Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dynamic Industries is considering a new project. The project may begin today or in exactly two years. The project will cost 11.5 million to

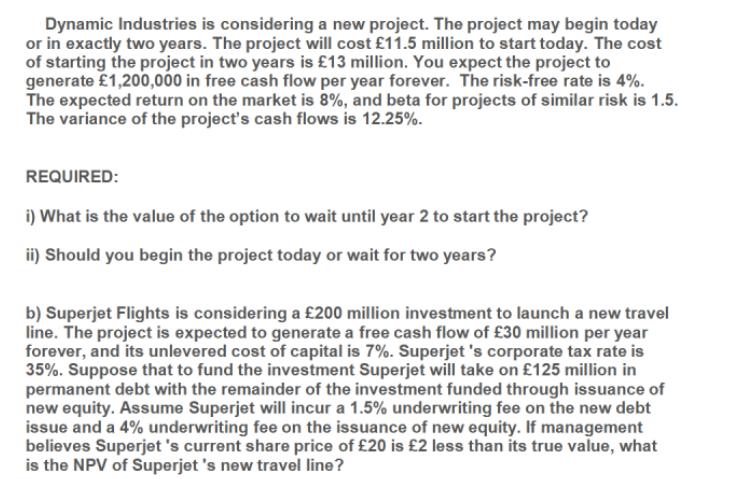

Dynamic Industries is considering a new project. The project may begin today or in exactly two years. The project will cost 11.5 million to start today. The cost of starting the project in two years is 13 million. You expect the project to generate 1,200,000 in free cash flow per year forever. The risk-free rate is 4%. The expected return on the market is 8%, and beta for projects of similar risk is 1.5. The variance of the project's cash flows is 12.25%. REQUIRED: i) What is the value of the option to wait until year 2 to start the project? ii) Should you begin the project today or wait for two years? b) Superjet Flights is considering a 200 million investment to launch a new travel line. The project is expected to generate a free cash flow of 30 million per year forever, and its unlevered cost of capital is 7%. Superjet 's corporate tax rate is 35%. Suppose that to fund the investment Superjet will take on 125 million in permanent debt with the remainder of the investment funded through issuance of new equity. Assume Superjet will incur a 1.5% underwriting fee on the new debt issue and a 4% underwriting fee on the issuance of new equity. If management believes Superjet's current share price of 20 is 2 less than its true value, what is the NPV of Superjet 's new travel line?

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a i Option Value Cost of Delay NPV of Delay Cost of Delay 13 million 115 mi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started