Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During your examination of the 20x3 financial statements of Goyo Company, the following data were discovered. Give any correcting and adjusting entries called for

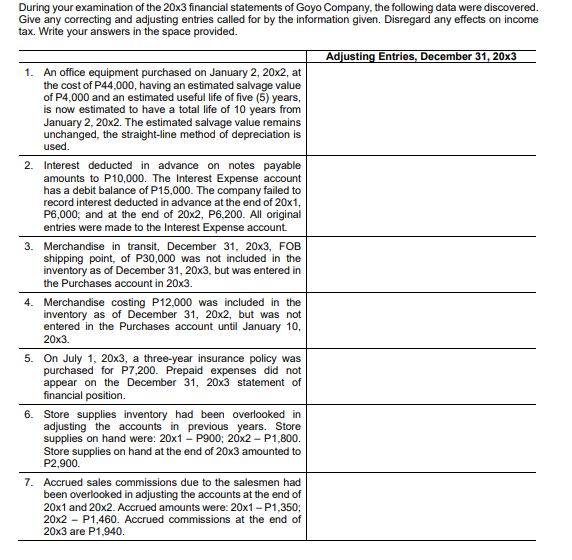

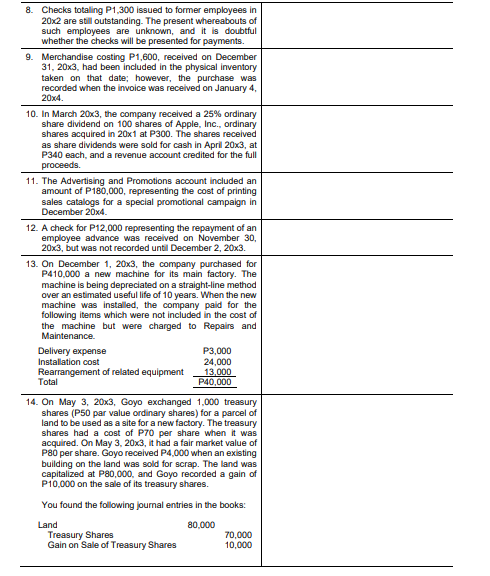

During your examination of the 20x3 financial statements of Goyo Company, the following data were discovered. Give any correcting and adjusting entries called for by the information given. Disregard any effects on income tax. Write your answers in the space provided. 1. An office equipment purchased on January 2, 20x2, at the cost of P44,000, having an estimated salvage value of P4,000 and an estimated useful life of five (5) years, is now estimated to have a total life of 10 years from January 2, 20x2. The estimated salvage value remains unchanged, the straight-line method of depreciation is used. 2. Interest deducted in advance on notes payable amounts to P10,000. The Interest Expense account has a debit balance of P15,000. The company failed to record interest deducted in advance at the end of 20x1, P6,000; and at the end of 20x2, P6,200. All original entries were made to the Interest Expense account. 3. Merchandise in transit, December 31, 20x3, FOB shipping point, of P30,000 was not included in the inventory as of December 31, 20x3, but was entered in the Purchases account in 20x3. 4. Merchandise costing P12,000 was included in the inventory as of December 31, 20x2, but was not entered in the Purchases account until January 10, 20x3. 5. On July 1, 20x3, a three-year insurance policy was purchased for P7,200. Prepaid expenses did not appear on the December 31, 20x3 statement of financial position. 6. Store supplies inventory had been overlooked in adjusting the accounts in previous years. Store supplies on hand were: 20x1-P900; 20x2 - P1,800. Store supplies on hand at the end of 20x3 amounted to P2,900. 7. Accrued sales commissions due to the salesmen had been overlooked in adjusting the accounts at the end of 20x1 and 20x2. Accrued amounts were: 20x1- P1,350; 20x2 P1,460. Accrued commissions at the end of 20x3 are P1,940. Adjusting Entries, December 31, 20x3 8. Checks totalling P1,300 issued to former employees in 20x2 are still outstanding. The present whereabouts of such employees are unknown, and it is doubtful whether the checks will be presented for payments. 9. Merchandise costing P1,600, received on December 31, 20x3, had been included in the physical inventory taken on that date; however, the purchase was recorded when the invoice was received on January 4, 20x4. 10. In March 20x3, the company received a 25% ordinary share dividend on 100 shares of Apple, Inc., ordinary shares acquired in 20x1 at P300. The shares received as share dividends were sold for cash in April 20x3, at P340 each, and a revenue account credited for the full proceeds. 11. The Advertising and Promotions account included an amount of P180,000, representing the cost of printing sales catalogs for a special promotional campaign in December 20x4. 12. A check for P12,000 representing the repayment of an employee advance was received on November 30, 20x3, but was not recorded until December 2, 20x3. 13. On December 1, 20x3, the company purchased for P410,000 a new machine for its main factory. The machine is being depreciated on a straight-line method over an estimated useful life of 10 years. When the new machine was installed, the company paid for the following items which were not included in the cost of the machine but were charged to Repairs and Maintenance. Delivery expense Installation cost Rearrangement of related equipment Total 14. On May 3, 20x3, Goyo exchanged 1,000 treasury shares (P50 par value ordinary shares) for a parcel of land to be used as a site for a new factory. The treasury shares had a cost of P70 per share when it was acquired. On May 3, 20x3, it had a fair market value of P80 per share. Goyo received P4,000 when an existing building on the land was sold for scrap. The land was capitalized at P80,000, and Goyo recorded a gain of P10,000 on the sale of its treasury shares. P3,000 24,000 Treasury Shares Gain on Sale of Treasury Shares 13,000 P40,000 You found the following journal entries in the books: Land 80,000 70,000 10,000

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started