Answered step by step

Verified Expert Solution

Question

1 Approved Answer

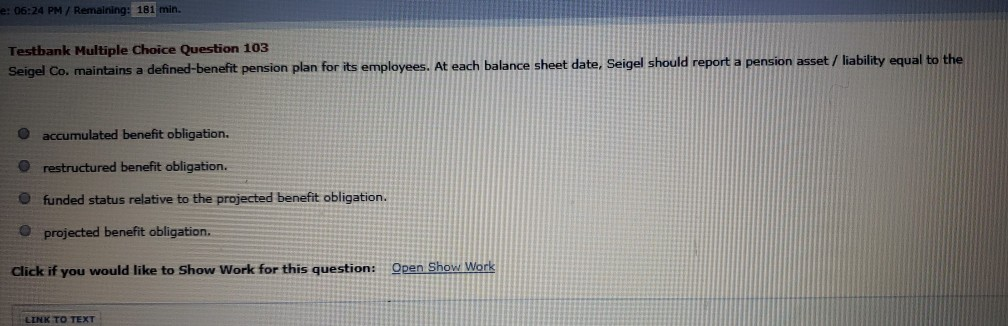

e: 06:24 PM / Remaining: 181 min. Testbank Multiple Choice Question 103 Seigel Co. maintains a defined-benefit pension plan for its employees. At each balance

