Answered step by step

Verified Expert Solution

Question

1 Approved Answer

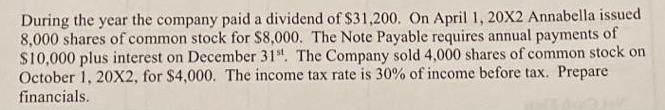

During the year the company paid a dividend of $31,200. On April 1, 20X2 Annabella issued 8,000 shares of common stock for $8,000. The

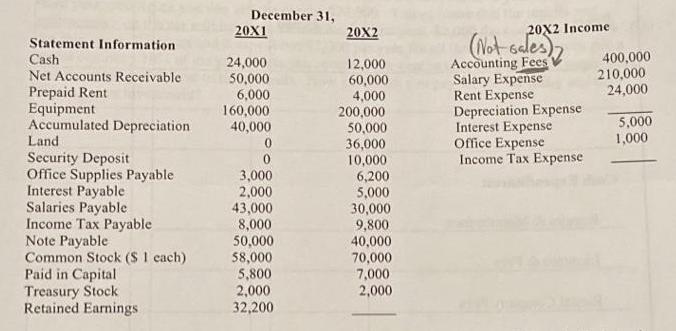

During the year the company paid a dividend of $31,200. On April 1, 20X2 Annabella issued 8,000 shares of common stock for $8,000. The Note Payable requires annual payments of $10,000 plus interest on December 31st. The Company sold 4,000 shares of common stock on October 1, 20X2, for $4,000. The income tax rate is 30% of income before tax. Prepare financials. Statement Information Cash Net Accounts Receivable Prepaid Rent Equipment Accumulated Depreciation Land Security Deposit Office Supplies Payable Interest Payable Salaries Payable Income Tax Payable Note Payable Common Stock ($ 1 each) Paid in Capital Treasury Stock Retained Earnings December 31, 20X1 24,000 50,000 6,000 160,000 40,000 0 0 3,000 2,000 43,000 8,000 50,000 58,000 5,800 2,000 32,200 20X2 12,000 60,000 4,000 200,000 50,000 36,000 10,000 6,200 5,000 30,000 9,800 40,000 70,000 7,000 2,000 20X2 Income (Not sales) Accounting Fees Salary Expense Rent Expense Depreciation Expense Interest Expense Office Expense Income Tax Expense 400,000 210,000 24,000 5,000 1,000

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the financial statements as of December 31 20X2 we need to analyze the given information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started