Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily

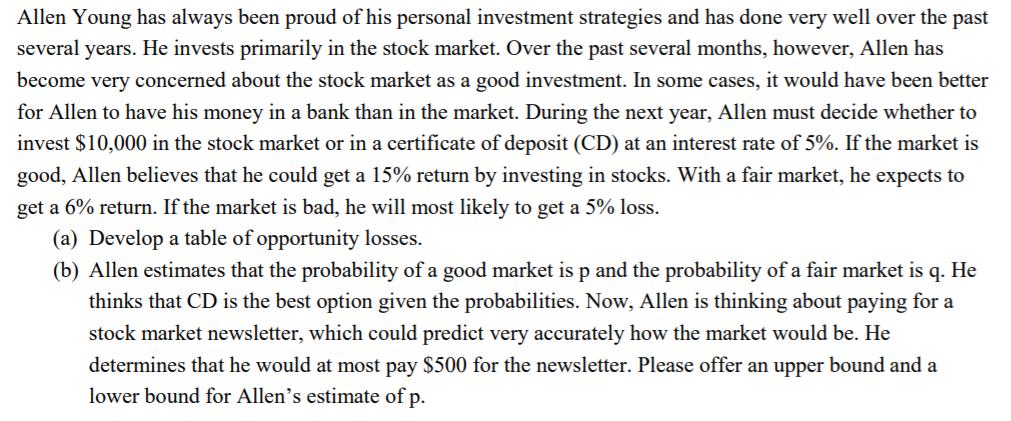

Allen Young has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the stock market. Over the past several months, however, Allen has become very concerned about the stock market as a good investment. In some cases, it would have been better for Allen to have his money in a bank than in the market. During the next year, Allen must decide whether to invest $10,000 in the stock market or in a certificate of deposit (CD) at an interest rate of 5%. If the market is good, Allen believes that he could get a 15% return by investing in stocks. With a fair market, he expects to get a 6% return. If the market is bad, he will most likely to get a 5% loss. (a) Develop a table of opportunity losses. (b) Allen estimates that the probability of a good market is p and the probability of a fair market is q. thinks that CD is the best option given the probabilities. Now, Allen is thinking about paying for a stock market newsletter, which could predict very accurately how the market would be. He determines that he would at most pay $500 for the newsletter. Please offer an upper bound and a lower bound for Allen's estimate of p.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Decision Table The expected value of a stock can be determine...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started