Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Labson Limited has 3 production centres (Machine centre X, Machine centre Y and an Assembly centre) and 2 service centres (Materials procurement and General

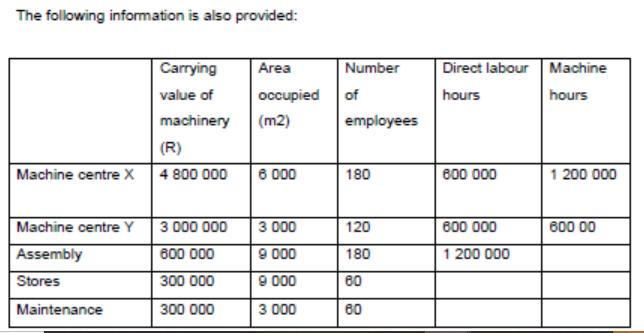

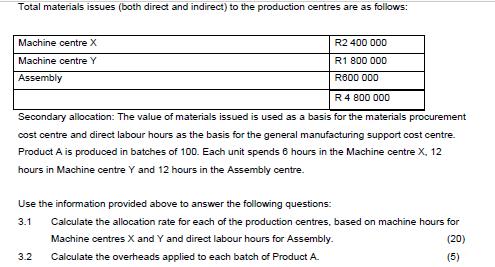

Labson Limited has 3 production centres (Machine centre X, Machine centre Y and an Assembly centre) and 2 service centres (Materials procurement and General manufacturing support). The annual overhead costs are as follows Indirect materials: Machine centre X Machine centre Y Assembly Materials procurement General manufacturing support Indirect labour: Machine centre Machine centre Y Assembly Materials procurement General manufacturing support Heating and lighting Property tax Insurance of machinery Depreciation of machinery Insurance of buildings Salaries of works management R 300 000 483 000 63 000 0 6 000 600 000 600 000 900 000 660 000 888 000 300 000 600 000 90.000 900 000 150 000 480 000 The following information is also provided: Machine centre X Machine centre Y Assembly Stores Maintenance Carrying value of machinery (R) 4 800 000 3 000 000 600 000 300 000 300 000 Area occupied (m2) 6 000 3 000 9 000 9 000 3.000 Number of employees 180 120 180 60 60 Direct labour Machine hours hours 600 000 600 000 1 200 000 1 200 000 600 00 Total materials issues (both direct and indirect) to the production centres are as follows: Machine centre X Machine centre Y Assembly R2 400 000 R1 800 000 R600 000 R 4 800 000 Secondary allocation: The value of materials issued is used as a basis for the materials procurement cost centre and direct labour hours as the basis for the general manufacturing support cost centre. Product A is produced in batches of 100. Each unit spends 6 hours in the Machine centre X, 12 hours in Machine centre Y and 12 hours in the Assembly centre. Use the information provided above to answer the following questions: 3.1 Calculate the allocation rate for each of the production centres, based on machine hours for Machine centres X and Y and direct labour hours for Assembly. (20) Calculate the overheads applied to each batch of Product A. (5) 3.2

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started