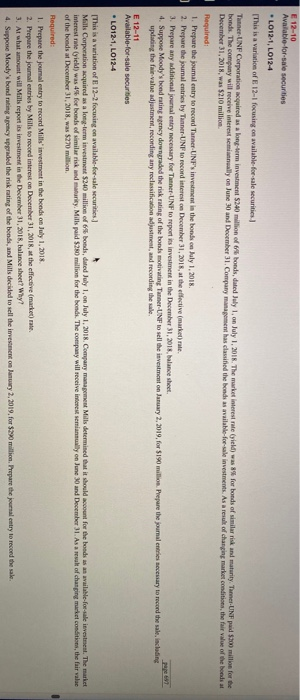

E 12-10 Avalable for sale securities L012-1, LO124 This is a variations of E 12-1 focusing on available for sale securities Tanner UNF Corporation acquired as a long-term investment 240 million of bonds, dated July 1, on July 1, 2016. The market interest rate field was for bonds of similar risk and maturity. The UNF paid to million for de bonds. The company will receive interest scminally on June 30 and December 31. Company management has classified the bonds as silable for sale investments. As a result of changing market conditions, the fair value of the boodsal December 31, 2018, was $210 million. Required: 1. Prepare the journal entry to record Tanner UNFS investment in the bonds on haly 1, 2018 2. Prepare the mal entries by Tanner-UNF to record interest December 31, 2018, at the effective market rate 3. Prepare any additional journal entry necessary for Tanner-UNF to report is investment in the December 31, 2015, balance sheet 4. Suppose Moody's band rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $190 million Prepare the journal entries necessary to record the sale, including updating the value adjustment recording any reclassification adjustment, and recording the sale E 12-11 Available-for-sale securities L012-1, L012-4 (This is a variation of E 12-2 focusing on available for sale securities] Mills Corporation acquired as a long-term investment $240 million of 66 bonds, dated July 1, on July 1, 2018. Company management Mills determined that it should account for the bonds as an available for sale investment. The market interest rate (yield) was 496 for bonds of similar risk and many. Mills paid $200 million for the bands. The company will receive in manually on June and December 31. As a result of changing market condition, the fair wala of the boods at December 31, 2018, was $270 million Required: 1. Prepare the journal entry to record Mills investment in the bends on July 1, 2018 2. Prepare the journal entries by Mills to record interest on December 31, 2018, at the effective market rate. 3. At what amount will Mills report its investment in the December 31, 2015, balance sheet? Why? 4. Suppose Moody's bonding pency upgraded the risk rating of the bends, and Mills decided to sell the investment on muy 2.2019. for $20 million. Prepare the journal entry to record the sale