Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the pre-project phase, a project manager is asked to compare three alternative software solutions. The company's expected return rate is 12% which is

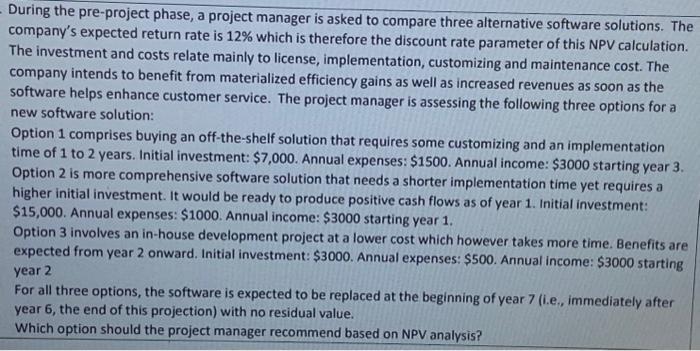

During the pre-project phase, a project manager is asked to compare three alternative software solutions. The company's expected return rate is 12% which is therefore the discount rate parameter of this NPV calculation. The investment and costs relate mainly to license, implementation, customizing and maintenance cost. The company intends to benefit from materialized efficiency gains as well as increased revenues as soon as the software helps enhance customer service. The project manager is assessing the following three options for a new software solution: Option 1 comprises buying an off-the-shelf solution that requires some customizing and an implementation time of 1 to 2 years. Initial investment: $7,000. Annual expenses: $1500. Annual income: $3000 starting year 3. Option 2 is more comprehensive software solution that needs a shorter implementation time yet requires a higher initial investment. It would be ready to produce positive cash flows as of year 1. Initial investment: $15,000. Annual expenses: $1000. Annual income: $3000 starting year 1. Option 3 involves an in-house development project at a lower cost which however takes more time. Benefits are expected from year 2 onward. Initial investment: $3000. Annual expenses: $500. Annual income: $3000 starting year 2 For all three options, the software is expected to be replaced at the beginning of year 7 (i.e., immediately after year 6, the end of this projection) with no residual value. Which option should the project manager recommend based on NPV analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started