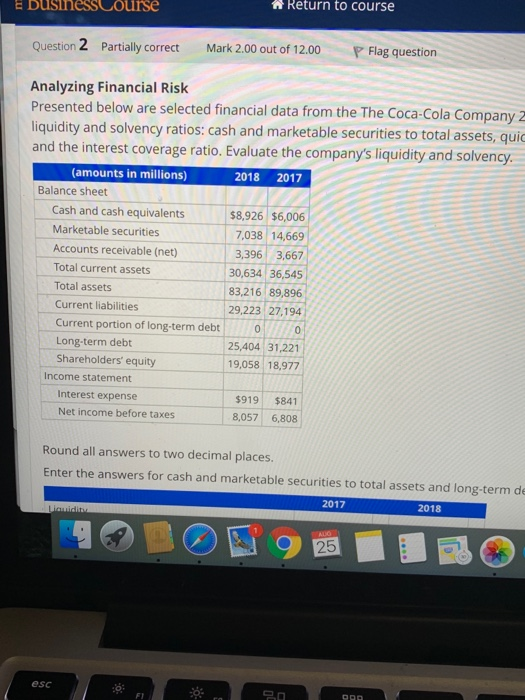

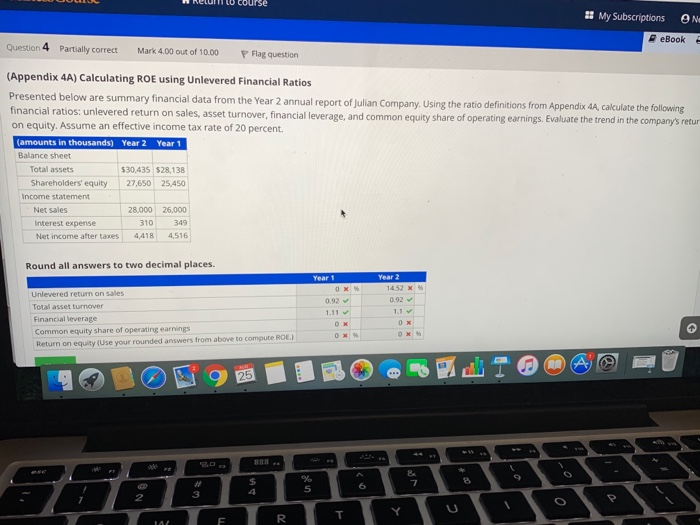

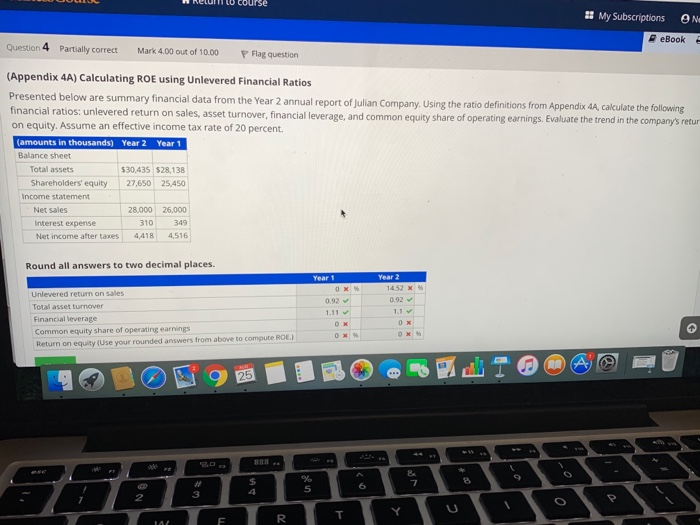

E DUS SSCourse Return to course Question 2 Partially correct Mark 2.00 out of 12.00 Flag question Analyzing Financial Risk Presented below are selected financial data from the The Coca-Cola Company 2 liquidity and solvency ratios: cash and marketable securities to total assets, quic and the interest coverage ratio. Evaluate the company's liquidity and solvency. (amounts in millions) 2018 2017 Balance sheet Cash and cash equivalents $8,926 $6,006 Marketable securities 7,038 14,669 Accounts receivable (net) 3,396 3,667 Total current assets 30,634 36,545 Total assets 83,216 89,896 Current liabilities 29,223 27,194 Current portion of long-term debt 0 Long-term debt 25,404 31,221 Shareholders' equity 19,058 18,977 Income statement Interest expense Net income before taxes 8,057 6.808 0 $919 $841 Round all answers to two decimal places. Enter the answers for cash and marketable securities to total assets and long-term de 2017 2018 Ularnidis AND 25 esc 20 urse 2 My Subscriptions ON eBook Question 4 Partially correct Mark 4.00 out of 10.00 P Flag question (Appendix 4A) Calculating ROE using Unlevered Financial Ratios Presented below are summary financial data from the Year 2 annual report of Julian Company. Using the ratio definitions from Appendix 4A, calculate the following financial ratios: unlevered return on sales, asset turnover, financial leverage, and common equity share of operating earnings. Evaluate the trend in the company's retur on equity. Assume an effective income tax rate of 20 percent (amounts in thousands) Year 2 Year 1 Balance sheet Total assets $30,435 528,138 Shareholders' equity 27,650 25.450 Income statement Net sales Interest expense Net income after taxes 28.000 26,000 310 349 4,418 4,516 Round all answers to two decimal places. Year 1 OX Year 2 1452 x 0.92 0.92 1.11 Unlevered return on sales Total asset turnover Financial leverage Common equity share of operating earrings Return on equity (Use your rounded answers from above to compute ROE. DK OX OM OX @ 25 $ 5 6 2 3 o R T 11/ F E DUS SSCourse Return to course Question 2 Partially correct Mark 2.00 out of 12.00 Flag question Analyzing Financial Risk Presented below are selected financial data from the The Coca-Cola Company 2 liquidity and solvency ratios: cash and marketable securities to total assets, quic and the interest coverage ratio. Evaluate the company's liquidity and solvency. (amounts in millions) 2018 2017 Balance sheet Cash and cash equivalents $8,926 $6,006 Marketable securities 7,038 14,669 Accounts receivable (net) 3,396 3,667 Total current assets 30,634 36,545 Total assets 83,216 89,896 Current liabilities 29,223 27,194 Current portion of long-term debt 0 Long-term debt 25,404 31,221 Shareholders' equity 19,058 18,977 Income statement Interest expense Net income before taxes 8,057 6.808 0 $919 $841 Round all answers to two decimal places. Enter the answers for cash and marketable securities to total assets and long-term de 2017 2018 Ularnidis AND 25 esc 20 urse 2 My Subscriptions ON eBook Question 4 Partially correct Mark 4.00 out of 10.00 P Flag question (Appendix 4A) Calculating ROE using Unlevered Financial Ratios Presented below are summary financial data from the Year 2 annual report of Julian Company. Using the ratio definitions from Appendix 4A, calculate the following financial ratios: unlevered return on sales, asset turnover, financial leverage, and common equity share of operating earnings. Evaluate the trend in the company's retur on equity. Assume an effective income tax rate of 20 percent (amounts in thousands) Year 2 Year 1 Balance sheet Total assets $30,435 528,138 Shareholders' equity 27,650 25.450 Income statement Net sales Interest expense Net income after taxes 28.000 26,000 310 349 4,418 4,516 Round all answers to two decimal places. Year 1 OX Year 2 1452 x 0.92 0.92 1.11 Unlevered return on sales Total asset turnover Financial leverage Common equity share of operating earrings Return on equity (Use your rounded answers from above to compute ROE. DK OX OM OX @ 25 $ 5 6 2 3 o R T 11/ F