Question

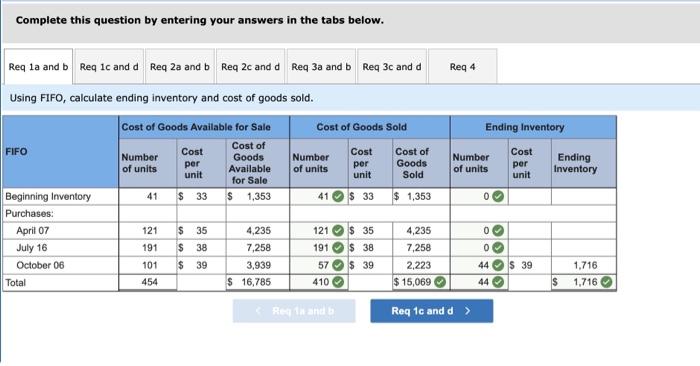

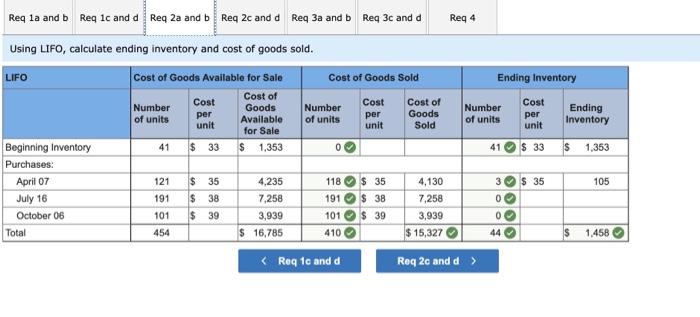

During the year, TRC Corporation has the following inventory transactions. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 41 $33

During the year, TRC Corporation has the following inventory transactions.

| Date | Transaction | Number of Units | Unit Cost | Total Cost |

|---|---|---|---|---|

| January 1 | Beginning inventory | 41 | $33 | $1,353 |

| April 7 | Purchase | 121 | 35 | 4,235 |

| July 16 | Purchase | 191 | 38 | 7,258 |

| October 6 | Purchase | 101 | 39 | 3,939 |

| 454 | $16,785 |

For the entire year, the company sells 410 units of inventory for $51 each.

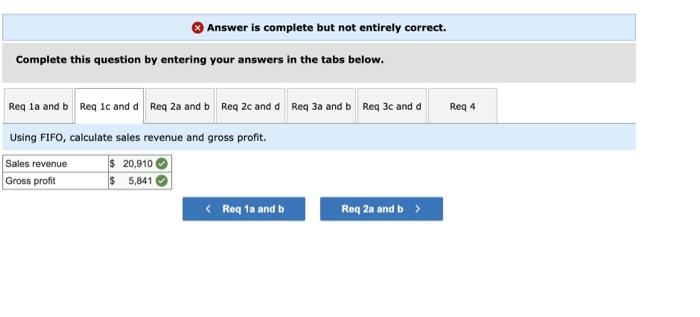

Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising.

Using weighted-average cost, calculate ending inventory and cost of goods sold. (Round "Average Cost per unit" to 4 decimal places and all other answers to 2 decimal places.)

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

- Req 2c and d

Using weighted-average cost, calculate sales revenue and gross profit. (Round answers to 2 decimal places.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started