Question

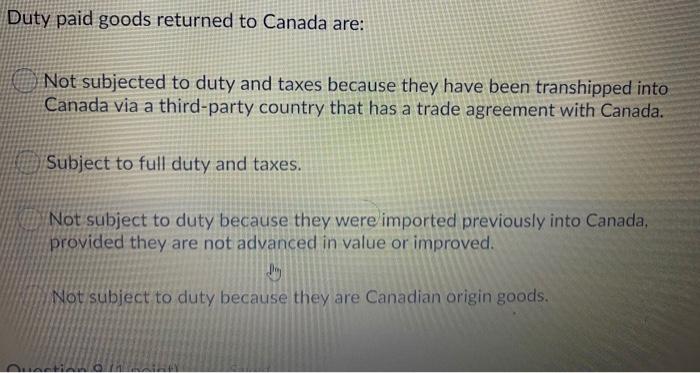

Duty paid goods returned to Canada are: Not subjected to duty and taxes because they have been transhipped into Canada via a third-party country

Duty paid goods returned to Canada are: Not subjected to duty and taxes because they have been transhipped into Canada via a third-party country that has a trade agreement with Canada. Subject to full duty and taxes. Not subject to duty because they were imported previously into Canada, provided they are not advanced in value or improved. Not subject to duty because they are Canadian origin goods.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The correct option is Option B which is Subject to full du...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Business Law

Authors: Anthony Liuzzo

9th edition

007802319X, 978-0078023194

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App