Answered step by step

Verified Expert Solution

Question

1 Approved Answer

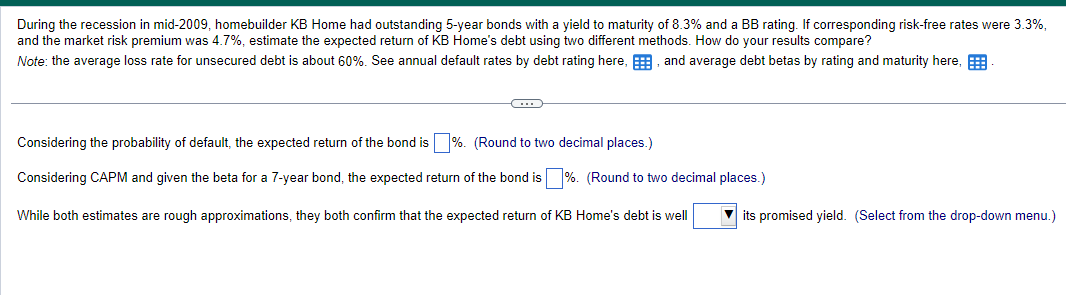

During the recession in mid - 2 0 0 9 , homebuilder KB Home had outstanding 5 - year bonds with a yield to maturity

During the recession in mid homebuilder KB Home had outstanding year bonds with a yield to maturity of and a BB rating. If corresponding riskfree rates were

and the market risk premium was estimate the expected return of KB Home's debt using two different methods. How do your results compare?

Note: the average loss rate for unsecured debt is about See annual default rates by debt rating here, and average debt betas by rating and maturity here,

Considering the probability of default, the expected return of the bond is

Round to two decimal places.

Considering CAPM and given the beta for a year bond, the expected return of the bond is

Round to two decimal places.

While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well

its promised yield. Select from the dropdown menu. Data table

Click on the following icon in order to copy its contents into a spreadsheet.

Annual Default Rates by Debt Rating

Source: "Corporate Defaults and Recovery Rates, Moody's Global Credit Policy, February

Data table

Click on the following icon in order to copy its contents into a spreadsheet.

Average Debt Betas by Rating and Maturity

Source: S Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB

working paper,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started