Answered step by step

Verified Expert Solution

Question

1 Approved Answer

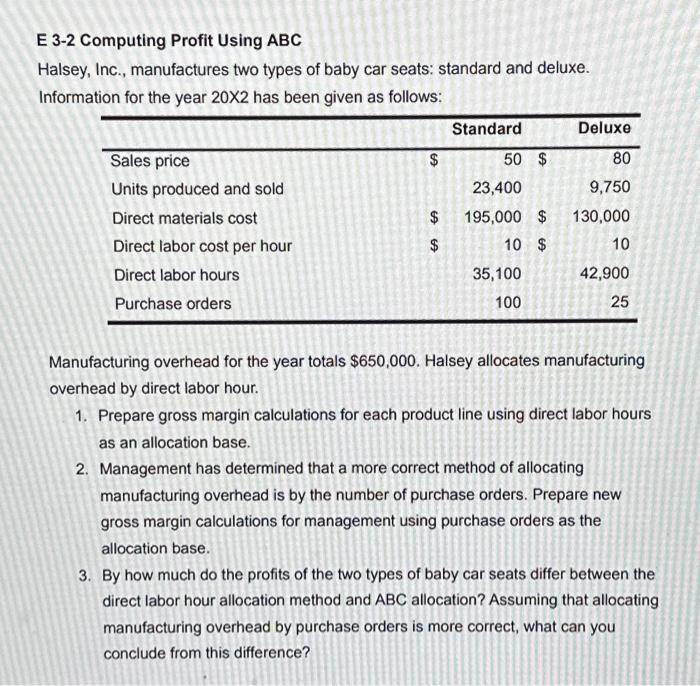

E 3-2 Computing Profit Using ABC Halsey, Inc., manufactures two types of baby car seats: standard and deluxe. Information for the year 20X2 has been

E 3-2 Computing Profit Using ABC Halsey, Inc., manufactures two types of baby car seats: standard and deluxe. Information for the year 20X2 has been given as follows: Sales price Units produced and sold Direct materials cost Direct labor cost per hour Direct labor hours Purchase orders $ $ LA LA $ Standard 50 $ 23,400 195,000 $ 10 $ 35,100 100 Deluxe 80 9,750 130,000 10 42,900 25 Manufacturing overhead for the year totals $650,000. Halsey allocates manufacturing overhead by direct labor hour. 1. Prepare gross margin calculations for each product line using direct labor hours as an allocation base. 2. Management has determined that a more correct method of allocating manufacturing overhead is by the number of purchase orders. Prepare new gross margin calculations for management using purchase orders as the allocation base. 3. By how much do the profits of the two types of baby car seats differ between the direct labor hour allocation method and ABC allocation? Assuming that allocating manufacturing overhead by purchase orders is more correct, what can you conclude from this difference?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started