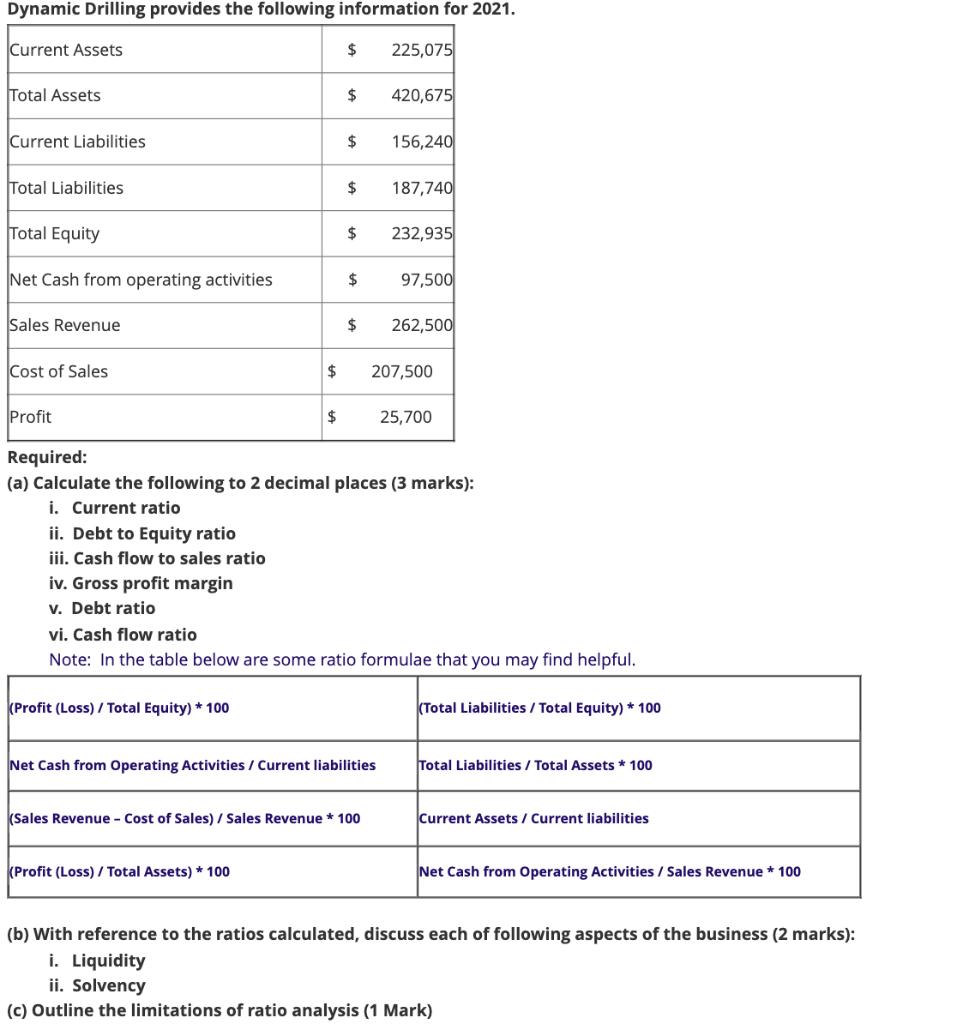

Question: Dynamic Drilling provides the following information for 2021. Current Assets Total Assets Current Liabilities Total Liabilities Total Equity Net Cash from operating activities Sales

Dynamic Drilling provides the following information for 2021. Current Assets Total Assets Current Liabilities Total Liabilities Total Equity Net Cash from operating activities Sales Revenue Cost of Sales $ (Profit (Loss) / Total Equity) * 100 $ $ $ (Profit (Loss) / Total Assets) * 100 $ $ $ 225,075 420,675 156,240 Net Cash from Operating Activities / Current liabilities (Sales Revenue - Cost of Sales) / Sales Revenue * 100 187,740 232,935 $ 262,500 Profit Required: (a) Calculate the following to 2 decimal places (3 marks): i. Current ratio ii. Debt to Equity ratio iii. Cash flow to sales ratio 97,500 207,500 $ 25,700 iv. Gross profit margin v. Debt ratio vi. Cash flow ratio Note: In the table below are some ratio formulae that you may find helpful. (Total Liabilities/Total Equity) * 100 Total Liabilities/Total Assets * 100 Current Assets / Current liabilities Net Cash from Operating Activities / Sales Revenue * 100 (b) With reference to the ratios calculated, discuss each of following aspects of the business (2 marks): i. Liquidity ii. Solvency (c) Outline the limitations of ratio analysis (1 Mark)

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

a RATIOS Current ratio Current assets Current liabilities 225075 156240 144 Debt to Equity ratio Tot... View full answer

Get step-by-step solutions from verified subject matter experts