Answered step by step

Verified Expert Solution

Question

1 Approved Answer

during the year of assessment 2020 the control panel of one of the lifts at damelin braamfontein campus broke down (30 marks) (30) ESTION 1

during the year of assessment 2020 the control panel of one of the lifts at damelin braamfontein campus broke down

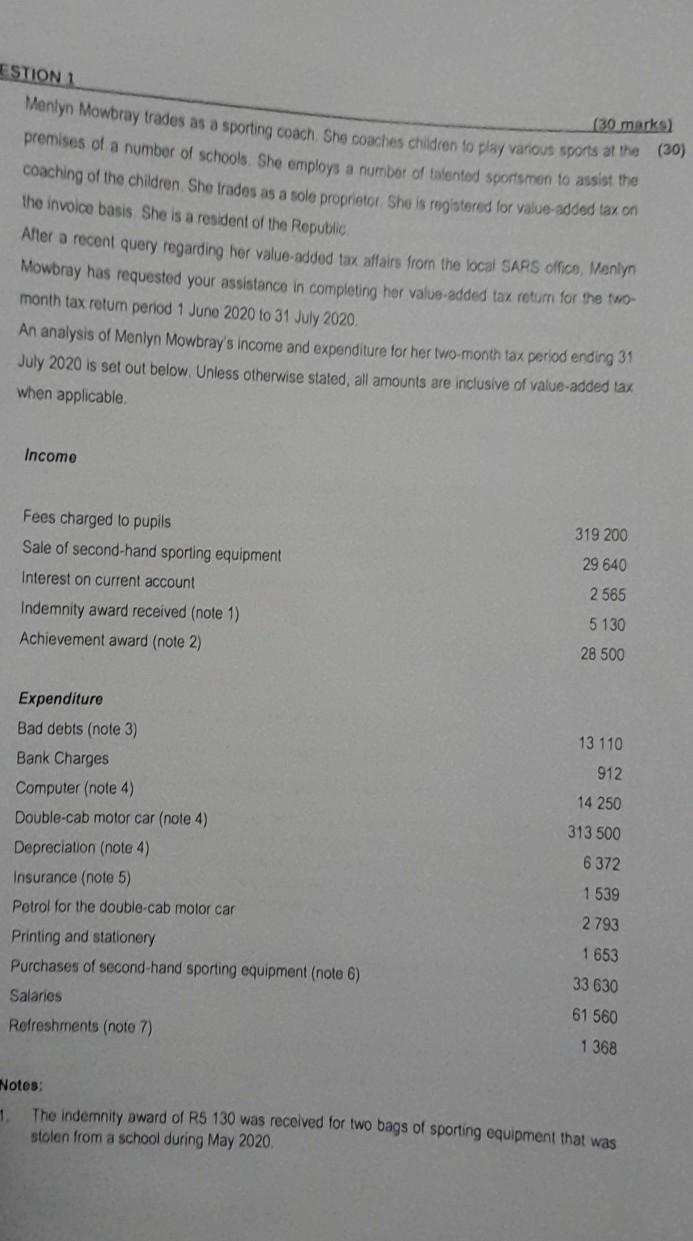

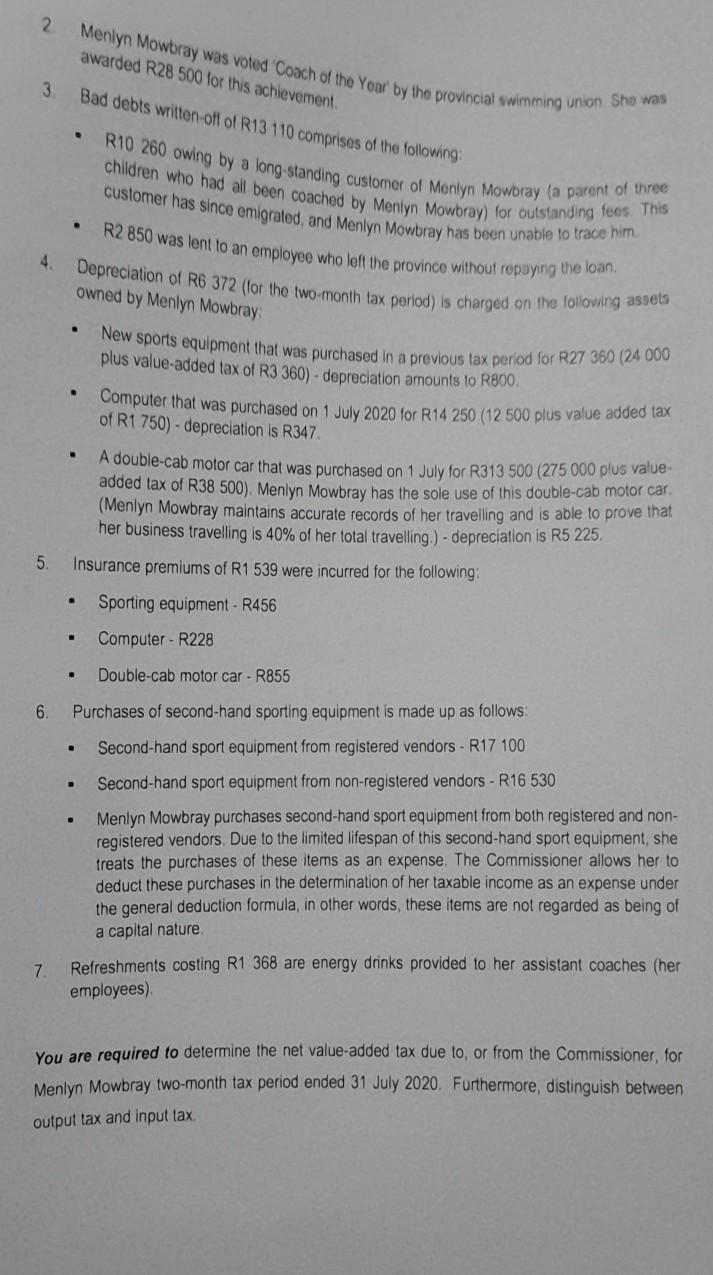

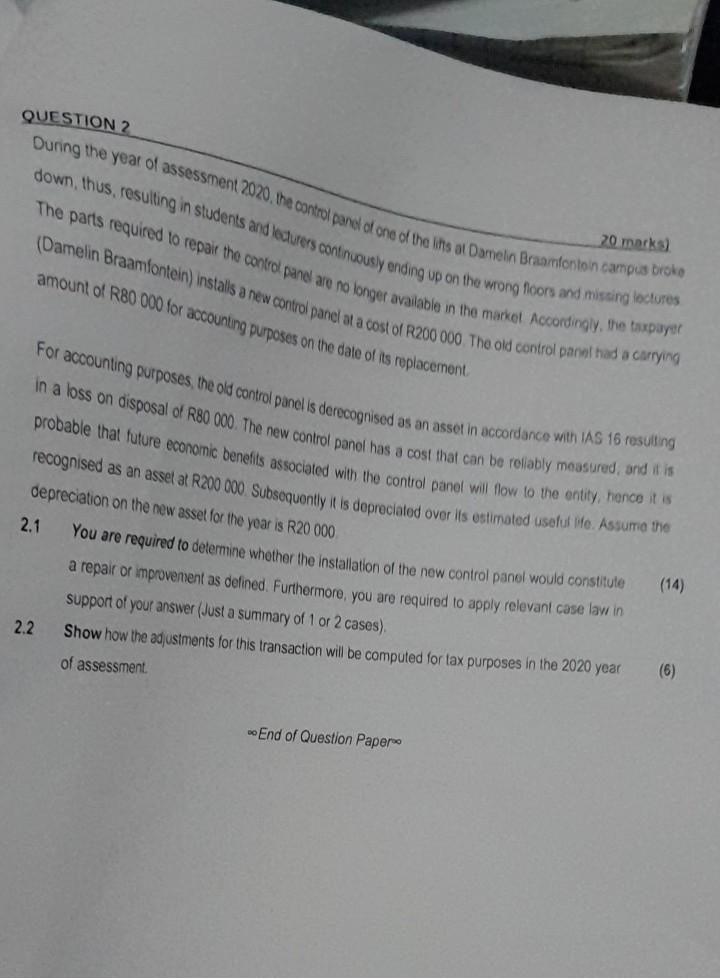

(30 marks) (30) ESTION 1 Manlyn Mowbray trades as a sporting coach She coaches children to play various sports at the premises of a number of schools. She employs a number of titented sportsmen to assist the coaching of the children. She trades as a sole proprietor She is registered for value-added tax. on the invoice basis. She is a resident of the Republic After a recent query regarding her value-added tax affairs from the local SARS offica, Menlyn Mowbray has requested your assistance in completing her value-added tax retum for the two- month tax retur period 1 June 2020 to 31 July 2020 An analysis of Menlyn Mowbray's income and expenditure for her two-month tax period ending 31 July 2020 is set out below. Unless otherwise stated, all amounts are inclusive of value-added tax when applicable Income 319 200 Fees charged to pupils Sale of second-hand sporting equipment Interest on current account Indemnity award received (note 1) Achievement award (note 2) 29 640 2565 5 130 28 500 13 110 912 14 250 313 500 Expenditure Bad debts (note 3) Bank Charges Computer (note 4) Double-cab motor car (note 4) Depreciation (note 4) Insurance (note 5) Petrol for the double-cab motor car Printing and stationery Purchases of second-hand sporting equipment (note 6) Salaries Refreshments (note 7) 6372 1539 2793 1 653 33 630 61 560 1368 1 Notes: The indemnity award of R5 130 was received for two bags of sporting equipment that was stolen from a school during May 2020 2 Menlyn Mowbray was voted Coach of the Year by the provincial swimming union. She was awarded R28 500 for this achievement. 3 Bad debts written off of R13 110 comprises of the following . R10 260 owing by a long-standing customer of Menlyn Mowbray (a parent of three children who had all been coached by Menlyn Mowbray) for outstanding fees. This customer has since emigrated, and Menlyn Mowbray has been unable to trace him R2 850 was lent to an employee who left the province without ropaying the loan Depreciation of R6 372 (for the two month tax period) is charged on the following assets 4. owned by Menlyn Mowbray . New sports equipment that was purchased in a previous tax period for R27 360 (24 000 plus value-added tax of R3 360) - depreciation amounts to R800. Computer that was purchased on 