Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The cash reccipts and the cash payments of Meadowvale Bowling for Novermber 2020 are as follows. A (Click the lcon to view the chequebook.)

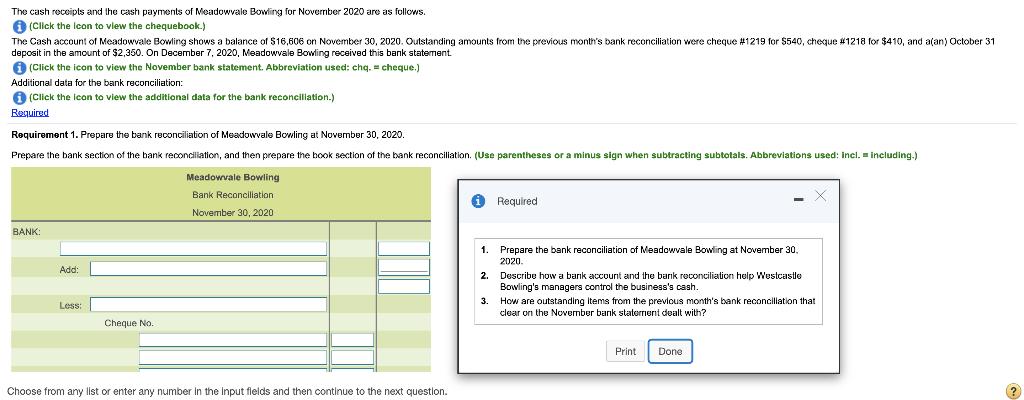

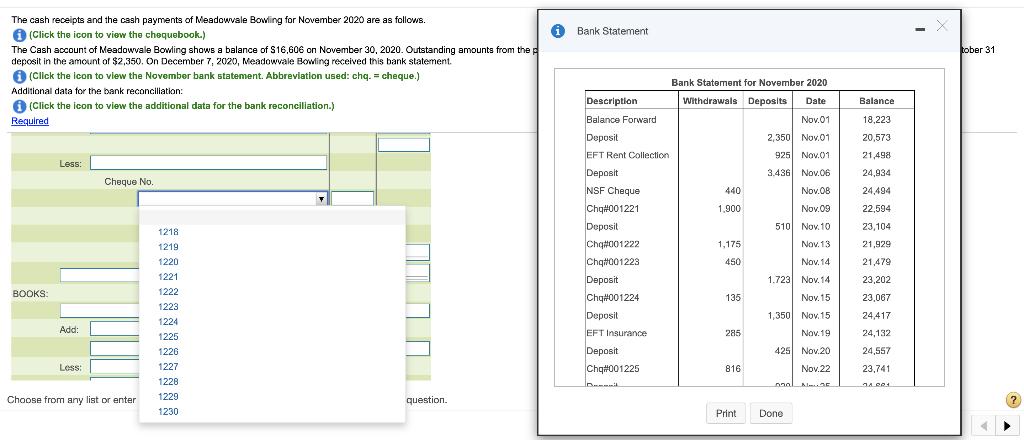

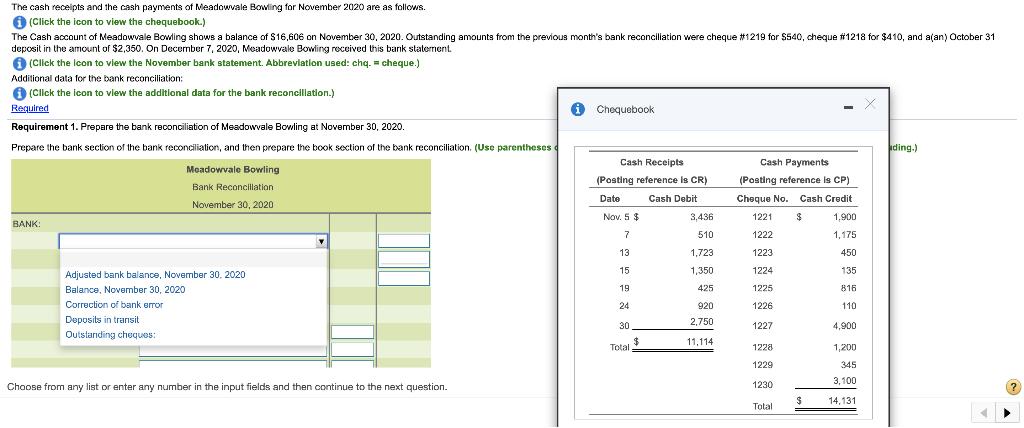

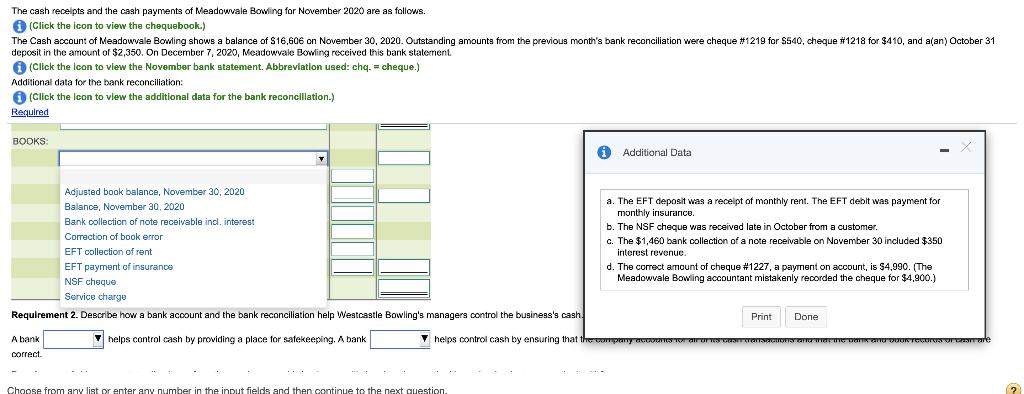

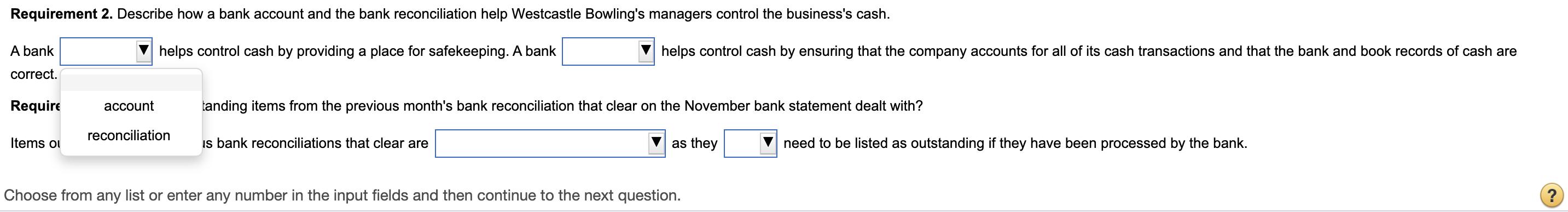

The cash reccipts and the cash payments of Meadowvale Bowling for Novermber 2020 are as follows. A (Click the lcon to view the chequebook.) The Cash account of Meadowvale Bowling shows a balance of $16,606 on November 30, 2020. Outstanding amounts from the previous month's bank reconciliation were cheque #1219 for $540, cheque #1218 for $410, and a(an) October 31 deposit in the amount of $2,350. On December 7, 2020, Meadowvale Bowling received this bank statement i (Click the icon to view the November bank statement. Abbreviation used: chq. = cheque.) Additional data for the bank reconciliation: i (Click the icon to view the additional data for the bank reconcilation.) Required Requirement 1. Prepare the bank reconciliation of Meadowvale Bowling at November 30, 2020. Prepare the bank section of the bank reconciliation, and then prepare the book section of the bank reconciliation. (Use parentheses or a minus sign when subtracting subtotals. Abbreviations used: incl. = including.) Meadowvale Bowling Bank Reconciliation O Required November 30, 2020 BANK: 1. Prepare the bank reconciliation of Meadowvale Bowling at November 30, 2020. Add: 2. Describe how a bark account and the bark reconciliation help Westcastle Bowling's managers control the business's cash. 3. How are outstanding Items from the previous month's bank reconcillation that Less: clear on the November bank staternent dealt with? Cheque No. Print Done Choose from any list or enter any number in the Input flelds and then continue to the next question. The cash receipts and the cash payments of Meadowvale Bowling for November 2020 are as follows. 1 (Click the icon to view the chequebook.) i Bank Statement tober 31 The Cash account of Meadowvale Bowling shows a balance of S16,606 on November 30, 2020. Outstanding amounts from the p deposit in the amount of $2,350. On December 7, 2020, Meadowvale Bowling received this bank statement. i (Click the lcon to view the November bank statement. Abbreviation used: chq. = cheque.) Bank Statement for November 2020 Additional data