Answered step by step

Verified Expert Solution

Question

1 Approved Answer

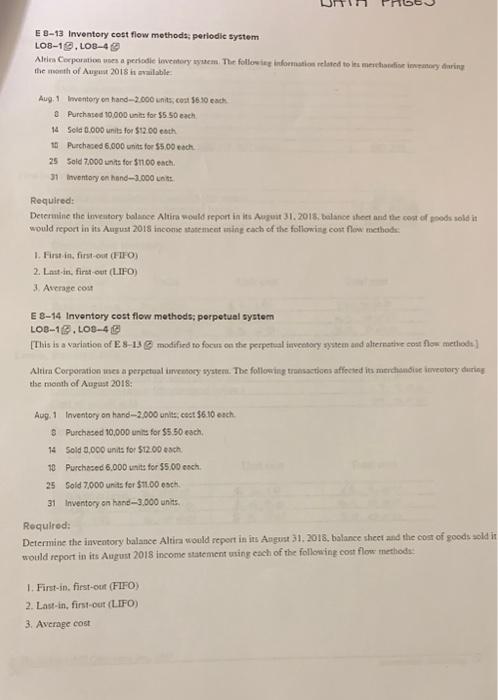

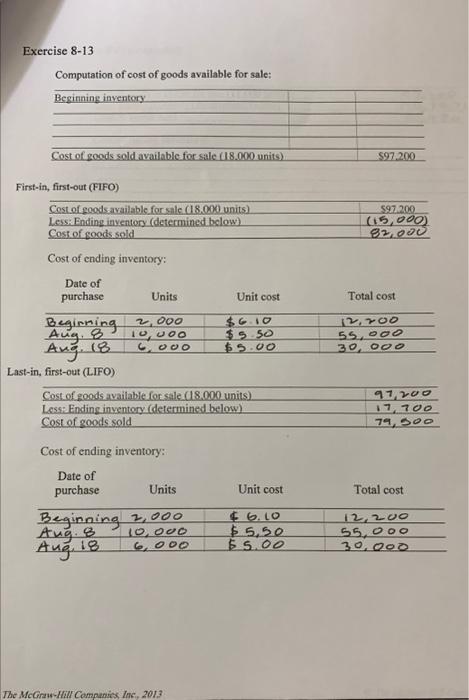

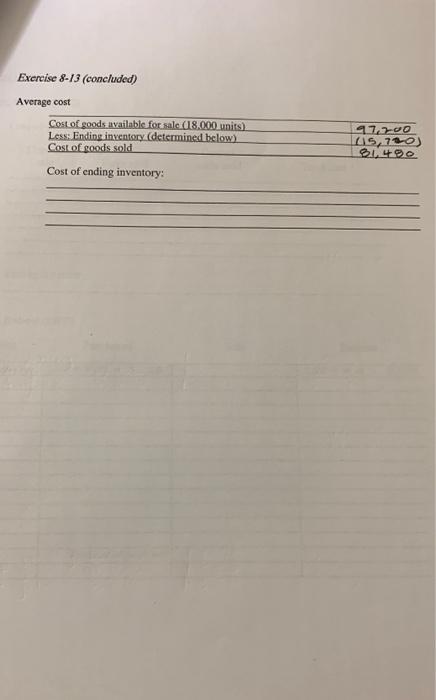

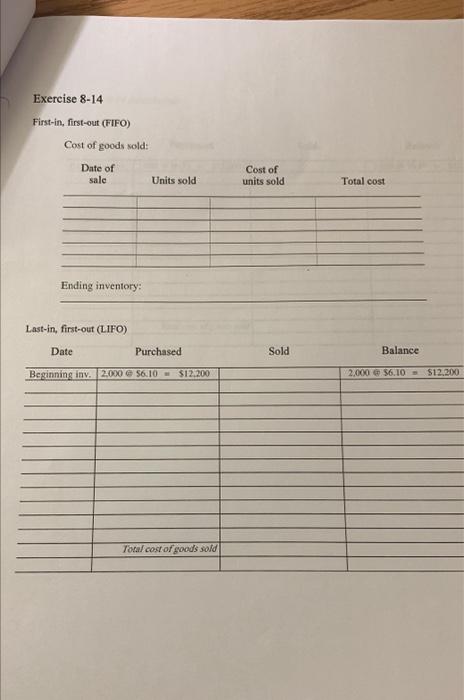

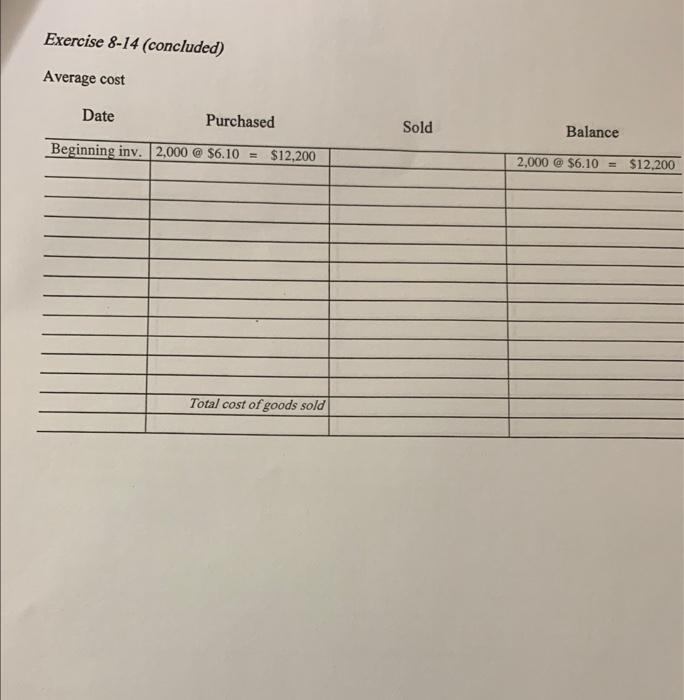

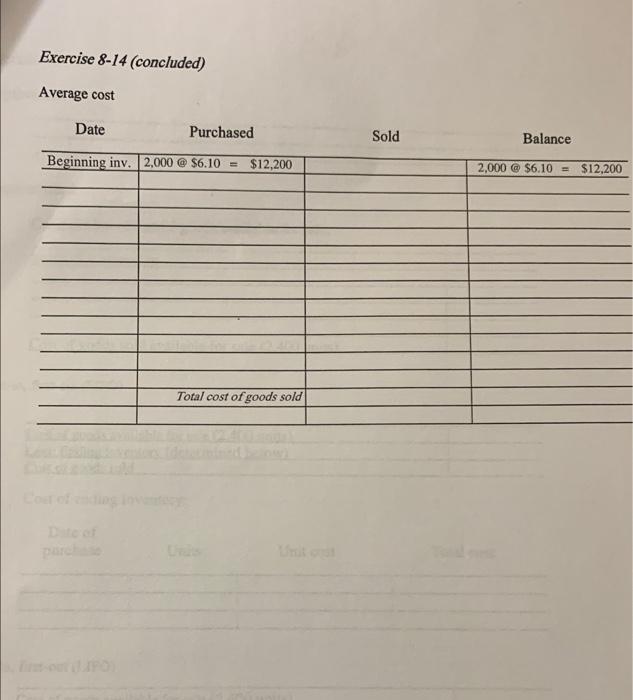