1 July 2020 for R14 250 (12 500 plus value added tax of R1 750) - depreciation is R347 A double-cab motor car that was purchased on 1 July for R313 500 (275 000 plus value added tax of R38 500). Menlyn Mowbray has the sole use of this double-cab motor car. (Menlyn Mowbray maintains accurate records of her travelling and is able to prove that her business travelling is 40% of her total travelling.) - depreciation is R5 225. Insurance premiums of R1 539 were incurred for the following: 5 Sporting equipment - R456 Computer - R228 Double-cab motor car - R855 6. Purchases of second-hand sporting equipment is made up as follows: Second-hand sport equipment from registered vendors - R17 100 Second-hand sport equipment from non-registered vendors - R16 530 Menlyn Mowbray purchases second-hand sport equipment from both registered and non- registered vendors. Due to the limited lifespan of this second-hand sport equipment, she treats the purchases of these items as an expense. The Commissioner allows her to deduct these purchases in the determination of her taxable income as an expense under the general deduction formula, in other words, these items are not regarded as being of a capital nature Refreshments costing R1 368 are energy drinks provided to her assistant coaches (her employees) 7 You are required to determine the net value-added tax due to, or from the Commissioner, for Menlyn Mowbray two-month tax period ended 31 July 2020. Furthermore, distinguish between output tax and input tax QUESTION 2 During the year of assessment 2020, the control panel of one of the Is a Damelin Braamfontoin campus broke down, thus, resulting in students and lecturers continuously ending up on the wrong floors and misting loctures The parts required to repart the control panel are no longer available in the market Accordingly, the taxpayer (Damelin Braamfontein) installs a new control panel at a cost of R200 000 The old control panel had a carrying 20 marks) amount of R80 000 for accounting purposes on the date of its replacement For accounting purposes, the old control panel is derecognised as an asset in accordance with IAS 16 resulting in a loss on disposal of R80 000. The new control panel has a cost that can be reliably measured, and it is probable that future economic benefits associated with the control panel will flow to the entity, hence it is recognised as an asset at R200 000. Subsoquently it is depreciated over its estimated usalut we. Assume the depreciation on the new asset for the year is R20 000 2.1 You are required to determine whether the installation of the new control panel would constitute a repair or improvement as defined. Furthermore, you are required to apply relevant case law in