Answered step by step

Verified Expert Solution

Question

1 Approved Answer

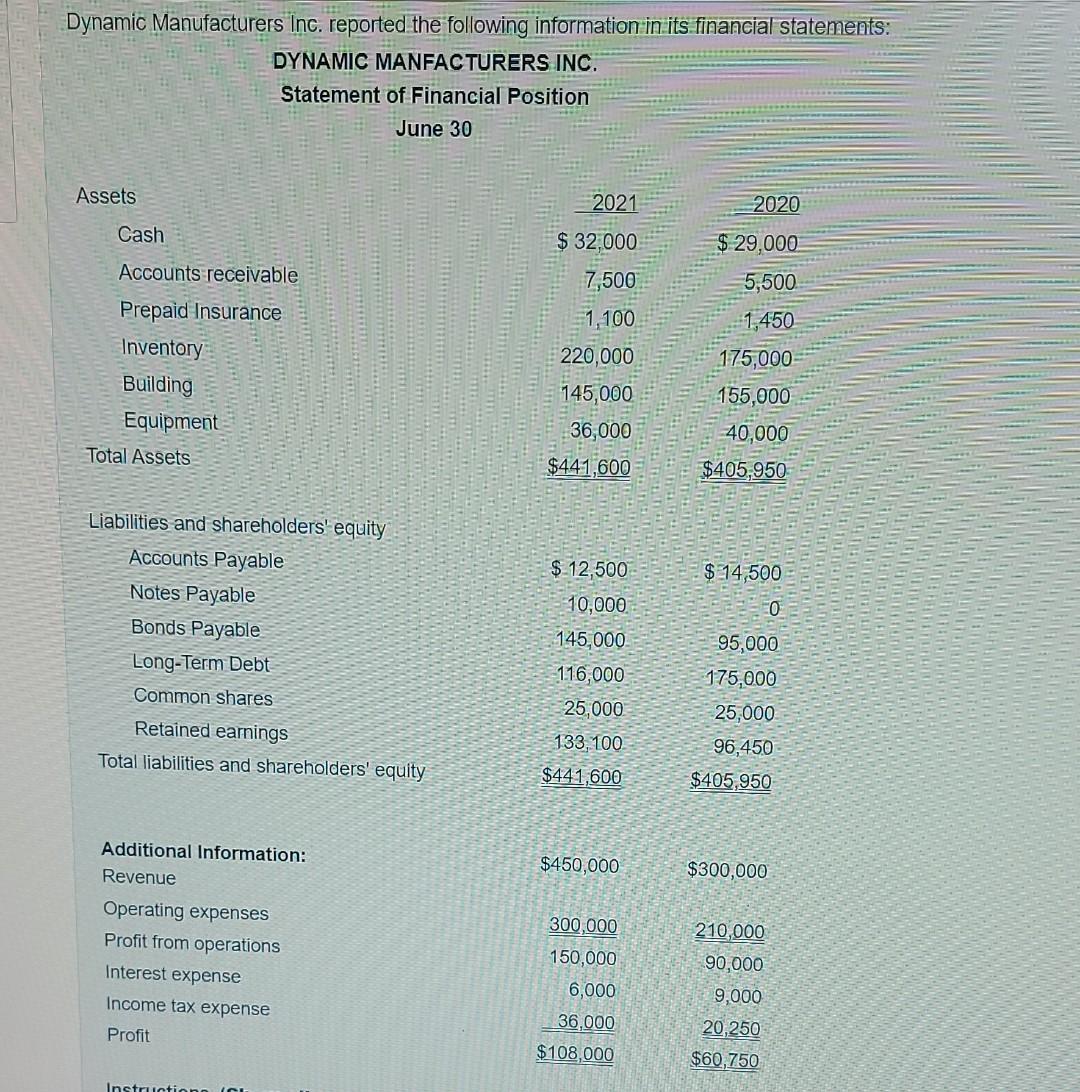

Dynamic Manufacturers Inc. reported the following information in its financial statements: DYNAMIC MANFACTURERS INC. Statement of Financial Position June 30 Assets 2021 2020 Cash $

Dynamic Manufacturers Inc. reported the following information in its financial statements: DYNAMIC MANFACTURERS INC. Statement of Financial Position June 30 Assets 2021 2020 Cash $ 29,000 $ 32,000 7,500 1,100 Accounts receivable Prepaid Insurance Inventory Building Equipment Total Assets 5,500 1,450 175,000 220,000 145,000 155,000 36,000 40,000 $405,950 $441,600 $ 14,500 Liabilities and shareholders' equity Accounts Payable Notes Payable Bonds Payable Long-Term Debt Common shares Retained earnings Total liabilities and shareholders' equity $ 12,500 10,000 145,000 o 1.16,000 25,000 133, 100 $441,600 95,000 175,000 25,000 96,450 $405,950 Additional Information: Revenue $450,000 $300,000 210,000 Operating expenses Profit from operations Interest expense Income tax expense 300,000 150,000 90.000 6,000 Profit 36,000 $108,000 9,000 20,250 $60,750 Instruction Instructions (Show all your calculations for full marks.) a) Calculate the company's debt to equity and interest coverage ratios for 2021. b) If industry averages for debt to equity is 1.2 to 1 and interest coverage is 9 times, are Dynamic ratios comparable? Explain. 1 A - B I Instructions (Show all your calculations for full marks.) a) Calculate the company's debt to equity and interest coverage ratios for 2021. b) If industry averages for debt to equity is 1.2 to 1 and interest coverage is 9 times, are Dynamic ratios comparable? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started