Answered step by step

Verified Expert Solution

Question

1 Approved Answer

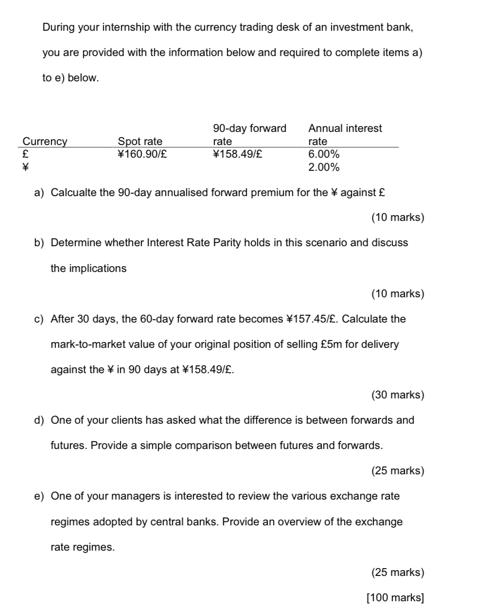

During your internship with the currency trading desk of an investment bank, you are provided with the information below and required to complete items

During your internship with the currency trading desk of an investment bank, you are provided with the information below and required to complete items a) to e) below. Currency * Spot rate 160.90/ 90-day forward rate 158.49/ Annual interest rate 6.00% 2.00% a) Calcualte the 90-day annualised forward premium for the against (10 marks) b) Determine whether Interest Rate Parity holds in this scenario and discuss the implications (10 marks) c) After 30 days, the 60-day forward rate becomes 157.45/. Calculate the mark-to-market value of your original position of selling 5m for delivery against the * in 90 days at 158.49/. (30 marks) d) One of your clients has asked what the difference is between forwards and futures. Provide a simple comparison between futures and forwards. (25 marks) e) One of your managers is interested to review the various exchange rate regimes adopted by central banks. Provide an overview of the exchange rate regimes. (25 marks) [100 marks]

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

It looks like the image contains a series of questions related to currency trading Lets go through each question one by one a Calculate the 90day annualised forward premium for the against To calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started