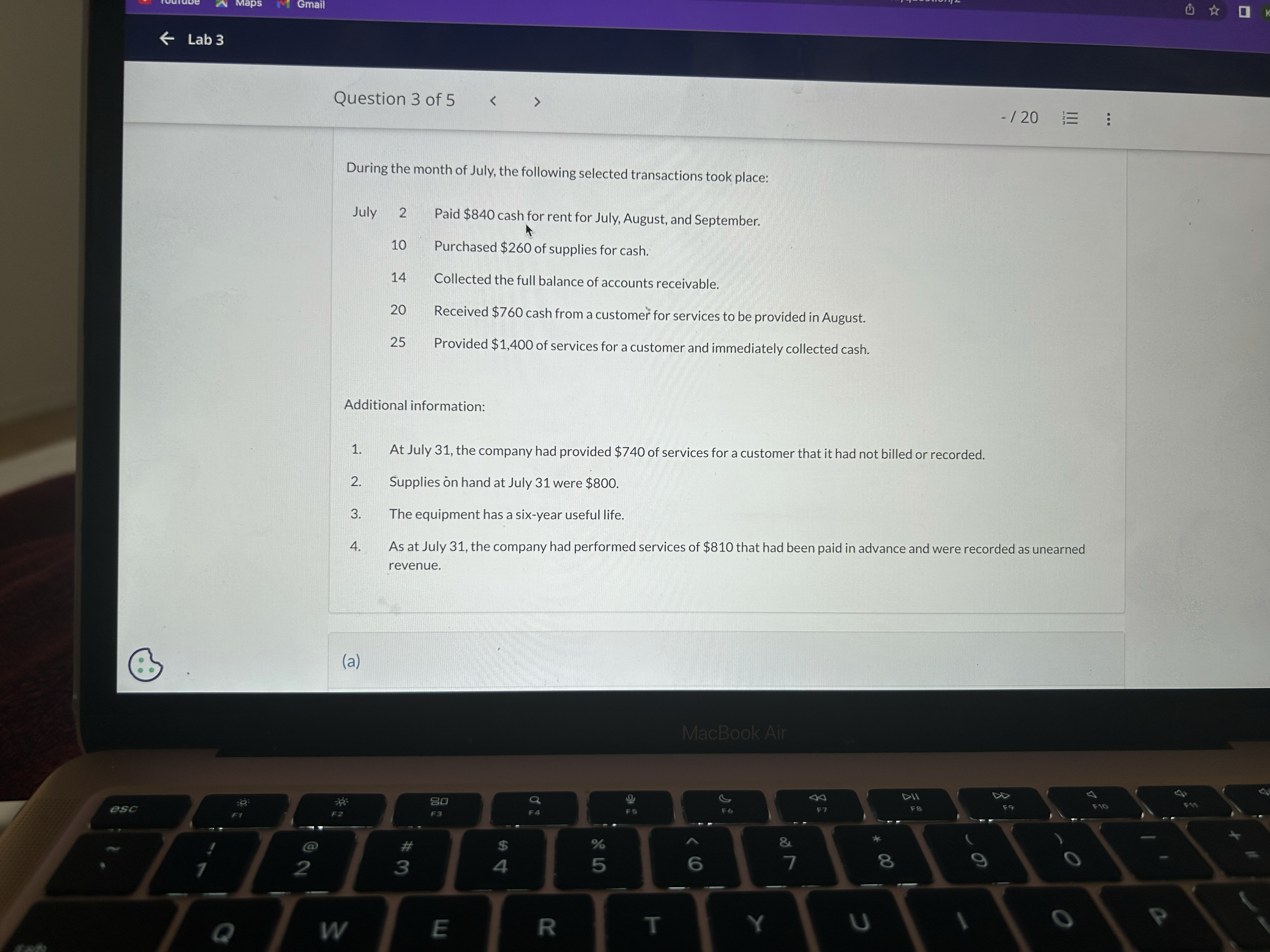

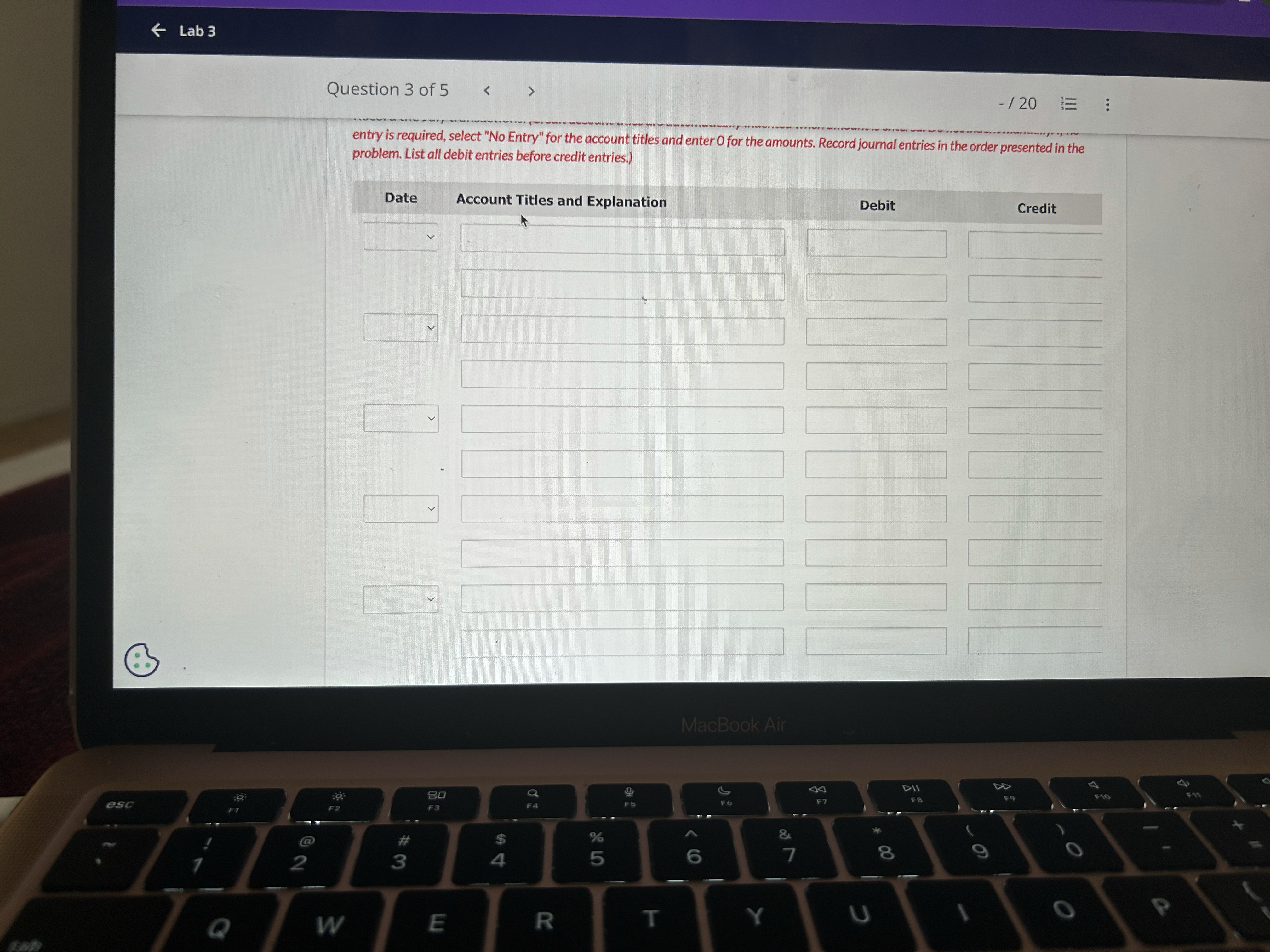

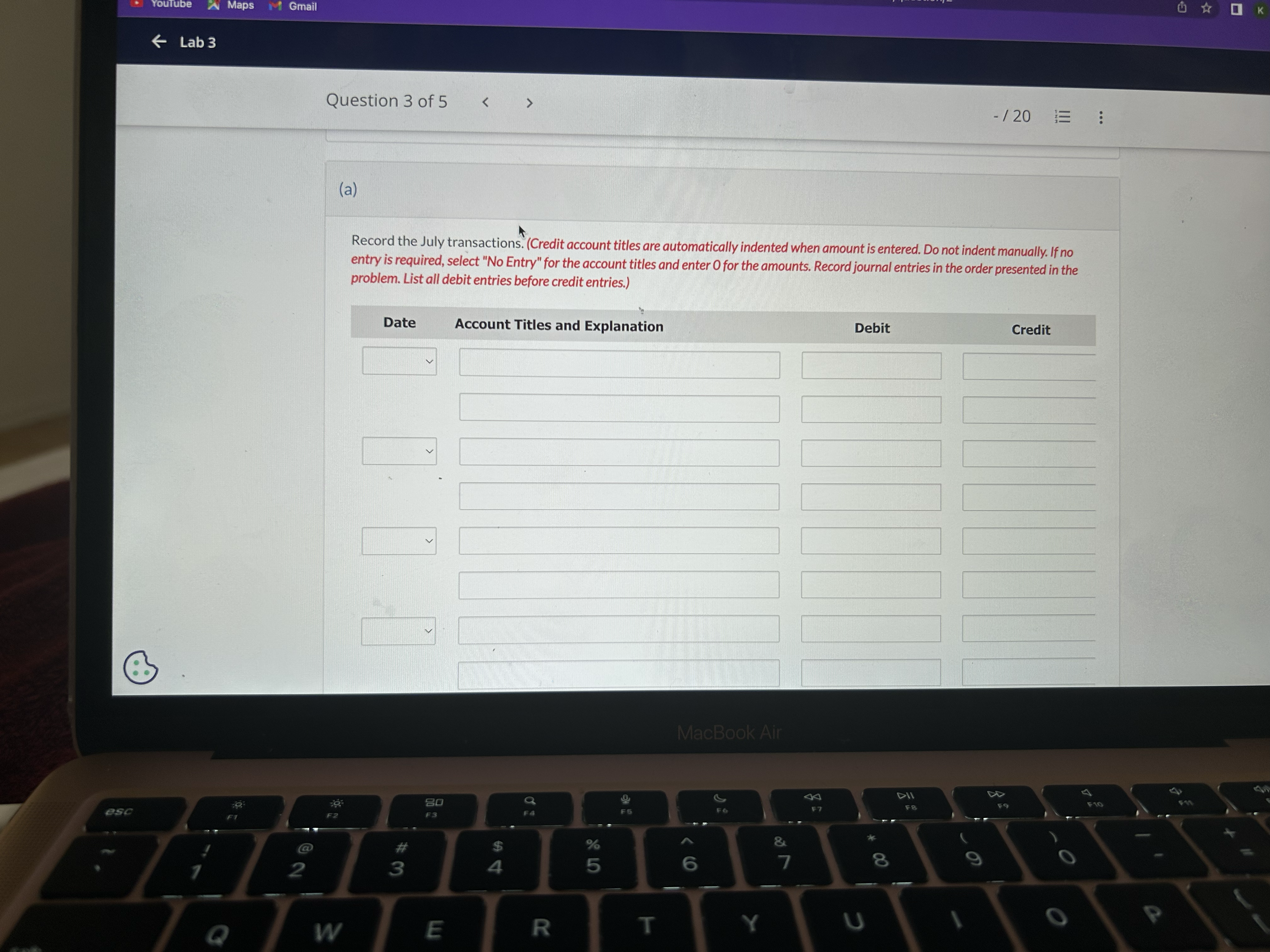

During the month of July, the following selected transactions took place: July 2 Paid $840 cash for rent for July, August, and September. 10 Purchased $260 of supplies for cash. 14 Collected the full balance of accounts receivable. 20 Received $760 cash from a customer for services to be provided in August. 25 Provided $1,400 of services for a customer and immediately collected cash. Additional information: -/20 1. At July 31, the company had provided $740 of services for a customer that it had not billed or recorded. 2. Supplies on hand at July 31 were $800. 3. The equipment has a six-year useful life. 4. As at July 31, the company had performed services of $810 that had been paid in advance and were recorded as unearned revenue. (a) esc F1 F2 2 Q W #3 80 F3 94 01 F4 % 95 F5 MacBook Air F6 & 6 7 DII 4 F7 F8 F9 E R T Y U 8 00 K F10 34 < -/20 : entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation esc F1 F2 2 Q W #3 80 F3 $ 4 a FA % 95 F5 Debit MacBook Air 66 F6 P F7 27 & E R T Y Credit DII F8 FTO 8 U a YouTube Maps Gmail (a) F1 -/20 Record the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Q Date Account Titles and Explanation 2 @ F2 > #3 80 F3 $ 01 F4 % 4 5 F5 Debit MacBook Air 66 F6 W E R T Y 27 DII F7 F8 8 Credit F9 K E FIO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started