Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e AutoSave OFF Insert Draw LG Calibri (Bo... BIU Design Layout A A A 82 C 6 11 U ab x x A. A

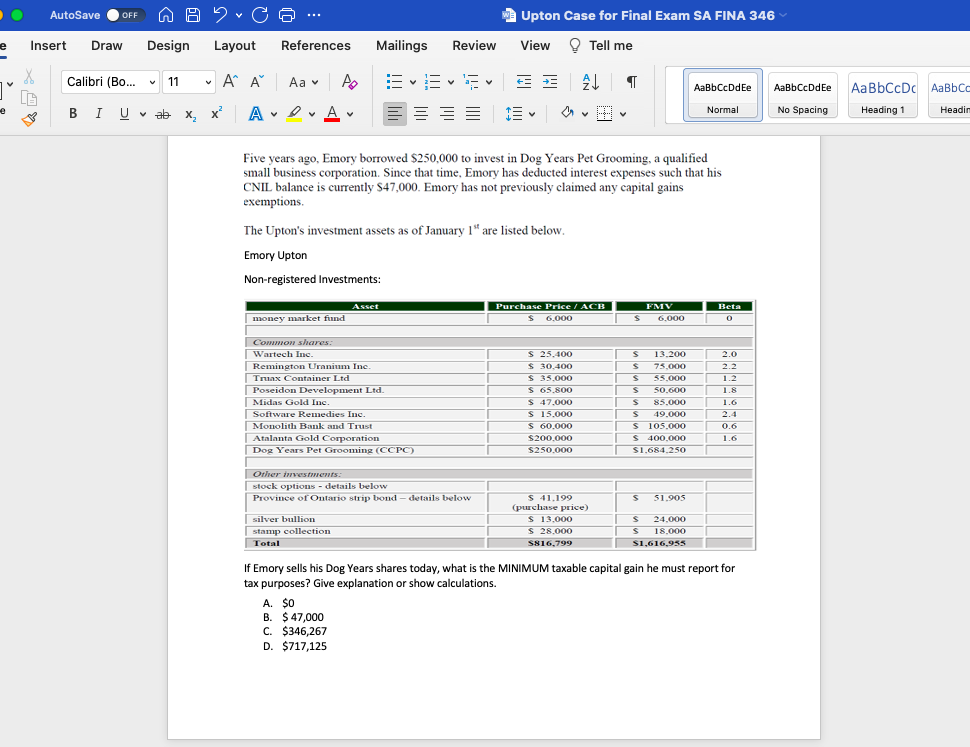

e AutoSave OFF Insert Draw LG Calibri (Bo... BIU Design Layout A A A 82 C 6 11 U ab x x A. A References Aa Po 18 A V | money market fund Mailings Common shares: Wartech Inc. Remington Uranium Inc. Asset Truax Container Ltd. Poseidon Development Ltd. Midas Gold Inc. Software Remedies Inc. Monolith Bank and Trust The Upton's investment assets as of January 1" are listed below. Emory Upton Non-registered Investments: Atalanta Gold Corporation Dog Years Pet Grooming (CCPC) silver bullion stamp collection Total Review Five years ago, Emory borrowed $250,000 to invest in Dog Years Pet Grooming, a qualified small business corporation. Since that time, Emory has deducted interest expenses such that his CNIL balance is currently $47,000. Emory has not previously claimed any capital gains exemptions. Other investments: stock options - details below Province of Ontario strip bond - details below A. $0 B. $47,000 C. $346,267 D. $717,125 V Upton Case for Final Exam SA FINA 346 View Tell me +=+= a Purchase Price / ACB $ 6,000 $ 25,400 $ 30,400 $ 35.000 $ 65.800 $ 47,000 $ 15,000 $ 60,000 $200,000 $250,000 $ 41.199 (purchase price) $ 13,000 $ 28,000 S816,799 $ FMV 6,000 S 13.200 S 75,000 S 55,000 S 50,600 $ 85.000 S 49,000 $ 105,000 $ 400,000 $1,684.250 S 51.905 $ S 24,000 18,000 $1,616,955 AaBbCcDdEe Normal Beta 0 2.0 2.2 1.2 1.8 1.6 0.6 1.6 If Emory sells his Dog Years shares today, what is the MINIMUM taxable capital gain he must report for tax purposes? Give explanation or show calculations. AaBbCcDdEe No Spacing AaBbCcDc AaBbCe Heading 1 Headim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below C 203000 Explanation The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started