Answered step by step

Verified Expert Solution

Question

1 Approved Answer

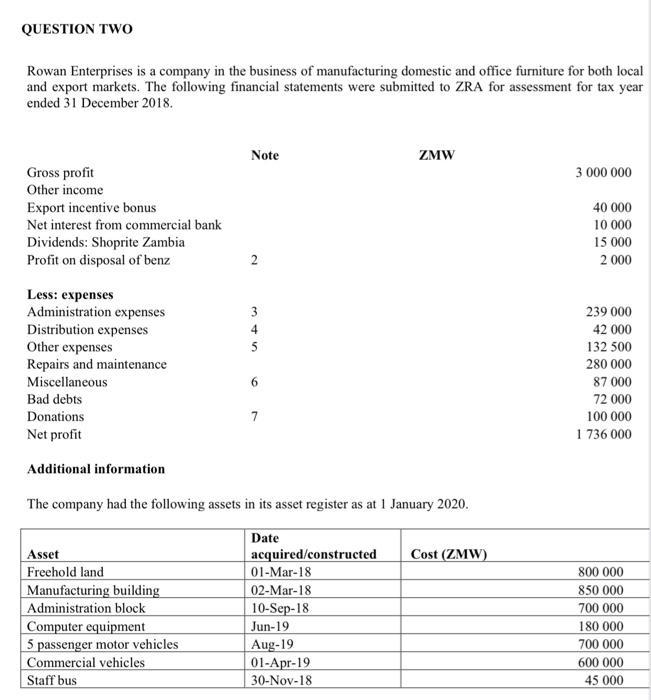

QUESTION TWO Rowan Enterprises is a company in the business of manufacturing domestic and office furniture for both local and export markets. The following

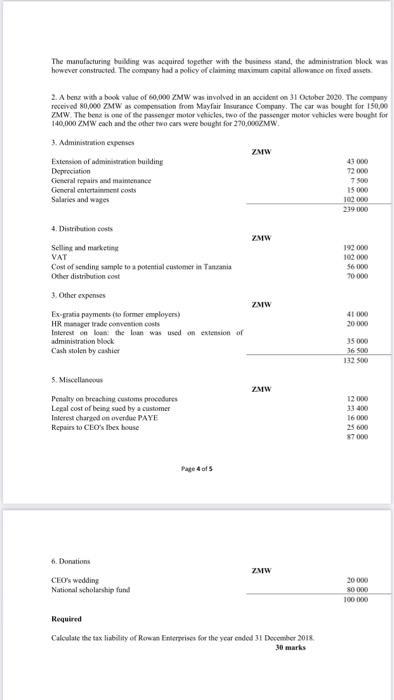

QUESTION TWO Rowan Enterprises is a company in the business of manufacturing domestic and office furniture for both local and export markets. The following financial statements were submitted to ZRA for assessment for tax year ended 31 December 2018. Gross profit Other income Export incentive bonus Net interest from commercial bank Dividends: Shoprite Zambia Profit on disposal of benz Less: expenses Administration expenses Distribution expenses Other expenses Repairs and maintenance Miscellaneous Bad debts Donations Net profit Additional information Asset Freehold land Manufacturing building Administration block Note Computer equipment 5 passenger motor vehicles Commercial vehicles Staff bus 2 345 6 The company had the following assets in its asset register as at 1 January 2020. 7 Date acquired/constructed 01-Mar-18 02-Mar-18 10-Sep-18 ZMW Jun-19 Aug-19 01-Apr-19 30-Nov-18 Cost (ZMW) 3 000 000 40 000 10 000 15 000 2 000 239 000 42 000 132 500 280 000 87 000 72 000 100 000 1 736 000 800 000 850 000 700 000 180 000 700 000 600 000 45 000 The manufacturing building was acquired together with the business stand, the administration block was however constructed. The company had a policy of claiming maximum capital allowance on fixed assets 2. A benz with a book value of 60,000 ZMW was involved in an accident on 31 October 2020. The company received 80,000 ZMW as compensation from Mayfair Insurance Company. The car was bought for 150,00 ZMW. The benz is one of the passenger motor vehicles, two of the passenger motor vehicles were bought for 140,000 ZMW each and the other two cars were bought for 270,000MW 3. Administration expenses Extension of administration building Depreciation General repairs and maintenance General entertainment costs Salaries and wages 4. Distribution costs Selling and marketing VAT Cost of sending sample to a potential customer in Tanzania Other distribution cost 3. Other expenses Ex-gratia payments (to former employers) HR manager trade convention costs Interest on loan the loan was used on extension of administration block Cash stolen by cashier 5. Miscellaneous Penalty on breaching customs procedures Legal cost of being sued by a customer Interest charged on overdue PAYE Repairs to CEO's Ibex house 6. Donations CEO's wedding National scholarship fund Page 4 of 5 ZMW ZMW ZMW ZMW ZMW Required Calculate the tax liability of Rowan Enterprises for the year ended 31 December 2018. 30 marks 43 000 72 000 7.500 15 000 102 000 239 000 192 000 102 000 56 000 70 000 41000 20:000 35 000 36 500 132 500 12 000 33 400 16 000 25 600 87.000 20 000 80 000 100 000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Qualified education expenses are amounts paid in 2019 for tution and fees required for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started