e. and g.

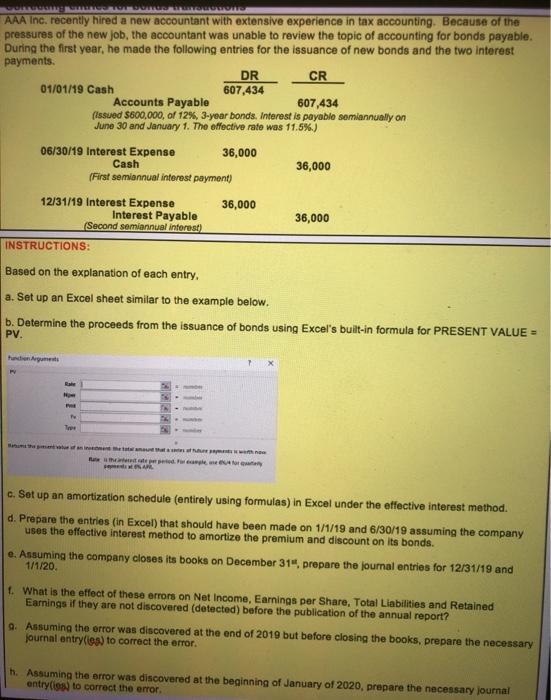

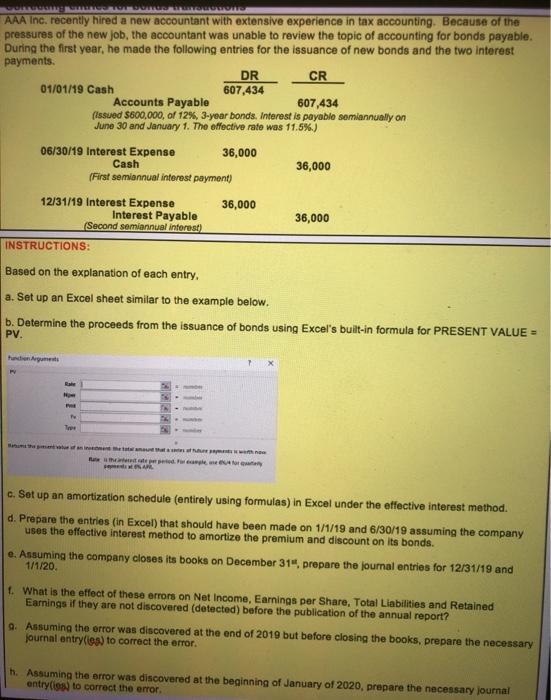

Com LONG AAA Inc. recently hired a new accountant with extensive experience in tax accounting. Because of the pressures of the new job, the accountant was unable to review the topic of accounting for bonds payable. During the first year, he made the following entries for the issuance of new bonds and the two interest payments. DR CR 01/01/19 Cash 607,434 Accounts Payable 607,434 (issued $600,000, of 12%, 3-year bonds. Interest is payable semiannually on June 30 and January 1. The effective rate was 11.5%) 06/30/19 Interest Expense 36,000 Cash 36,000 (First semiannual interest payment) 12/31/19 Interest Expense 36,000 Interest Payable 36,000 (Second semiannual interest) INSTRUCTIONS: Based on the explanation of each entry, a. Set up an Excel sheet similar to the example below. b. Determine the proceeds from the issuance of bonds using Excel's built-in formula for PRESENT VALUE PV. Tree w NAL c. Set up an amortization schedule (entirely using formulas) in Excel under the effective interest method. d. Prepare the entries (in Excel) that should have been made on 1/1/19 and 6/30/19 assuming the company uses the effective interest method to amortize the premium and discount on its bonds. e. Assuming the company closes its books on December 31, prepare the journal entries for 12/31/19 and 1/1/20 t. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and Retained Earnings if they are not discovered (detected) before the publication of the annual report? a. Assuming the error was discovered at the end of 2019 but before closing the books, prepare the necessary journal entry(ies) to correct the error. h. Assuming the error was discovered at the beginning of January of 2020, prepare the necessary journal entrycos) to correct the error. Com LONG AAA Inc. recently hired a new accountant with extensive experience in tax accounting. Because of the pressures of the new job, the accountant was unable to review the topic of accounting for bonds payable. During the first year, he made the following entries for the issuance of new bonds and the two interest payments. DR CR 01/01/19 Cash 607,434 Accounts Payable 607,434 (issued $600,000, of 12%, 3-year bonds. Interest is payable semiannually on June 30 and January 1. The effective rate was 11.5%) 06/30/19 Interest Expense 36,000 Cash 36,000 (First semiannual interest payment) 12/31/19 Interest Expense 36,000 Interest Payable 36,000 (Second semiannual interest) INSTRUCTIONS: Based on the explanation of each entry, a. Set up an Excel sheet similar to the example below. b. Determine the proceeds from the issuance of bonds using Excel's built-in formula for PRESENT VALUE PV. Tree w NAL c. Set up an amortization schedule (entirely using formulas) in Excel under the effective interest method. d. Prepare the entries (in Excel) that should have been made on 1/1/19 and 6/30/19 assuming the company uses the effective interest method to amortize the premium and discount on its bonds. e. Assuming the company closes its books on December 31, prepare the journal entries for 12/31/19 and 1/1/20 t. What is the effect of these errors on Net Income, Earnings per Share, Total Liabilities and Retained Earnings if they are not discovered (detected) before the publication of the annual report? a. Assuming the error was discovered at the end of 2019 but before closing the books, prepare the necessary journal entry(ies) to correct the error. h. Assuming the error was discovered at the beginning of January of 2020, prepare the necessary journal entrycos) to correct the error