Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the year, sales to non-government customers amounted to $950,000 and sales of water to the General Fund amounted to $25,000. An analysis determined that

- During the year, sales to non-government customers amounted to $950,000 and sales of water to the General Fund amounted to $25,000. An analysis determined that $5,000 was estimated to be uncollectible.

- Cash collections from non-government customers amounted to $915,000.

- Materials and supplies in the amount of $90,000 were received on account. (inventory balances are not recorded since the Enterprise uses the purchase method of accounting)

- Payroll expenses totaled $380,000, of which $300,000 was paid in cash and the remainder was recorded as payroll taxes payable.

- Bond interest (6%) in the amount of $195,000 was paid. No principal was due.

- Contractual services were purchased on account totaling $165,000.

- Payment of accounts payable amounted to $290,000. Payments of payroll taxes totaled $65,000.

- Depreciation expense for the year was computed to be $180,000.

- Post the transactions in Step 2 above to the T-accounts as well. Use the adjacent columns to record the reference letter a through h. There are formulas provided to ease calculation.

- Using the Closing Entry section at the bottom of the Enterprise Fund Journal tab, an entry to close out all nominal accounts to Net Position. Note that for this exercise we will only be reporting the total Net Position and will not be calculating the components of Net Position (e.g., Restricted Net Position).

- Finalize the Financial Statements in the appropriate fields in the Financial Statements tab for the year ended June 30, 2023.

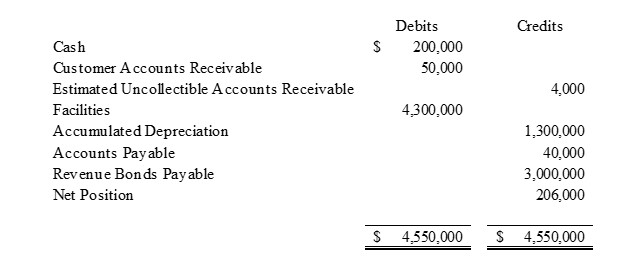

Cash Customer Accounts Receivable Estimated Uncollectible Accounts Receivable Facilities Accumulated Depreciation Accounts Payable Revenue Bonds Payable Net Position Debits $ 200,000 50,000 Credits 4,000 4,300,000 1,300,000 40,000 $ 4,550,000 3,000,000 206,000 $ 4,550,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started