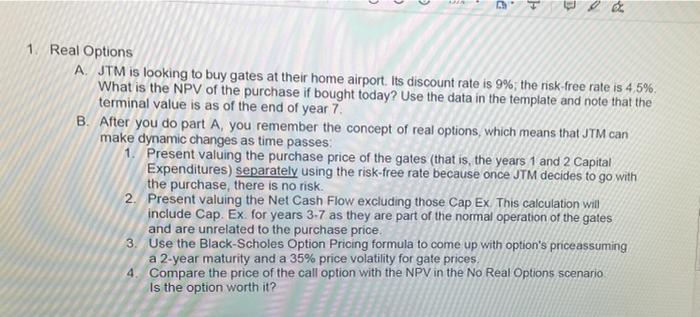

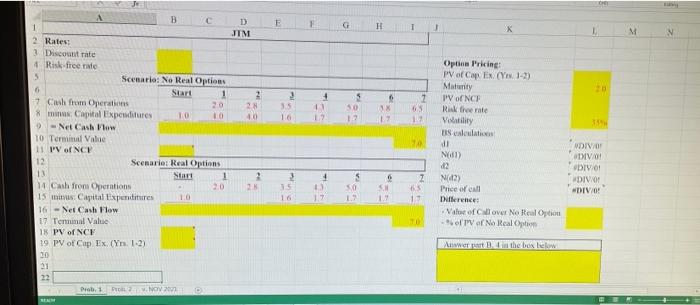

e * 3 1. Real Options A. JTM is looking to buy gates at their home airport. Its discount rate is 9%; the risk-free rate is 4.5%, What is the NPV of the purchase if bought today? Use the data in the template and note that the terminal value is as of the end of year 7. B. After you do part A, you remember the concept of real options, which means that JTM can make dynamic changes as time passes 1. Present valuing the purchase price of the gates (that is, the years 1 and 2 Capital Expenditures) separately using the risk-free rate because once JTM decides to go with the purchase, there is no risk. 2. Present valuing the Net Cash Flow excluding those Cap Ex. This calculation will include Cap. Ex. for years 3-7 as they are part of the normal operation of the gates and are unrelated to the purchase price. 3. Use the Black-Scholes Option Pricing formula to come up with option's priceassuming a 2-year maturity and a 35% price volatility for gate prices, 4. Compare the price of the call option with the NPV in the No Real Options scenario Is the option worth it? E G H 1 1 X M 20 3 15 6 MX SO 7 63 D 1 JIM Rates 3 Discount rate Risk-free rate 5 Scenario: No Real Options 6 Start 1 7 Cash from Operation 20 IN #m Capital Expenditures 10 10 Net Cash Flow 10 Terminal Value 11 PV of NCH 12 Scenarie: Real Options 13 Star 1 14 Cath front Operations 2.0 2 15 mins Capital Expenditures 1.0 16 - Net Cash Flow 17 Term Value 18 PV of NCE 19 PV of Cup Ex(Yn 1-2) 20 31 22 Prob. 1 POL.NO Option Pricing PV of Cap En Ye 1-2) Maturity IV of NCE Risk free rate Volatility us allatie di N81) 02 Nd2 Price of a Durence Value of Clover No Real Option of af No Real Optic WDIVO DIVO DIVO DIVAO DIVOF 6 2 15 16 1 4 11 1.7 5 50 1.7 TO Answer in the box flow e * 3 1. Real Options A. JTM is looking to buy gates at their home airport. Its discount rate is 9%; the risk-free rate is 4.5%, What is the NPV of the purchase if bought today? Use the data in the template and note that the terminal value is as of the end of year 7. B. After you do part A, you remember the concept of real options, which means that JTM can make dynamic changes as time passes 1. Present valuing the purchase price of the gates (that is, the years 1 and 2 Capital Expenditures) separately using the risk-free rate because once JTM decides to go with the purchase, there is no risk. 2. Present valuing the Net Cash Flow excluding those Cap Ex. This calculation will include Cap. Ex. for years 3-7 as they are part of the normal operation of the gates and are unrelated to the purchase price. 3. Use the Black-Scholes Option Pricing formula to come up with option's priceassuming a 2-year maturity and a 35% price volatility for gate prices, 4. Compare the price of the call option with the NPV in the No Real Options scenario Is the option worth it? E G H 1 1 X M 20 3 15 6 MX SO 7 63 D 1 JIM Rates 3 Discount rate Risk-free rate 5 Scenario: No Real Options 6 Start 1 7 Cash from Operation 20 IN #m Capital Expenditures 10 10 Net Cash Flow 10 Terminal Value 11 PV of NCH 12 Scenarie: Real Options 13 Star 1 14 Cath front Operations 2.0 2 15 mins Capital Expenditures 1.0 16 - Net Cash Flow 17 Term Value 18 PV of NCE 19 PV of Cup Ex(Yn 1-2) 20 31 22 Prob. 1 POL.NO Option Pricing PV of Cap En Ye 1-2) Maturity IV of NCE Risk free rate Volatility us allatie di N81) 02 Nd2 Price of a Durence Value of Clover No Real Option of af No Real Optic WDIVO DIVO DIVO DIVAO DIVOF 6 2 15 16 1 4 11 1.7 5 50 1.7 TO Answer in the box flow