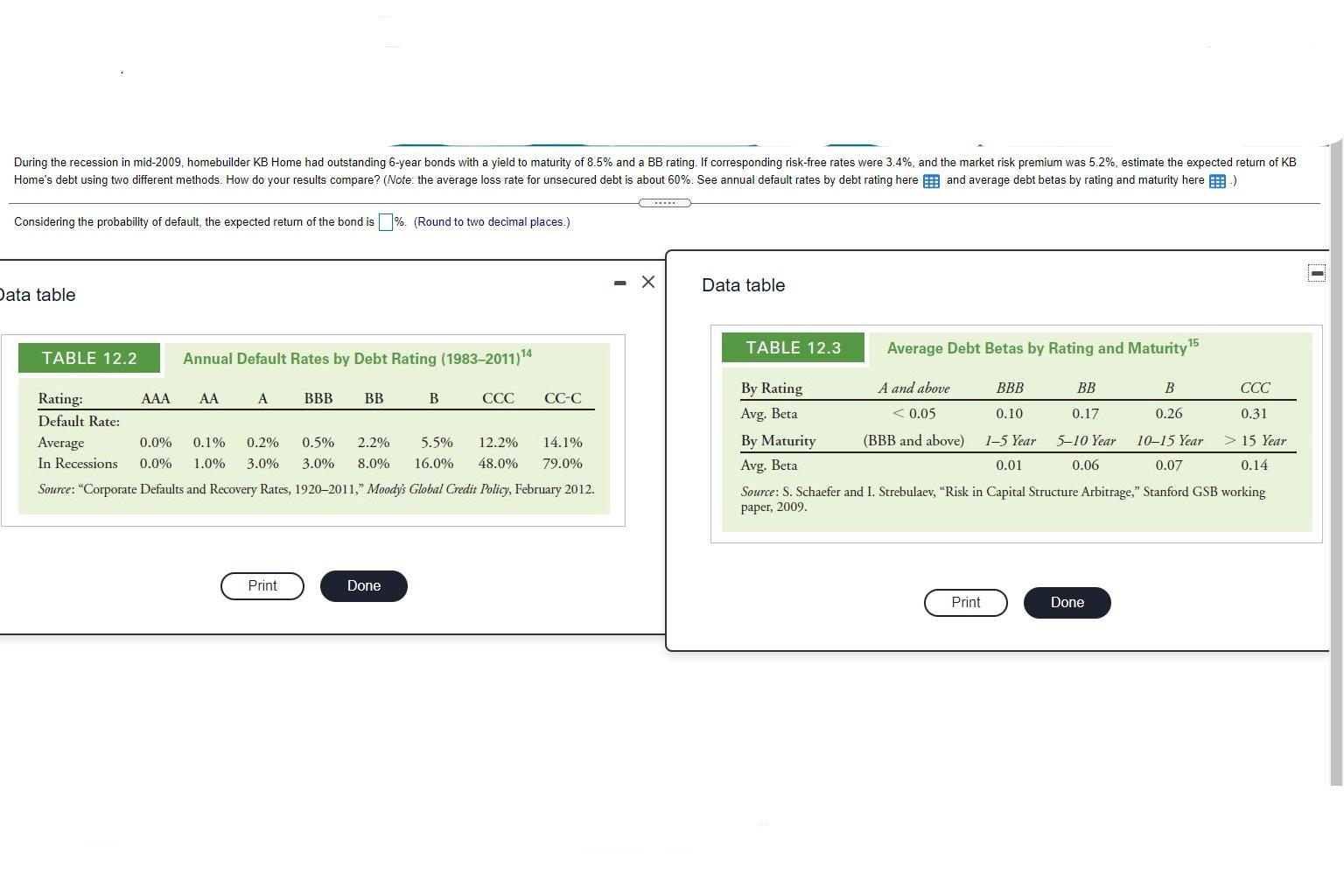

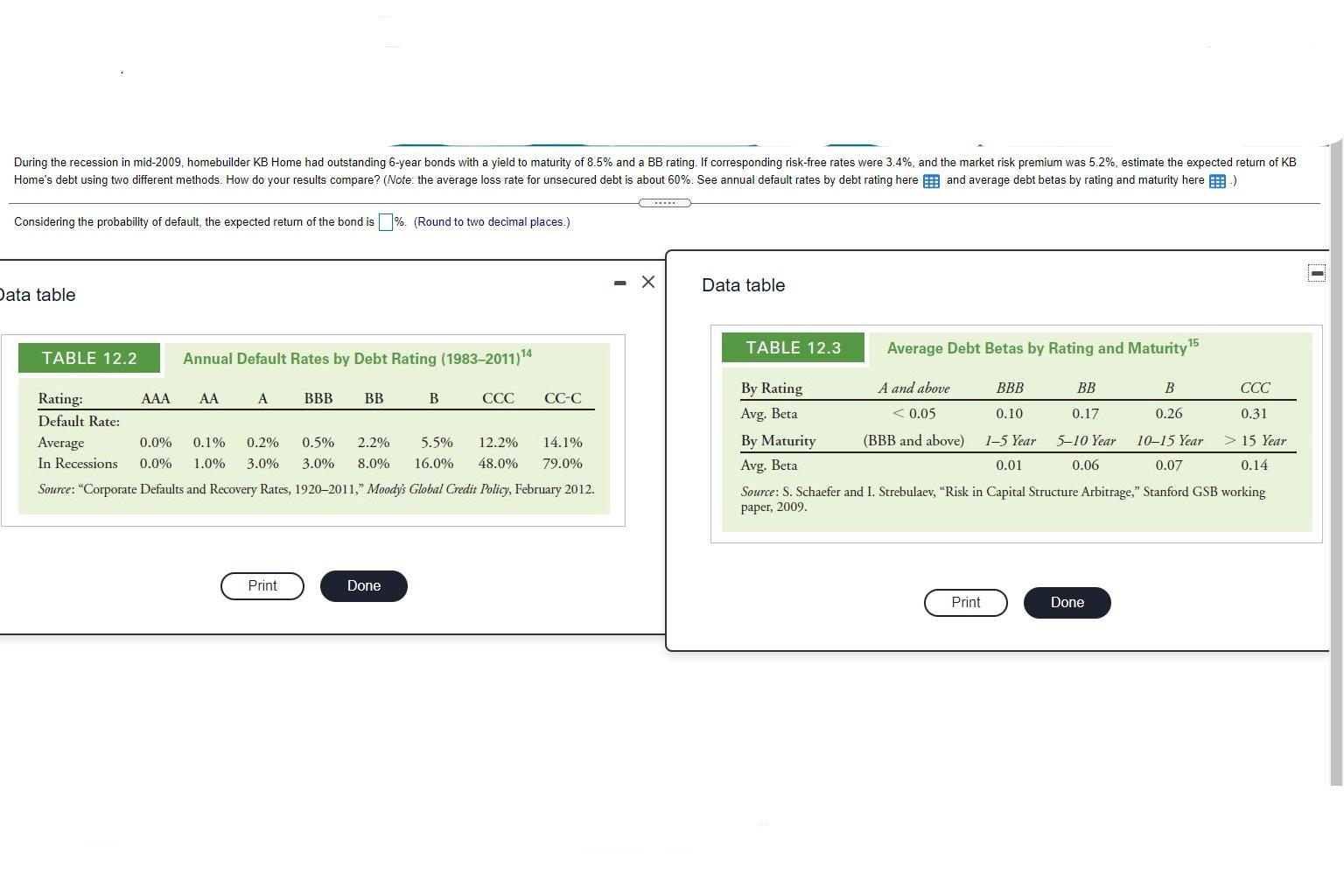

During the recession in mid-2009, homebuilder KB Home had outstanding 6-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 3.4%, and the market risk premium was 5.2%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating here and average debt betas by rating and maturity here :-) Considering the probability of default, the expected return of the bond is % (Round to two decimal places.) - - X Data table Data table TABLE 12.3 TABLE 12.2 Annual Default Rates by Debt Rating (1983-2011)14 Average Debt Betas by Rating and Maturity AAA AA BBB BB B CCC CC-C Rating: Default Rate: Average In Recessions 5.5% 0.0% 0.0% 0.1% 1.0% 0.2% 3.0% 0.5% 3.0% 2.2% 8.0% 12.2% 48.0% 14.1% 79.0% By Rating A and above BBB BB B CCC Avg. Beta 15 Year Avg. Beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009. 16.0% Source: "Corporate Defaults and Recovery Rates, 19202011," Moody's Global Credit Policy, February 2012. Print Done Print Done During the recession in mid-2009, homebuilder KB Home had outstanding 6-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 3.4%, and the market risk premium was 5.2%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating here and average debt betas by rating and maturity here :-) Considering the probability of default, the expected return of the bond is % (Round to two decimal places.) - - X Data table Data table TABLE 12.3 TABLE 12.2 Annual Default Rates by Debt Rating (1983-2011)14 Average Debt Betas by Rating and Maturity AAA AA BBB BB B CCC CC-C Rating: Default Rate: Average In Recessions 5.5% 0.0% 0.0% 0.1% 1.0% 0.2% 3.0% 0.5% 3.0% 2.2% 8.0% 12.2% 48.0% 14.1% 79.0% By Rating A and above BBB BB B CCC Avg. Beta 15 Year Avg. Beta 0.01 0.06 0.07 0.14 Source: S. Schaefer and I. Strebulaev, Risk in Capital Structure Arbitrage," Stanford GSB working paper, 2009. 16.0% Source: "Corporate Defaults and Recovery Rates, 19202011," Moody's Global Credit Policy, February 2012. Print Done Print Done