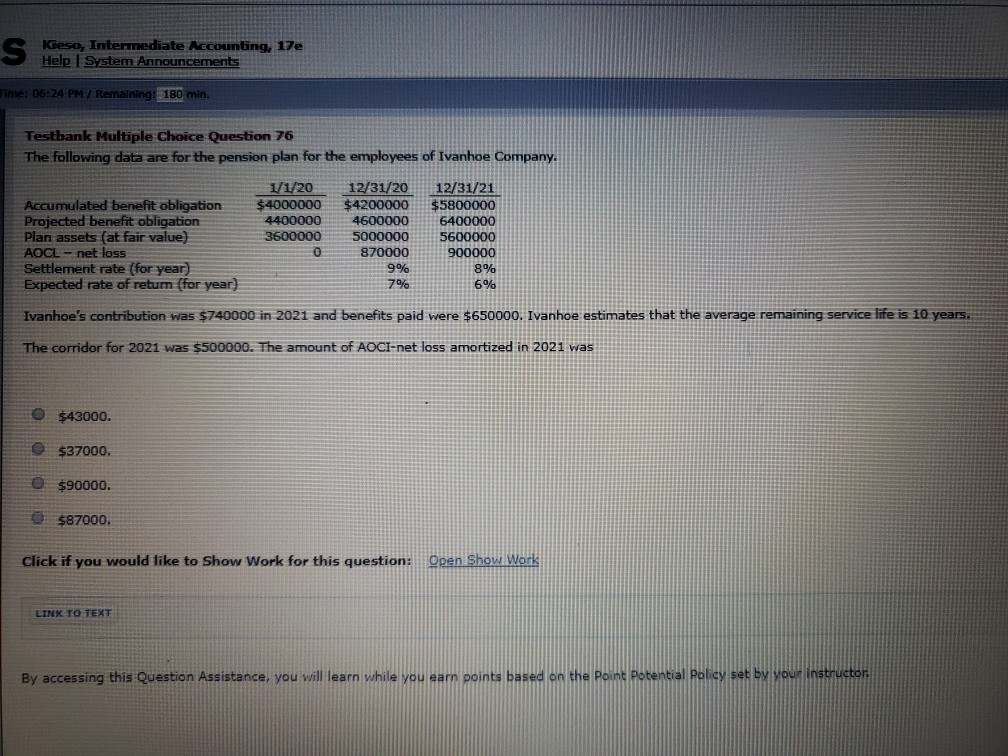

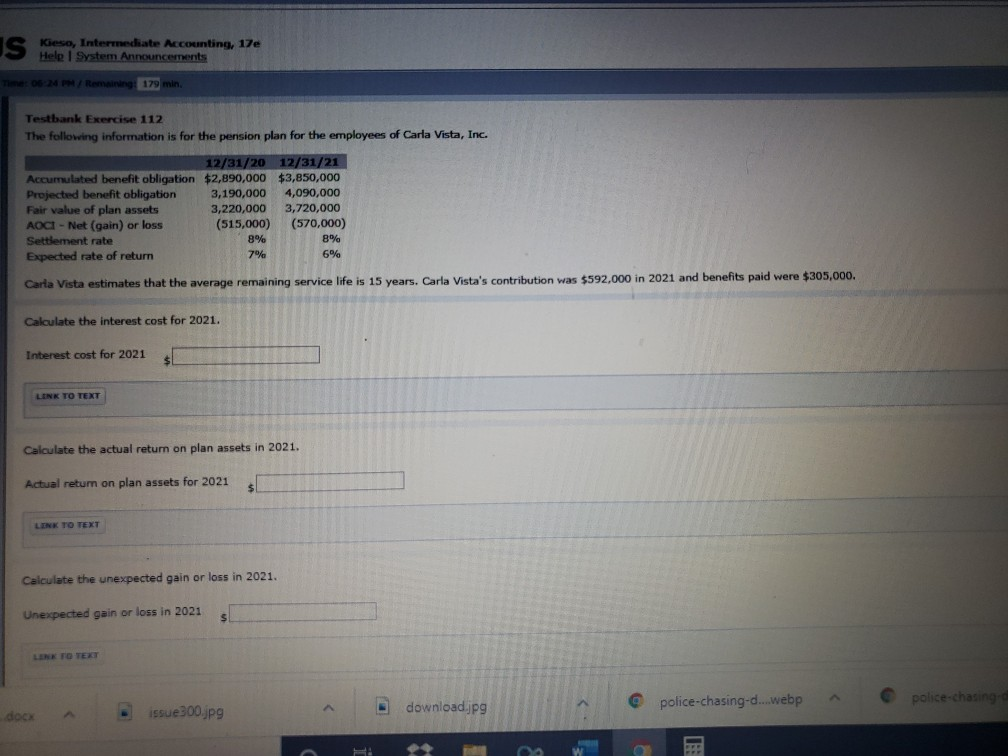

e: 06:24 PM / Remaining: 181 min. Testbank Multiple Choice Question 103 Seigel Co. maintains a defined-benefit pension plan for its employees. At each balance sheet date, Seigel should report a pension asset / liability equal to the accumulated benefit obligation. restructured benefit obligation. funded status relative to the projected benefit obligation. projected benefit obligation. Click if you would like to Show Work for this question: Open Show LINK TO TEXT Kieso, Intermediate Accounting, 17e Help 1 System Announcements Time: 06:24 PM / Remlning: 180 min. Testbank Multiple Choice Question 76 The following data are for the pension plan for the employees of Ivanhoe Company 1/1/20 1 2/31/20 12/31/21 Accumulated benefit obligation $4000000 $4200000 $5800000 Projected benefit obligation 4400000 46000006400000 Plan assets (at fair value) 3600000 5000000 5600000 AOCL - net loss 870000 900000 Settlement rate (for year) 9% 8% Expected rate of retur (for year) Ivanhoe's contribution was $740000 in 2021 and benefits paid were $650000. Ivanhoe estimates that the average remaining service life is 10 years. 70% The corridor for 2021 was $500000. The amount of AOCI-net loss amortized in 2021 was $43000. e $37000. $90000. $87000. Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT By accessing this Question Assistance, you will learn while you learn points based on the Point Potential Policy set by your instructor S Keso, Intermediate Accountino 17 Help System Announcements 06-24 P/ Remaining: 179 min. Testbank Exercise 112 The following information is for the pension plan for the employees of Carla Vista, Inc. 12/31/20 Accumulated benefit obligation $2,890,000 Projected benefit obligation 3,190,000 Fair value of plan assets 3,220,000 AOCI - Net (gain) or loss (515,000) Settlement rate 8% Expected rate of return 12/31/21 $3,850,000 4,090,000 3,720,000 (570,000) 8% 6% 7% Carla Vista estimates that the average remaining service life is 15 years. Carla Vista's contribution was $592,000 in 2021 and benefits paid were $305,000. Calculate the interest cost for 2021. Interest cost for 2021 LINK TO TEXT Calculate the actual return on plan assets in 2021. Actual return on plan assets for 2021 LINK TO TEXT Calculate the unexpected gain or loss in 2021. Unexpected gain or loss in 2021 LINK TO TEXT police-chasing-d....webp download.jpg police-chasing docx issue 300.jpg HI e: 06:24 PM / Remaining: 181 min. Testbank Multiple Choice Question 103 Seigel Co. maintains a defined-benefit pension plan for its employees. At each balance sheet date, Seigel should report a pension asset / liability equal to the accumulated benefit obligation. restructured benefit obligation. funded status relative to the projected benefit obligation. projected benefit obligation. Click if you would like to Show Work for this question: Open Show LINK TO TEXT Kieso, Intermediate Accounting, 17e Help 1 System Announcements Time: 06:24 PM / Remlning: 180 min. Testbank Multiple Choice Question 76 The following data are for the pension plan for the employees of Ivanhoe Company 1/1/20 1 2/31/20 12/31/21 Accumulated benefit obligation $4000000 $4200000 $5800000 Projected benefit obligation 4400000 46000006400000 Plan assets (at fair value) 3600000 5000000 5600000 AOCL - net loss 870000 900000 Settlement rate (for year) 9% 8% Expected rate of retur (for year) Ivanhoe's contribution was $740000 in 2021 and benefits paid were $650000. Ivanhoe estimates that the average remaining service life is 10 years. 70% The corridor for 2021 was $500000. The amount of AOCI-net loss amortized in 2021 was $43000. e $37000. $90000. $87000. Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT By accessing this Question Assistance, you will learn while you learn points based on the Point Potential Policy set by your instructor S Keso, Intermediate Accountino 17 Help System Announcements 06-24 P/ Remaining: 179 min. Testbank Exercise 112 The following information is for the pension plan for the employees of Carla Vista, Inc. 12/31/20 Accumulated benefit obligation $2,890,000 Projected benefit obligation 3,190,000 Fair value of plan assets 3,220,000 AOCI - Net (gain) or loss (515,000) Settlement rate 8% Expected rate of return 12/31/21 $3,850,000 4,090,000 3,720,000 (570,000) 8% 6% 7% Carla Vista estimates that the average remaining service life is 15 years. Carla Vista's contribution was $592,000 in 2021 and benefits paid were $305,000. Calculate the interest cost for 2021. Interest cost for 2021 LINK TO TEXT Calculate the actual return on plan assets in 2021. Actual return on plan assets for 2021 LINK TO TEXT Calculate the unexpected gain or loss in 2021. Unexpected gain or loss in 2021 LINK TO TEXT police-chasing-d....webp download.jpg police-chasing docx issue 300.jpg HI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started