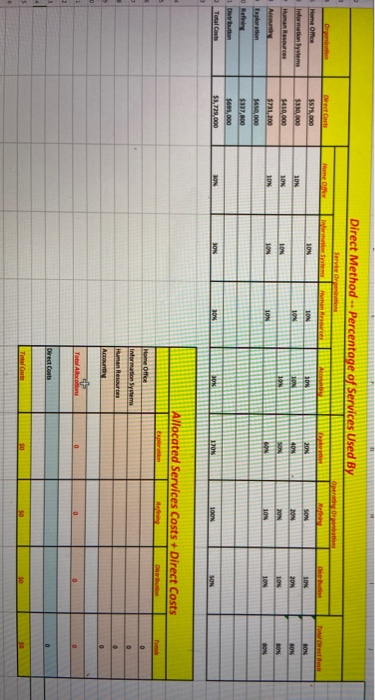

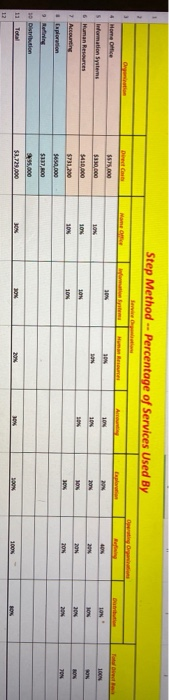

Dynamic Petroleum Logistical Solutions is an integrated company providing oil exploration, crude oil refining and petroleum products distribution throughout the United States and Canada, You have been provided with Direct Costs for the following 4 service organizations and 3 operating organizations: Service Organizations: 1. Home Office 2. Information Systems 3. Human Resources 4. Accounting I Operating Organizations: 1. Exploration 2. Refining 3. Distribution Using both the Direct and Step-Down methods, calculate the total allocated service costs and direct costs for the operating organizations: Exploration Division, Refining Division, and Distribution Division. Direct Method - Percentage of Services Used By Derbi De Corte Debut Trector Home Office 10 ION 20% SON 10% BON $575,000 $330,000 $410,000 SON 10 40% TON 20 SON BON 10W LON Account 10 $231,200 $450,000 10W 10N 10% 100 Rewing $337,000 $695,000 Darbation Total Cuts $2.729.000 BON BOX 30 BOK 1203 100N SON Allocated Services Costs + Direct Costs Explosion Home Office 0 Information Systems D Human Rewa Accu . + Total Alcon Direct Costs 0 Tolosa SO $0 Step Method -- Percentage of Services Used By 3 Operating Direct Humor 4 Home Office SS. 30 100 sommation Systems 10N 100 $330,000 LON SON 10 20 6 Human Resources low ON $410,000 109 105 SON son 20 Accounting JON SON 109 $731.100 S650.000 30 20W 20N Esploration 20N SUIT, 100 3 Distribution 95.000 Te $2.729.000 os 100 12 Step Down Services Costs Direct Coats Rose Court Step Cose portion Being Dorition 5 Home Office 6 Wormation Systems man Resources Accounting 1 Direct Costs Total Costs so Direct Method se SO Difference between the methods 50 Direct Method -- Percentage of Services Used By SO Information Organi Coute Aunting Die Tocal Home $575.000 10N 10N 10 10 SON LON BON $130.000 100 IN 20N 20 40 SON 7 Human Resources $410.000 10% SON 10N 20% 10 BON Ang 10 SON 10N BON S6000 50 10 Renang $337.800 SEOS 000 11 Distributie 12 TotalCout $3,729.000 30 30 2703 109 Allocated Services Costs + Direct Costs Exploration Refining Distribution Totals Home Office 0 Information Systems Human Resources 0 Accounting 0 Total Allocations 0 Direct Costs 0 Total Costs so $0 $0 $0 Step Method - Percentage of Services Used By 2 Sand co 4 Home One 10 10 10N 495 10% 100 $ Information Systems $575.000 $130,000 $410,000 10% 10% 10% 29 20 NON 6 Human Resources 10 10W 10% ON 20 201 BOX $731,200 10 10 20N 20% 795 7 Accounting * Exploration 9 Refining $650,000 $337,ADO s Distribution $695,000 52.720.000 11 Total JON 20 10% 100% 100% 10 Co 15 Home One 18 Information Systems 17 Human Resources 1 Accounting 10 Tote Alle come 10 31 Dret Ceuta 22 23 Total cos 24 25 26 Direct Methed SD 27 Dynamic Petroleum Logistical Solutions is an integrated company providing oil exploration, crude oil refining and petroleum products distribution throughout the United States and Canada, You have been provided with Direct Costs for the following 4 service organizations and 3 operating organizations: Service Organizations: 1. Home Office 2. Information Systems 3. Human Resources 4. Accounting I Operating Organizations: 1. Exploration 2. Refining 3. Distribution Using both the Direct and Step-Down methods, calculate the total allocated service costs and direct costs for the operating organizations: Exploration Division, Refining Division, and Distribution Division. Direct Method - Percentage of Services Used By Derbi De Corte Debut Trector Home Office 10 ION 20% SON 10% BON $575,000 $330,000 $410,000 SON 10 40% TON 20 SON BON 10W LON Account 10 $231,200 $450,000 10W 10N 10% 100 Rewing $337,000 $695,000 Darbation Total Cuts $2.729.000 BON BOX 30 BOK 1203 100N SON Allocated Services Costs + Direct Costs Explosion Home Office 0 Information Systems D Human Rewa Accu . + Total Alcon Direct Costs 0 Tolosa SO $0 Step Method -- Percentage of Services Used By 3 Operating Direct Humor 4 Home Office SS. 30 100 sommation Systems 10N 100 $330,000 LON SON 10 20 6 Human Resources low ON $410,000 109 105 SON son 20 Accounting JON SON 109 $731.100 S650.000 30 20W 20N Esploration 20N SUIT, 100 3 Distribution 95.000 Te $2.729.000 os 100 12 Step Down Services Costs Direct Coats Rose Court Step Cose portion Being Dorition 5 Home Office 6 Wormation Systems man Resources Accounting 1 Direct Costs Total Costs so Direct Method se SO Difference between the methods 50 Direct Method -- Percentage of Services Used By SO Information Organi Coute Aunting Die Tocal Home $575.000 10N 10N 10 10 SON LON BON $130.000 100 IN 20N 20 40 SON 7 Human Resources $410.000 10% SON 10N 20% 10 BON Ang 10 SON 10N BON S6000 50 10 Renang $337.800 SEOS 000 11 Distributie 12 TotalCout $3,729.000 30 30 2703 109 Allocated Services Costs + Direct Costs Exploration Refining Distribution Totals Home Office 0 Information Systems Human Resources 0 Accounting 0 Total Allocations 0 Direct Costs 0 Total Costs so $0 $0 $0 Step Method - Percentage of Services Used By 2 Sand co 4 Home One 10 10 10N 495 10% 100 $ Information Systems $575.000 $130,000 $410,000 10% 10% 10% 29 20 NON 6 Human Resources 10 10W 10% ON 20 201 BOX $731,200 10 10 20N 20% 795 7 Accounting * Exploration 9 Refining $650,000 $337,ADO s Distribution $695,000 52.720.000 11 Total JON 20 10% 100% 100% 10 Co 15 Home One 18 Information Systems 17 Human Resources 1 Accounting 10 Tote Alle come 10 31 Dret Ceuta 22 23 Total cos 24 25 26 Direct Methed SD 27