Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DWAYNE COMPANY and EAGLE COMPANY agreed to exchange a set of machinery wherein DWAYNE COMPANY would likewise pay EAGLE COMPANY P60,000. The cash configuration

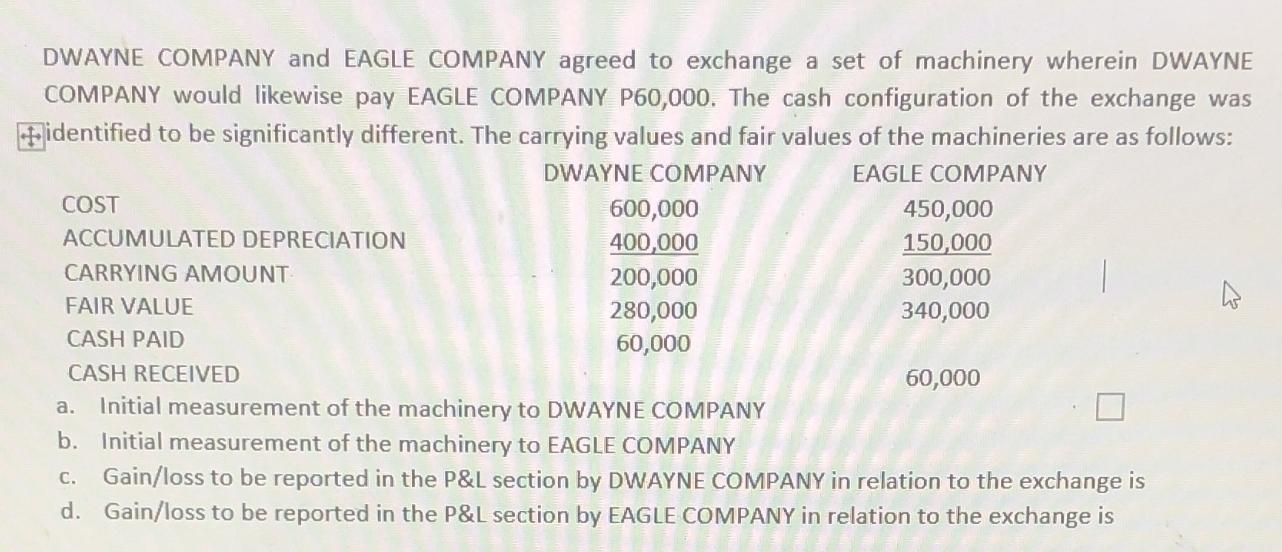

DWAYNE COMPANY and EAGLE COMPANY agreed to exchange a set of machinery wherein DWAYNE COMPANY would likewise pay EAGLE COMPANY P60,000. The cash configuration of the exchange was identified to be significantly different. The carrying values and fair values of the machineries are as follows: DWAYNE COMPANY EAGLE COMPANY COST ACCUMULATED DEPRECIATION CARRYING AMOUNT FAIR VALUE CASH PAID CASH RECEIVED 600,000 400,000 200,000 280,000 60,000 450,000 150,000 300,000 340,000 60,000 a. Initial measurement of the machinery to DWAYNE COMPANY b. Initial measurement of the machinery to EAGLE COMPANY c. Gain/loss to be reported in the P&L section by DWAYNE COMPANY in relation to the exchange is d. Gain/loss to be reported in the P&L section by EAGLE COMPANY in relation to the exchange is

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Initial measurement of the machinery to DWAYNE COMPANY The fair value of the machinery received by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started