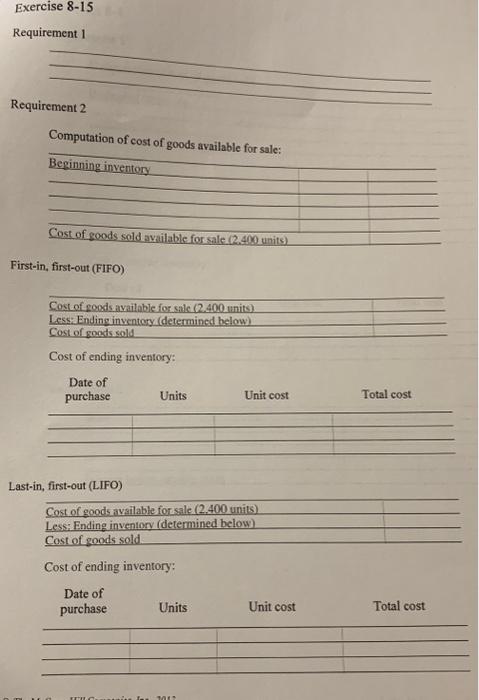

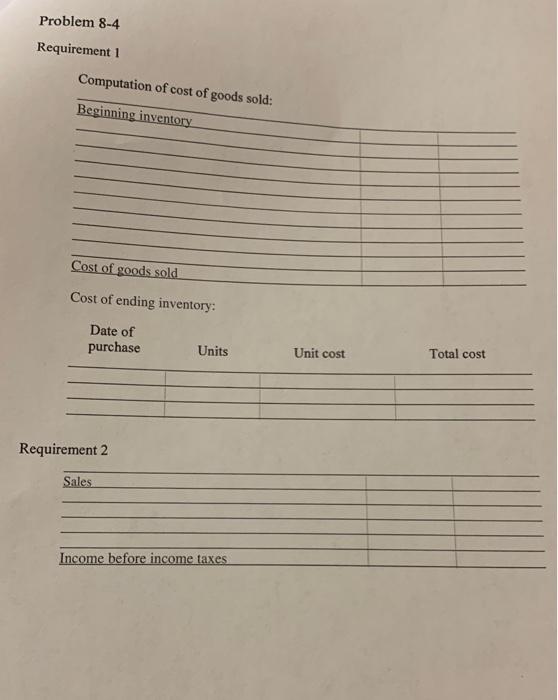

E 8-13 Inventory cost flow methods; periodie system LOB19,LOB4B the manth of Aurust 2018h avalable: Aug. 1 Inventory on hand-2000 units, cout $630 each. 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started