Question

During the year, Hepworth Company earned a net income of $62,425. Beginning and ending balances for the year for selected accounts are as follows: Account

During the year, Hepworth Company earned a net income of $62,425. Beginning and ending balances for the year for selected accounts are as follows:

| Account | ||

| Beginning | Ending | |

| Cash | $102,000 | $121,200 |

| Accounts receivable | 68,100 | 99,350 |

| Inventory | 36,500 | 52,100 |

| Prepaid expenses | 27,400 | 29,600 |

| Accumulated depreciation | 81,400 | 91,000 |

| Accounts payable | 45,400 | 54,525 |

| Wages payable | 27,300 | 14,400 |

There were no financing or investing activities for the year. The above balances reflect all of the adjustments needed to adjust net income to operating cash flows.

Required:

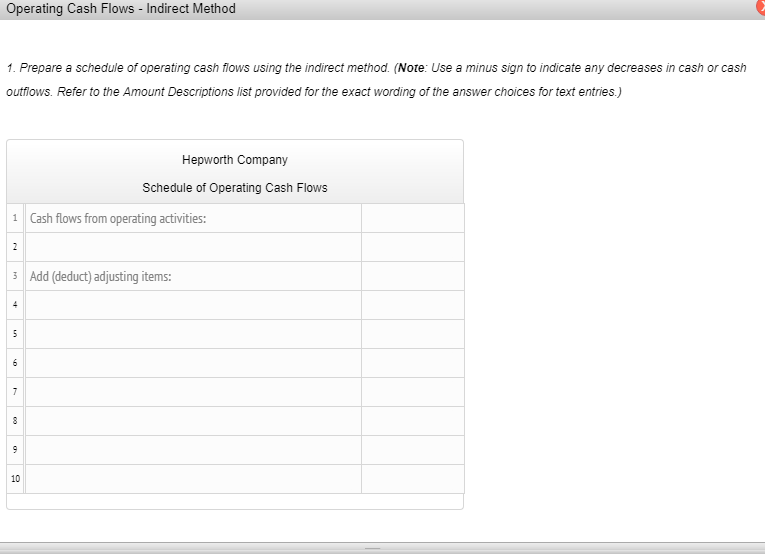

| 1. | Prepare a schedule of operating cash flows using the indirect method. |

| 2. | Suppose that all the data used in Requirement 1 except the ending accounts payable and cash balances are not known. Assume also that you know that the operating cash flow for the year was $20,975. What is the ending balance of accounts payable? |

| Conceptual Connection: Hepworth has an opportunity to buy some equipment that will significantly increase productivity. The equipment costs $25,000. Assuming exactly the same data used for Requirement 1, can Hepworth buy the equipment using this years operating cash flows?

2. Suppose that all the data used in Requirement 1 except the ending accounts payable and cash balances are not known. Assume also that you know that the operating cash flow for the year was $20,975. What is the ending balance of accounts payable? Conceptual Connection: Hepworth has an opportunity to buy some equipment that will significantly increase productivity. The equipment costs $25,000. Assuming exactly the same data used for Requirement 1, can Hepworth buy the equipment using this years operating cash flows? YES/NO |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started