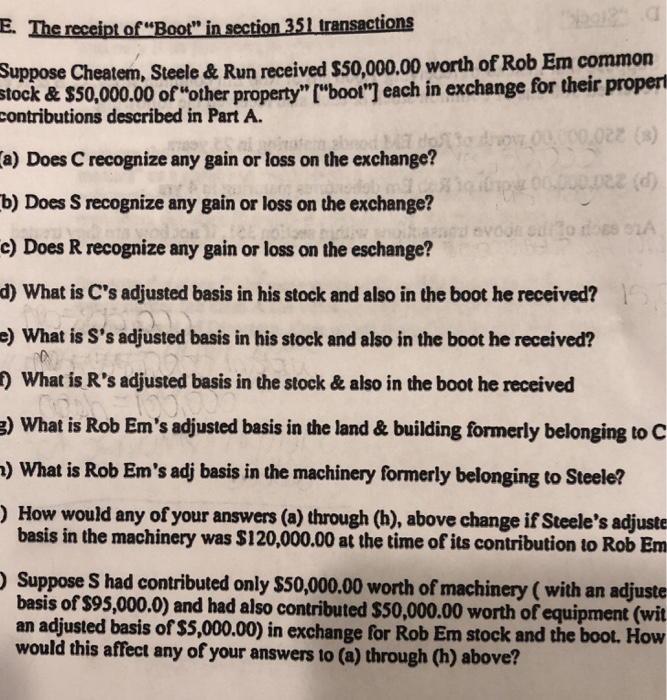

E. e receipt of"Boot" in section 351 transactions Suppose Cheatem, Steele & Run received $50,000.00 worth of Rob Em common tock&s000.00 of"other property" ["bool"] each in exchange for their propen contributions described in Part A. ez (8) Does C recognize any gain or loss on the exchange? b) Does S recognize any gain or loss on the exchange? c) Does R recognize any gain or loss on the eschange? d) What is C's adjusted basis in his stock and also in the boot he received? e) What is S's adjusted basis in his stock and also in the boot he received? (a) d) What is R's adjusted basis in the stock & also in the boot he received ) What is Rob Em's adjusted basis in the land& building formerly belonging to C ) What is Rob Em's adj basis in the machinery formerly belonging to Steele? How would any of your answers (a) through (h), above change if Steele's adjuste basis in the machinery was $120,000.00 at the time of its contribution to Rob Em Suppose S had contributed only $50,000.00 worth of machinery ( with an adjuste besis of s9,000.0) and had also contributed S50,000.00 worth of equipment (wit an adjusted basis of $5,000.00) in exchange for Rob Em stock and the boot. How ould this affect any of your answers to (a) through (h) above? E. e receipt of"Boot" in section 351 transactions Suppose Cheatem, Steele & Run received $50,000.00 worth of Rob Em common tock&s000.00 of"other property" ["bool"] each in exchange for their propen contributions described in Part A. ez (8) Does C recognize any gain or loss on the exchange? b) Does S recognize any gain or loss on the exchange? c) Does R recognize any gain or loss on the eschange? d) What is C's adjusted basis in his stock and also in the boot he received? e) What is S's adjusted basis in his stock and also in the boot he received? (a) d) What is R's adjusted basis in the stock & also in the boot he received ) What is Rob Em's adjusted basis in the land& building formerly belonging to C ) What is Rob Em's adj basis in the machinery formerly belonging to Steele? How would any of your answers (a) through (h), above change if Steele's adjuste basis in the machinery was $120,000.00 at the time of its contribution to Rob Em Suppose S had contributed only $50,000.00 worth of machinery ( with an adjuste besis of s9,000.0) and had also contributed S50,000.00 worth of equipment (wit an adjusted basis of $5,000.00) in exchange for Rob Em stock and the boot. How ould this affect any of your answers to (a) through (h) above