Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following independent and material situations: (i) During your review of the final copy of Company A's annual report prior to signing the

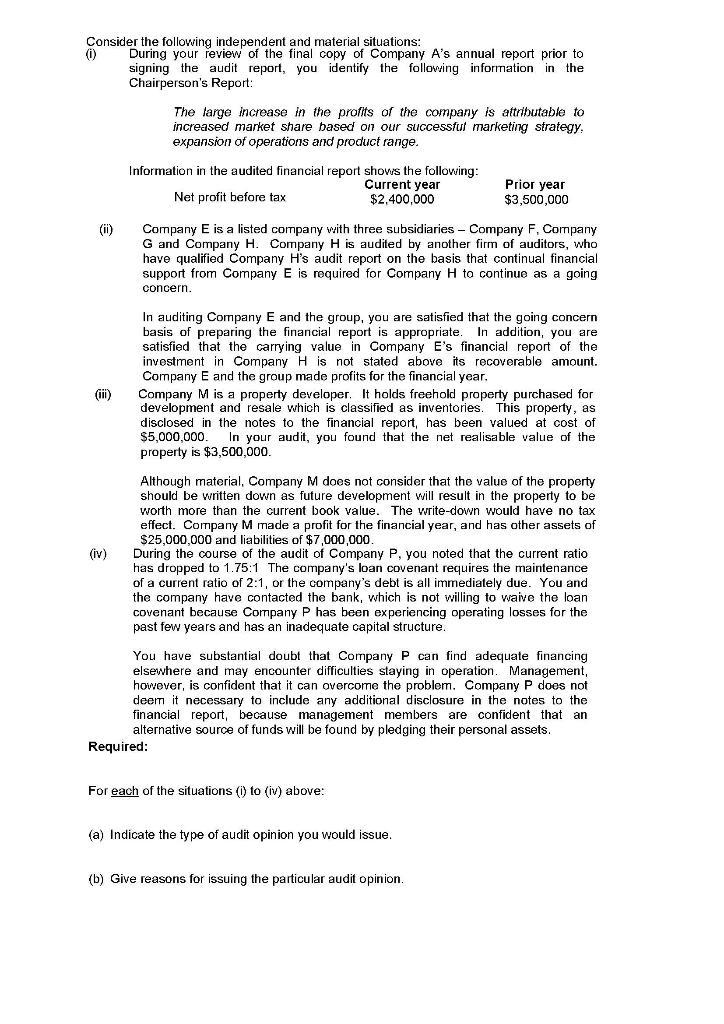

Consider the following independent and material situations: (i) During your review of the final copy of Company A's annual report prior to signing the audit report, you identify the following information in the Chairperson's Report: The large increase in the profits of the company is attributable to increased market share based on our successfut marketing strategy, expansion of operations and product range. Information in the audited financial report shows the following: Current year $2,400,000 Prior year $3,500,000 Net profit before tax (i) Company E is a listed company with three subsidiaries - Company F, Company G and Company H. Company H is audited by another firm of auditors, who have qualified Company H's audit report on the basis that continual financial support from Company E is required for Company H to continue as a going concern. In auditing Company E and the group, you are satisfied that the going concern basis of preparing the financial report is appropriate. In addition, you are satisfied that the carrying value in Company E's financial report of the investment in Company H is not stated above its recoverable amount. Company E and the group made profits for the financial year. Company M is a property developer. It holds freehold property purchased for development and resale which is classified as inventories. This property, as disclosed in the notes to the financial report, has been valued at cost of $5,000,000 property is $3,500,000. (ii) In your audit, you found that the net realisable value of the Although material, Company M does not consider that the value of the property should be written down as future development will result in the property to be worth more than the current book value. The write-down would have no tax effect. Company M made a profit for the financial year, and has other assets of $25,000,000 and liabilities of $7,000,000. During the course of the audit of Company P, you noted that the current ratio has dropped to 1.75:1 The company's loan covenant requires the maintenance of a current ratio of 2:1, or the company's debt is all immediately due. You and the company have contacted the bank, which is not willing to waive the loan covenant because Company P has been experiencing operating losses for the past few years and has an inadequate capital structure. (iv) You have substantial doubt that Company P can find adequate financing elsewhere and may encounter difficulties staying in operation. Management, however, is confident that it can overcome the problem. Company P does not deem it necessary to include any additional disclosure in the notes to the financial report, because management members are confident that an alternative source of funds will be found by pledging their personal assets. Required: For each of the situations (i) to (iv) above: (a) Indicate the type of audit opinion you would issue. (b) Give reasons for issuing the particular audit opinion.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution i a Adverse Opinion b In the given case The auditor come to know that there is increase in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started