Answered step by step

Verified Expert Solution

Question

1 Approved Answer

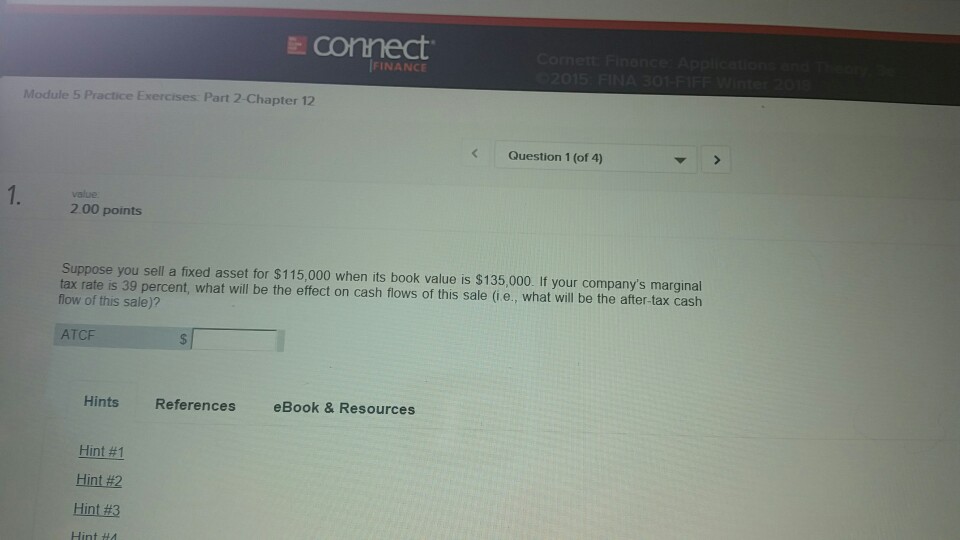

E connect FINANCE Module 5 Practice Exercises Part 2-Chapter 12 Question 1 (of 4) value 2.00 points Suppose you sell a fixed asset for $115,000

E connect FINANCE Module 5 Practice Exercises Part 2-Chapter 12 Question 1 (of 4) value 2.00 points Suppose you sell a fixed asset for $115,000 when its book value is $135,000. If your company's marginal flow of this sale)? ATCF tax rate is 39 percent, what will be the effect on cash flows of this sale (i e., what will be the after-tax cash Hints References eBook & Resources Hint #1 Hint #2 Hint#3 Hint HA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started