support of your answer (Just a summary of 1 or 2 cases) 2.2 Show how the adjustments for this transaction will be computed for tax purposes in the 2020 year of assessment (14) (6) -End of Question Paper (30 marks) (30) ESTION 1 Manlyn Mowbray trades as a sporting coach She coaches children to play various sports at the premises of a number of schools. She employs a number of titented sportsmen to assist the coaching of the children. She trades as a sole proprietor She is registered for value-added tax. on the invoice basis. She is a resident of the Republic After a recent query regarding her value-added tax affairs from the local SARS offica, Menlyn Mowbray has requested your assistance in completing her value-added tax retum for the two- month tax retur period 1 June 2020 to 31 July 2020 An analysis of Menlyn Mowbray's income and expenditure for her two-month tax period ending 31 July 2020 is set out below. Unless otherwise stated, all amounts are inclusive of value-added tax when applicable Income 319 200 Fees charged to pupils Sale of second-hand sporting equipment Interest on current account Indemnity award received (note 1) Achievement award (note 2) 29 640 2565 5 130 28 500 13 110 912 14 250 313 500 Expenditure Bad debts (note 3) Bank Charges Computer (note 4) Double-cab motor car (note 4) Depreciation (note 4) Insurance (note 5) Petrol for the double-cab motor car Printing and stationery Purchases of second-hand sporting equipment (note 6) Salaries Refreshments (note 7) 6372 1539 2793 1 653 33 630 61 560 1368 1 Notes: The indemnity award of R5 130 was received for two bags of sporting equipment that was stolen from a school during May 2020 2 Menlyn Mowbray was voted Coach of the Year by the provincial swimming union. She was awarded R28 500 for this achievement. 3 Bad debts written off of R13 110 comprises of the following . R10 260 owing by a long-standing customer of Menlyn Mowbray (a parent of three children who had all been coached by Menlyn Mowbray) for outstanding fees. This customer has since emigrated, and Menlyn Mowbray has been unable to trace him R2 850 was lent to an employee who left the province without ropaying the loan Depreciation of R6 372 (for the two month tax period) is charged on the following assets 4. owned by Menlyn Mowbray . New sports equipment that was purchased in a previous tax period for R27 360 (24 000 plus value-added tax of R3 360) - depreciation amounts to R800. Computer that was purchased on 1 July 2020 for R14 250 (12 500 plus value added tax of R1 750) - depreciation is R347 A double-cab motor car that was purchased on 1 July for R313 500 (275 000 plus value added tax of R38 500). Menlyn Mowbray has the sole use of this double-cab motor car. (Menlyn