Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dux Store is a bike retailing store. Following is related information for Dux Store's inventory account in March 2017. March 1 March 5 March

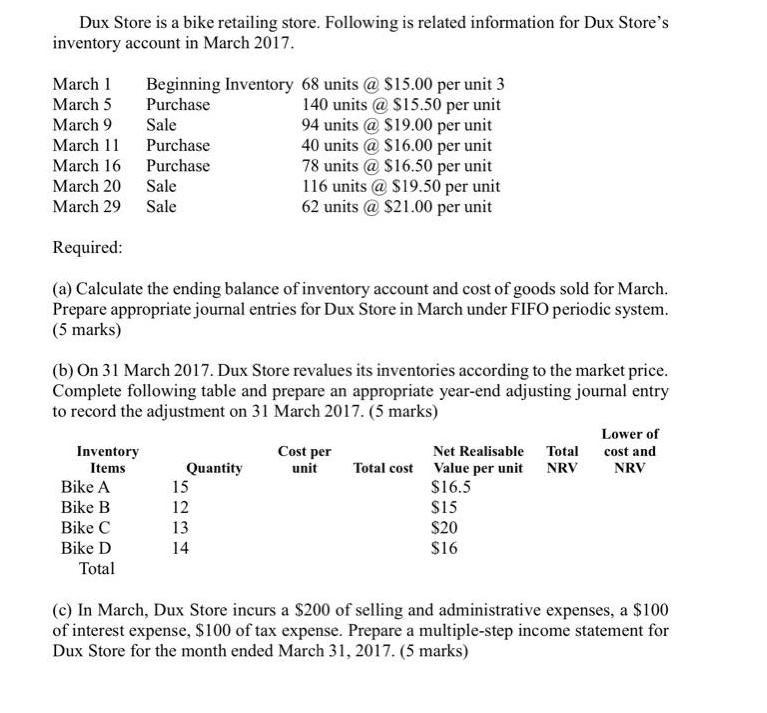

Dux Store is a bike retailing store. Following is related information for Dux Store's inventory account in March 2017. March 1 March 5 March 9 March 11 March 16 March 20 March 29 Required: (a) Calculate the ending balance of inventory account and cost of goods sold for March. Prepare appropriate journal entries for Dux Store in March under FIFO periodic system. (5 marks) Beginning Inventory 68 units @ $15.00 per unit 3 Purchase Sale Purchase Purchase Sale 140 units @ $15.50 per unit 94 units @ $19.00 per unit 40 units @ $16.00 per unit 78 units @ $16.50 per unit 116 units @ $19.50 per unit 62 units @ $21.00 per unit Sale (b) On 31 March 2017. Dux Store revalues its inventories according to the market price. Complete following table and prepare an appropriate year-end adjusting journal entry to record the adjustment on 31 March 2017. (5 marks) Inventory Items Bike A Bike B Bike C Bike D Total Quantity 15 12 13 14 Cost per unit Net Realisable Total Total cost Value per unit NRV $16.5 $15 $20 $16 Lower of cost and NRV (c) In March, Dux Store incurs a $200 of selling and administrative expenses, a $100 of interest expense, $100 of tax expense. Prepare a multiple-step income statement for Dux Store for the month ended March 31, 2017. (5 marks)

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Solution Periodic inventory system updates inventory records only at the end of reporting period con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started