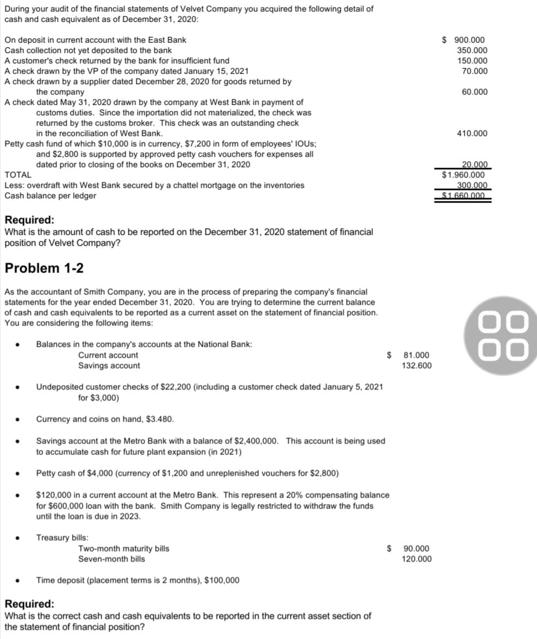

During your audit of the financial statements of Velvet Company you acquired the following detail of cash and cash equivalent as of December 31,

During your audit of the financial statements of Velvet Company you acquired the following detail of cash and cash equivalent as of December 31, 2020: On deposit in current account with the East Bank Cash collection not yet deposited to the bank A customer's check returned by the bank for insufficient fund A check drawn by the VP of the company dated January 15, 2021 A check drawn by a supplier dated December 28, 2020 for goods returned by the company A check dated May 31, 2020 drawn by the company at West Bank in payment of customs duties. Since the importation did not materialized, the check was returned by the customs broker. This check was an outstanding check in the reconciliation of West Bank Petty cash fund of which $10,000 is in currency, $7,200 in form of employees' IOUS; and $2,800 is supported by approved petty cash vouchers for expenses all dated prior to closing of the books on December 31, 2020 TOTAL Less: overdraft with West Bank secured by a chattel mortgage on the inventories Cash balance per ledger Required: What is the amount of cash to be reported on the December 31, 2020 statement of financial position of Velvet Company? Problem 1-2 As the accountant of Smith Company, you are in the process of preparing the company's financial statements for the year ended December 31, 2020. You are trying to determine the current balance of cash and cash equivalents to be reported as a current asset on the statement of financial position. You are considering the following items: . . . . Balances in the company's accounts at the National Bank: Current account Savings account Undeposited customer checks of $22.200 (including a customer check dated January 5, 2021 for $3,000) Currency and coins on hand, $3.480. Savings account at the Metro Bank with a balance of $2,400,000. This account is being used to accumulate cash for future plant expansion (in 2021) Petty cash of $4,000 (currency of $1,200 and unreplenished vouchers for $2.800) $ 81.000 132.600 $120,000 in a current account at the Metro Bank. This represent a 20% compensating balance for $600,000 loan with the bank. Smith Company is legally restricted to withdraw the funds until the loan is due in 2023. Treasury bills: Two-month maturity bills Seven-month bills Time deposit (placement terms is 2 months), $100,000 Required: What is the correct cash and cash equivalents to be reported in the current asset section of the statement of financial position? $ 90.000 120.000 $ 900.000 350.000 150.000 70.000 60.000 410.000 20.000 $1.960.000 300.000 $1.660.000 00 00 Problem 1-3 During your audit of December 31, 2020 books and records of Oswald Company, you uncover the following facts regarding the cash and cash equivalent presented as current assets: 1. 2. 3. 4. 5. 6. 7. 8 9 10. 11. Savings account of $900,000 and a checking account balance of $1,200,000 are held at North Bay Bank. Money market placement with maturity of 3 months, $7,500,000. Currency and coins on hand amounted at $11,550 Travel advances of $270,000 for the first quarter of next year (employee reimbursement will ne through salary deduction) Oswald Company has purchased $3,150,000 of commercial paper of Moon Company which is due in 60 days. A separate cash fund amounting to $2,250,000 is restricted for the retirement of long-term debt. Petty cash fund of $1,500. 1. 2. An IOU from an employee of Oswald Company in the amount of $2,000. Two certificates of deposit, each totaling $500,000. These CD's have maturity of 120 days. Oswald Company has received a check from a customer in the amount of $187,500 dated January 15, 2021. Required: What amount should be reported as cash and cash equivalents on December 31, 2020? Problem 1-4 On January 1, 2020, Davis Company established a petty cash fund of $10,000. On December 31, 2020 the petty cash fund was examined and found to have receipts and documents for miscellaneous general expenses amounting to $8,120. In addition, there was cash amounting to $1,500. On January 1, 2020, Oswald Company purchased marketable equity securities to be held as "trading" for $3,000,000. On December 31, 2020, its market value is $4,300,000. Required: 1. 2. Problem 1-5 You are reviewing the cash accounting for Bolton Company. Your focus is on the petty cash account and the bank reconciliation for the month ended May 31, 2020. You have collected the following information from Bolton Company's bookkeeper for this task: What is the amount of petty cash shortage or overage? What entry would be required to adjust the petty cash fund on December 31, 2020? Petty Cash Fund 1. 2. 3. The petty cash fund was established on May 2, 2020, in the amount of $10,000. Expenditures from the fund by the custodian as of May 31, 2020 were evidenced by approved petty cash vouchers for the following: Various office supplies IOU from employees Shipping charges Miscellaneous expense On May 31, 2020, the petty cash fund was replenished and increased to $12,000; currency and coins in the fund at that time totaled $756. Bank Reconciliation Balance, May 1, 2020 Deposits Note payment direct from customer (interest, $1,200) Checks cleared during May Bank service charges Balance, May 31, 2020 Bolton Company's Cash Account Balance, May 1, 2020 Deposits during May 2020 Checks written during May 2020 Required: Smart Bank Bank Statement Disbursements $1.246.000 1.080 $ What is the amount of petty cash shortage or overage? The journal entry to record the replenishment of and increase in the petty cash fund. What amount of cash should be reported in the May 31, 2020, statement of financial position? Deposit in transit are determined to be $120,000, and checks outstanding at May 31, total $34,000. Cash on hand (besides petty cash) at May 31, 2020, is $9,840. 3.920 1.200 2.298 1.526 Receipts $1.120.000 37.200 $ 354.000 1.240.000 1.273.400 00 00 Balance $ 350.760 260.880

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You have provided images containing five separate accounting problems Each problem has different requirements regarding the reporting of cash and cash equivalents or the reconciliation and management ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started