Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the year just ended, Betty Riddle's taxable income of $142,000 was twice as large as her younger sister Rachel's taxable income of $71,000.

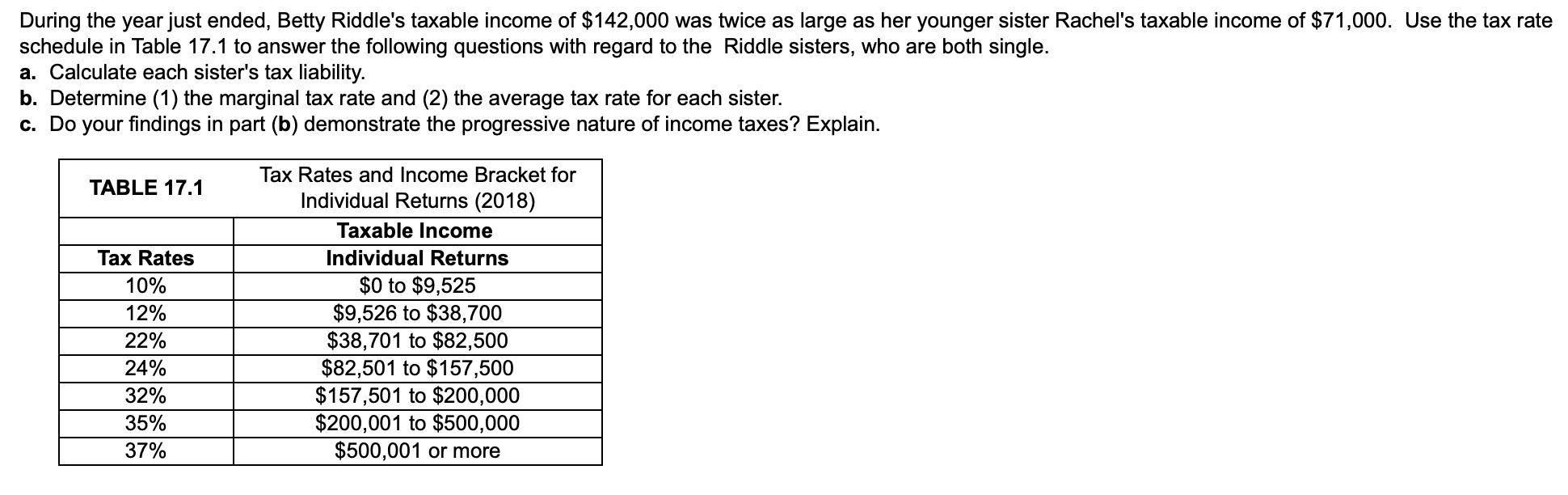

During the year just ended, Betty Riddle's taxable income of $142,000 was twice as large as her younger sister Rachel's taxable income of $71,000. Use the tax rate schedule in Table 17.1 to answer the following questions with regard to the Riddle sisters, who are both single. a. Calculate each sister's tax liability. b. Determine (1) the marginal tax rate and (2) the average tax rate for each sister. c. Do your findings in part (b) demonstrate the progressive nature of income taxes? Explain. TABLE 17.1 Tax Rates 10% 12% 22% 24% 32% 35% 37% Tax Rates and Income Bracket for Individual Returns (2018) Taxable Income Individual Returns $0 to $9,525 $9,526 to $38,700 $38,701 to $82,500 $82,501 to $157,500 $157,501 to $200,000 $200,001 to $500,000 $500,001 or more

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

In USD Betty Rachel Progressive Tax Rates Income Tax Mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started