for the bank reconcillation: Description Withdrawals Deposits Date Balance A (Click the icon to view the additional data for the bank reconciliation.) Required Balance Forward Deposit Nov.01 18,223 2,350 Nov.01 20,573 EFT Rent Collection 925 Nov.01 21,498 Less: Deposit 3.436 Nov.06 24,934 Cheque No. NSF Cheque 440 Nov.08 24,494 Chq#001221 Deposit Cha#001222 Chq#001223 1,900 Nov.09 22,594 510 Nov. 10 23,104 1218 1219 1,175 Nov. 13 21,929 1220 450 Nov. 14 21,479 1221 Deposit Chq#001224 Deposil 1.723 Nov. 14 23,202 BOOKS: 1222 135 Nov. 15 23,067 1223 1,350 Nov. 15 24,417 1224 Add: 1225 EFT Insurance 285 Nov. 19 24,132 Deposit 425 Nov.20 24,557 1226 Less: 1227 Chq#001225 816 Nov.22 23,741 1228 1229 Choose from any list or enter question. 1230 Print Done The cash receipts and the cash payments of Meadowvale Bowling for November 2020 are as follows. A (Click the icon to view the chequebook.) The Cash account of Meadowvale Bowling shows a balance of S16,606 on November 30, 2020. Outstanding amounts from the previous month's bank reconciliation were cheque #1219 for $540, cheque #1218 for $410, and a(an) October 31 deposit in the amount of $2,350. On December 7, 2020, Meadowvale Bowling received this bank statement. 1 (Click the Icon to view the November bank statement. Abbrevlation used: chq. = cheque.) Additional data for the bank reconciliation: A (Clck the icon to vlew the additlonal data for the bank reconcillation.) Required i Chequebook Requirement 1. Prepare the bank reconciliation of Meadowvale Bowling at November 30, 2020. Prepare the bank section of the bank reconciliation, and then prepare the book section of the bank reconciliation. (Use parentheses iding.) Cash Receipts Cash Payments Meadowvale Bowling (Posting reference is CR) (Posting reference is CP) Bank Reconcillation Date Cash Debit Cheque No. Cash Credit November 30, 2020 Nov. 5 $ 3,436 1221 1,900 BANK: 7 510 1222 1,175 13 1,723 1223 450 15 1,350 1224 135 Adjusted bank balance, November 30, 2020 Balance, November 30, 2020 19 425 1225 816 Correction of bank error 24 920 1226 110 Deposits in transit 2,750 30 1227 4,900 Outstanding cheques: $ Total 11,114 1228 1,200 1229 345 3,100 Choose from any list or enter any number in the input fields and then continue to the next question. 