Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E 4 - 8 ( Algo ) Recording Transactions Including Adjusting and Closing Entries LO 4 - 1 , 4 - 4 E 4 -

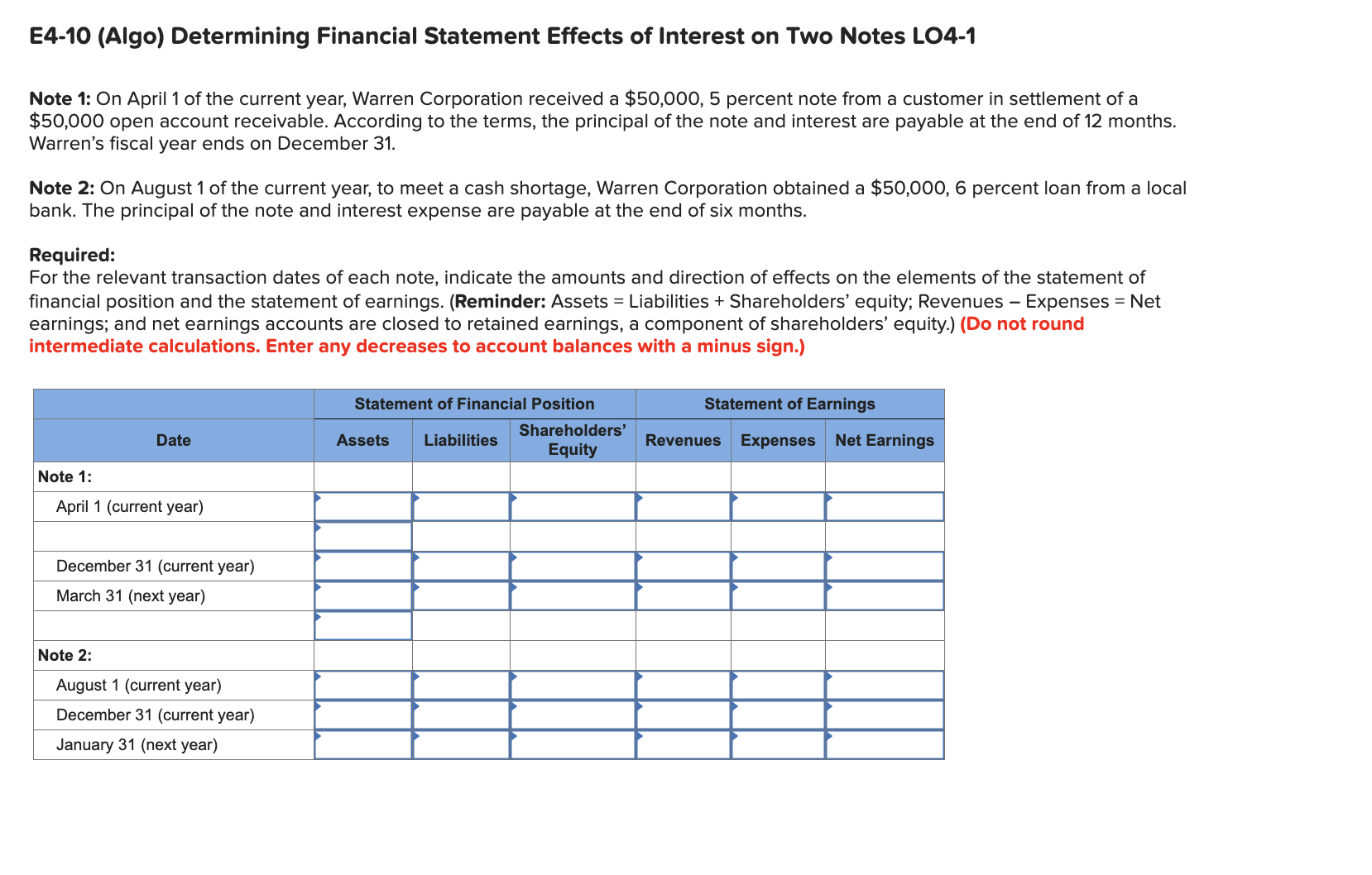

EAlgo Recording Transactions Including Adjusting and Closing Entries LOEAlgo Determining Financial Statement Effects of Interest on Two Notes LO

Note : On April of the current year, Warren Corporation received a $ percent note from a customer in settlement of a $ open account receivable. According to the terms, the principal of the note and interest are payable at the end of months. Warren's fiscal year ends on December

Note : On August of the current year, to meet a cash shortage, Warren Corporation obtained a $ percent loan from a local bank. The principal of the note and interest expense are payable at the end of six months.

Required:

For the relevant transaction dates of each note, indicate the amounts and direction of effects on the elements of the statement of financial position and the statement of earnings. Reminder: Assets Liabilities Shareholders' equity; Revenues Expenses Net earnings; and net earnings accounts are closed to retained earnings, a component of shareholders' equity.Do not round intermediate calculations. Enter any decreases to account balances with a minus sign.

tableDateStatement of Financial Position,Statement of Earnings,,Assets,Liabilities,tableShareholdersEquityRevenues,Expenses,Net EarningsNote :April current yearDecember current yearMarch next yearNote :August current yearDecember current yearJanuary next year

The following accounts are used by Britt's Knits Inc.

tableCodeAccounts,Code,AccountsACash,JContributed capitalBOffice supplies,KRetained earningsCAccounts receivable,LService revenueDOffice equipment,MInterest RevenueEAccumulated depreciation,NWages expenseF Note payable,Depreciation expense,GWages payable,PInterest expenseHInterest payable,QSupplies expenseIDeferred service revenue,RNone of the accounts

Required:

For each of the following nine independent situations, give the journal entry by selecting the appropriate codes from the dropdown menu and enter the amounts The first transaction is used as an example.

tableIndependent Situations,Debit,CreditCode,Amount,Code,AmountaAccrued wages, unrecorded and unpaid at yearend, $GcDividends declared and paid during the year, $dOffice supplies on hand during the year, $; supplies on hand at yearend, $gAt yearend, interest on note payable not yet recorded or paid, $hBalance at yearend in service revenue account, $ Give the closing entry at yearend.,,,,iBalance at yearend in interest expense, $ Give the closing entry at yearend.,,,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started