Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E 7 - 9 ( Algo ) Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow E 7 - 9 ( Algo

EAlgo Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow EAlgo Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow

Effects LO

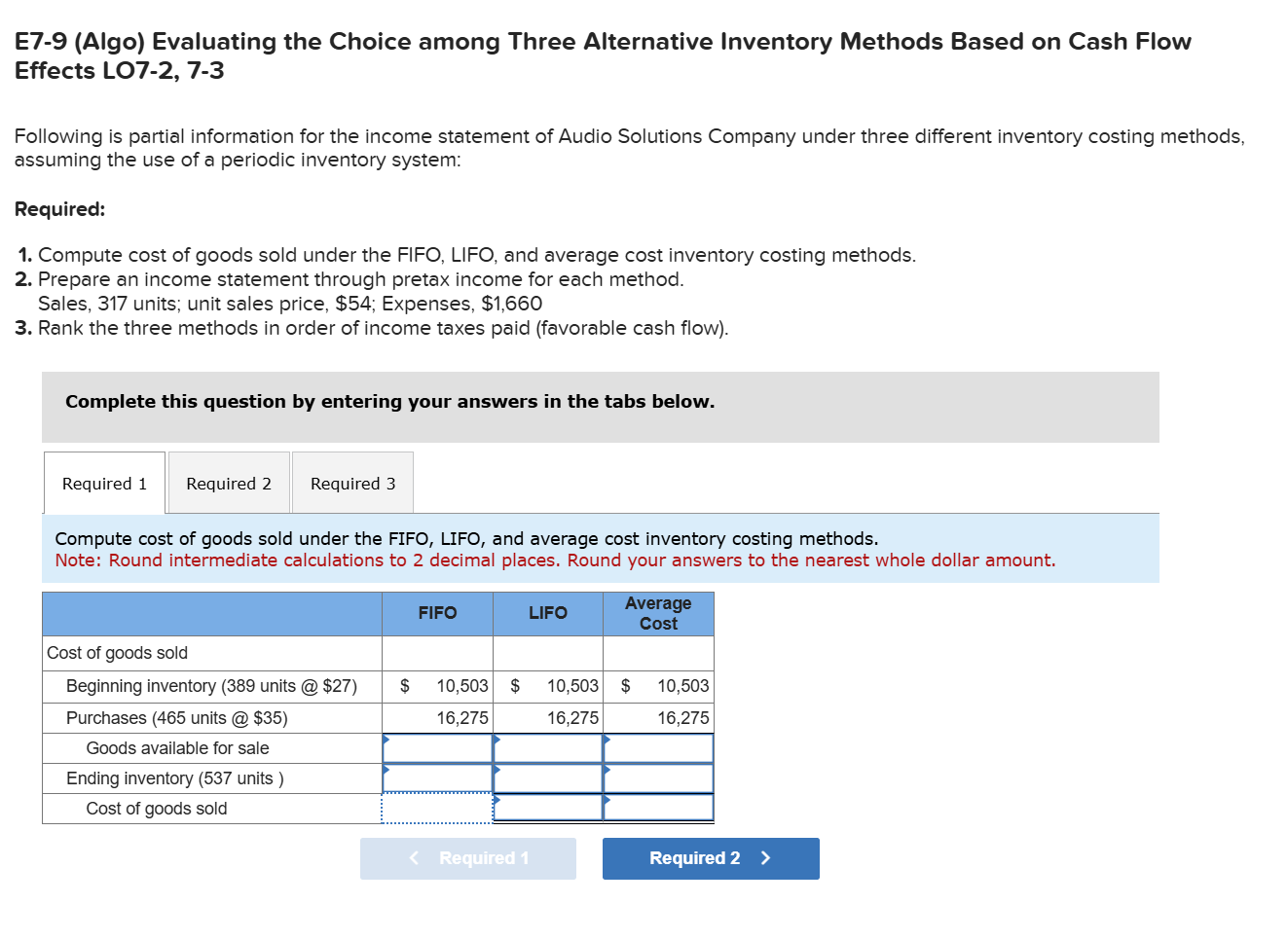

Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods,

assuming the use of a periodic inventory system:

Required:

Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

Prepare an income statement through pretax income for each method.

Sales, units; unit sales price, $; Expenses, $

Rank the three methods in order of income taxes paid favorable cash flow

Complete this question by entering your answers in the tabs below.

Prepare an income statement through pretax income for each method.

Sales, units; unit sales price, $; Expenses, $

Note: Use the COGS amount from Required EAlgo Evaluating the Choice among Three Alternative Inventory Methods Based on Cash Flow

Effects LO

Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods,

assuming the use of a periodic inventory system:

Required:

Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

Prepare an income statement through pretax income for each method.

Sales, units; unit sales price, $; Expenses, $

Rank the three methods in order of income taxes paid favorable cash flow

Complete this question by entering your answers in the tabs below.

Required

Rank the three methods in order of income taxes paid favorable cash flow

Effects LO

Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods,

assuming the use of a periodic inventory system:

Required:

Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

Prepare an income statement through pretax income for each method.

Sales, units; unit sales price, $; Expenses, $

Rank the three methods in order of income taxes paid favorable cash flow

Complete this question by entering your answers in the tabs below.

Required

Required

Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods.

Note: Round intermediate calculations to decimal places. Round your answers to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started