1230 14,131 Total The cash receipts and the cash payments of Meadowvale Bowling for November 2020 are as follows. e (Click the icon to view the chequebook.) The Cash account of Meadowvale Bowling shows a balance of S16,606 on November 30, 2020. Outstanding amounts from the previous month's bank reconciliation were cheque #1219 for $540, cheque #1218 for $410, and a(an) October 31 deposit in the amount of $2,350. On December 7, 2020, Meadowvale Bowling reccived this bank statement. A (Click the lcon to view the November bank statement. Abbrevlation used: chq. = cheque.) Additional data for the bank reconciliation: O (Click the Icon to view the additional data for the bank reconcillation.) Required BOOKS: O Additional Data Adjusted book balance, November 30, 2020 a. The EFT deposit was a recelpt of monthly rent. The EFT debit was payment for monthly insurance. Balance, November 30, 2020 Bank collection of note receivable ind. interest b. The NSF cheque was received late in October from a customer. Correction of book error c. The $1,460 bank collection of a note receivable on November 30 included $350 interest revenue. EFT collection of rent EFT payment of insurance d. The correct aIount of cheque #1227, a payment on account, is $4,990. (The Meadowvale Bowling accountant mistakenly recorded the cheque for $4,900.) NSF cheque Service charge Requirement 2. Describe how a bank account and the bank reconciliation help Westcastle Bowling's managers control the business's cash. Print Done A bank V helps control cash by providing a place for safekeeping. A bank V helps control cash by ensuring that therompany aour correct. Choose from any list pr enter any number in the input fields and then continue to the next question (? Requirement 2. Describe how a bank account and the bank reconciliation help Westcastle Bowling's managers control the business's cash. A bank helps control cash by providing a place for safekeeping. A bank helps control cash by ensuring that the company accounts for all of its cash transactions and that the bank and book records of cash are correct. Require account tanding items from the previous month's bank reconciliation that clear on the November bank statement dealt with? reconciliation Items ol is bank reconciliations that clear are as they need to be listed as outstanding if they have been processed by the bank. Choose from any list or enter any number in the input fields and then continue to the next question.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A B D E H K Solution 2 Requirement 1 Bank Book 4 Balance Septem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started