Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e 1 t EXAMPLE 14.1 Short-Term Notes Payable and Accrued Interest PROBLEM: Auso Company recently experienced a temporary delay in cash collections and needed

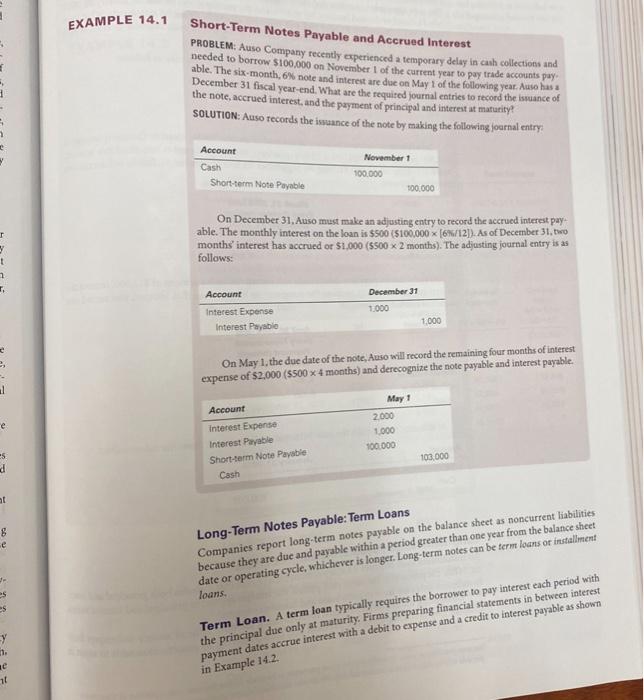

e 1 t EXAMPLE 14.1 Short-Term Notes Payable and Accrued Interest PROBLEM: Auso Company recently experienced a temporary delay in cash collections and needed to borrow $100,000 on November 1 of the current year to pay trade accounts pay able. The six-month, 6% note and interest are due on May 1 of the following year. Auso has a December 31 fiscal year-end. What are the required journal entries to record the issuance of the note, accrued interest, and the payment of principal and interest at maturity SOLUTION: Auso records the issuance of the note by making the following journal entry Account Cash Short-term Note Payable November 1 100,000 100,000 On December 31, Auso must make an adjusting entry to record the accrued interest pay able. The monthly interest on the loan is $500 ($100,000 x (6%/12]). As of December 31, two months' interest has accrued or $1,000 ($500 x 2 months). The adjusting journal entry is as follows: Account Interest Expense Interest Payable December 31 1.000 1,000 On May 1, the due date of the note, Auso will record the remaining four months of interest expense of $2,000 ($500 x 4 months) and derecognize the note payable and interest payable. Account May 1 e Interest Expense 2,000 Interest Payable 1,000 d Short-term Note Payable 100.000 103,000 Cash at g y e t e Long-Term Notes Payable: Term Loans Companies report long-term notes payable on the balance sheet as noncurrent liabilities because they are due and payable within a period greater than one year from the balance sheet date or operating cycle, whichever is longer. Long-term notes can be term loans or installment loans. Term Loan. A term loan typically requires the borrower to pay interest each period with the principal due only at maturity. Firms preparing financial statements in between interest payment dates accrue interest with a debit to expense and a credit to interest payable as shown in Example 14.2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started