Mowbray maintains accurate records of her travelling and is able to prove that her business travelling is 40% of her total travelling.) - depreciation is R5 225. Insurance premiums of R1 539 were incurred for the following: 5 Sporting equipment - R456 Computer - R228 Double-cab motor car - R855 6. Purchases of second-hand sporting equipment is made up as follows: Second-hand sport equipment from registered vendors - R17 100 Second-hand sport equipment from non-registered vendors - R16 530 Menlyn Mowbray purchases second-hand sport equipment from both registered and non- registered vendors. Due to the limited lifespan of this second-hand sport equipment, she treats the purchases of these items as an expense. The Commissioner allows her to deduct these purchases in the determination of her taxable income as an expense under the general deduction formula, in other words, these items are not regarded as being of a capital nature Refreshments costing R1 368 are energy drinks provided to her assistant coaches (her employees) 7 You are required to determine the net value-added tax due to, or from the Commissioner, for Menlyn Mowbray two-month tax period ended 31 July 2020. Furthermore, distinguish between output tax and input tax QUESTION 2 During the year of assessment 2020, the control panel of one of the Is a Damelin Braamfontoin campus broke down, thus, resulting in students and lecturers continuously ending up on the wrong floors and misting loctures The parts required to repart the control panel are no longer available in the market Accordingly, the taxpayer (Damelin Braamfontein) installs a new control panel at a cost of R200 000 The old control panel had a carrying 20 marks) amount of R80 000 for accounting purposes on the date of its replacement For accounting purposes, the old control panel is derecognised as an asset in accordance with IAS 16 resulting in a loss on disposal of R80 000. The new control panel has a cost that can be reliably measured, and it is probable that future economic benefits associated with the control panel will flow to the entity, hence it is recognised as an asset at R200 000. Subsoquently it is depreciated over its estimated usalut we. Assume the depreciation on the new asset for the year is R20 000 2.1 You are required to determine whether the installation of the new control panel would constitute a repair or improvement as defined. Furthermore, you are required to apply relevant case law in support of your answer (Just a summary of 1 or 2 cases) 2.2 Show how the adjustments for this transaction will be computed for tax purposes in the 2020 year of assessment (14) (6) -End of Question Paper

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started