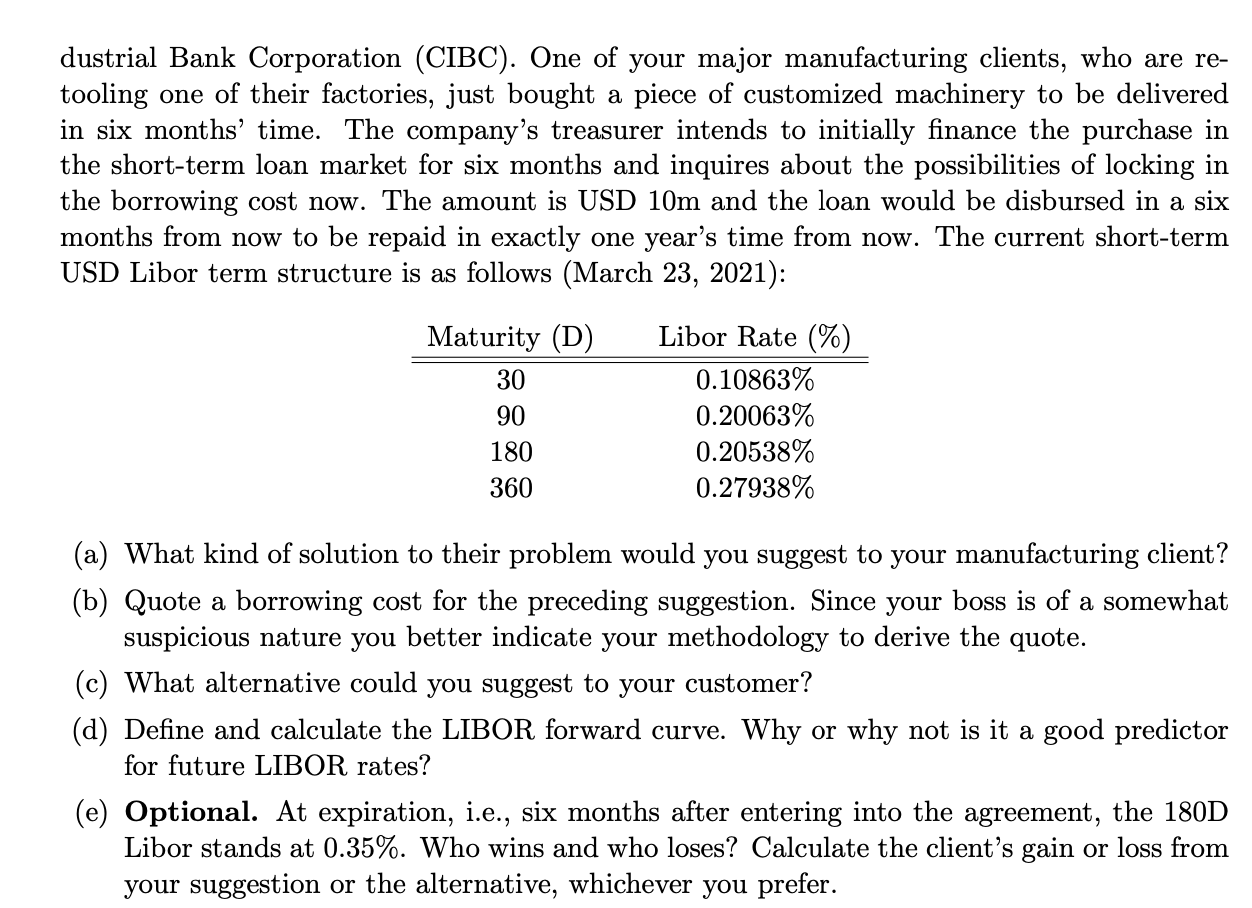

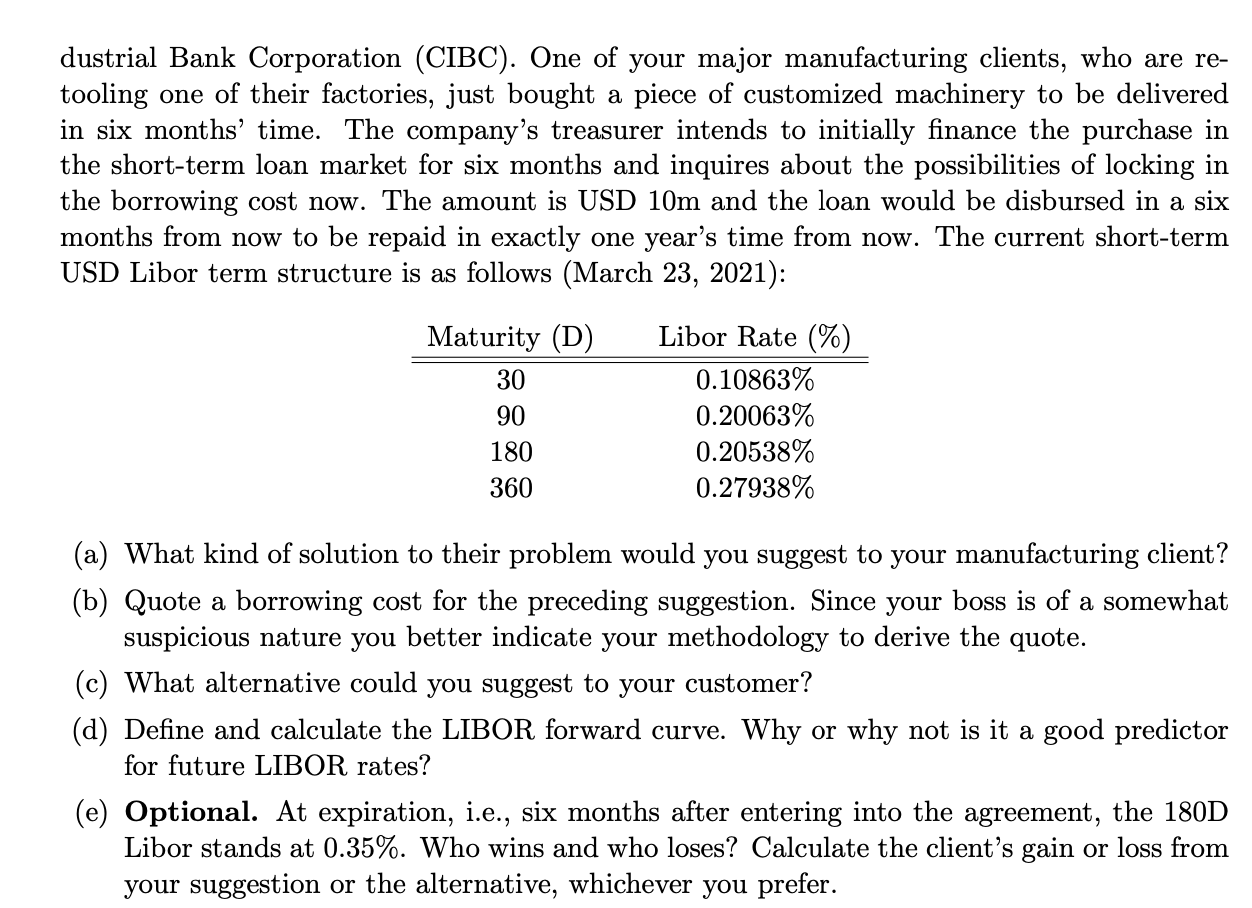

dustrial Bank Corporation (CIBC). One of your major manufacturing clients, who are re- tooling one of their factories, just bought a piece of customized machinery to be delivered in six months' time. The company's treasurer intends to initially finance the purchase in the short-term loan market for six months and inquires about the possibilities of locking in the borrowing cost now. The amount is USD 10m and the loan would be disbursed in a six months from now to be repaid in exactly one year's time from now. The current short-term USD Libor term structure is as follows (March 23, 2021): Maturity (D) 30 90 180 360 Libor Rate (%) 0.10863% 0.20063% 0.20538% 0.27938% (a) What kind of solution to their problem would you suggest to your manufacturing client? (b) Quote a borrowing cost for the preceding suggestion. Since your boss is of a somewhat suspicious nature you better indicate your methodology to derive the quote. (c) What alternative could you suggest to your customer? (d) Define and calculate the LIBOR forward curve. Why or why not is it a good predictor for future LIBOR rates? (e) Optional. At expiration, i.e., six months after entering into the agreement, the 180D Libor stands at 0.35%. Who wins and who loses? Calculate the client's gain or loss from your suggestion or the alternative, whichever you prefer. dustrial Bank Corporation (CIBC). One of your major manufacturing clients, who are re- tooling one of their factories, just bought a piece of customized machinery to be delivered in six months' time. The company's treasurer intends to initially finance the purchase in the short-term loan market for six months and inquires about the possibilities of locking in the borrowing cost now. The amount is USD 10m and the loan would be disbursed in a six months from now to be repaid in exactly one year's time from now. The current short-term USD Libor term structure is as follows (March 23, 2021): Maturity (D) 30 90 180 360 Libor Rate (%) 0.10863% 0.20063% 0.20538% 0.27938% (a) What kind of solution to their problem would you suggest to your manufacturing client? (b) Quote a borrowing cost for the preceding suggestion. Since your boss is of a somewhat suspicious nature you better indicate your methodology to derive the quote. (c) What alternative could you suggest to your customer? (d) Define and calculate the LIBOR forward curve. Why or why not is it a good predictor for future LIBOR rates? (e) Optional. At expiration, i.e., six months after entering into the agreement, the 180D Libor stands at 0.35%. Who wins and who loses? Calculate the client's gain or loss from your suggestion or the alternative, whichever you prefer