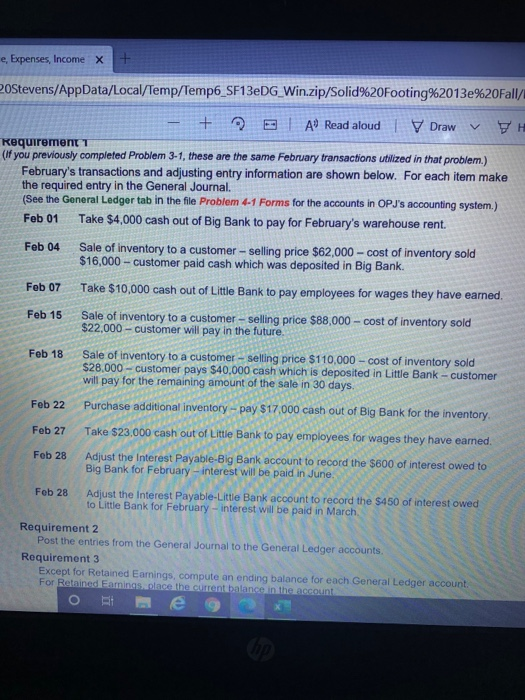

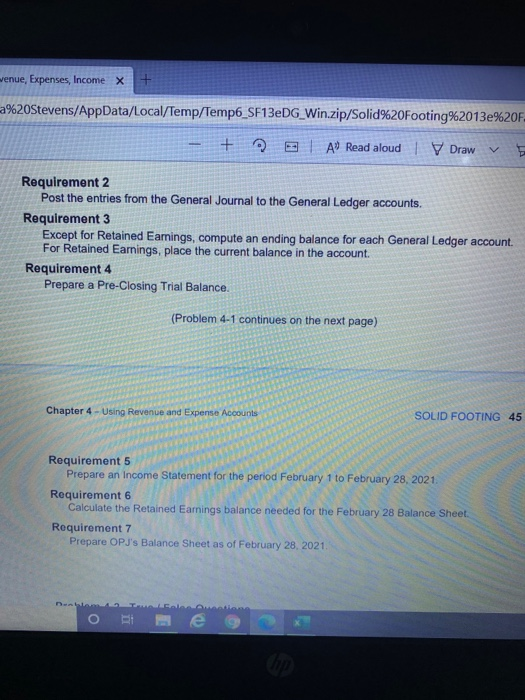

e, Expenses, Income x + 20Stevens/AppData/Local/Temp/Temp6_SF13eDG_Win.zip/Solid%20Footing%2013%20Fall/ + A Read aloud V Draw H Requirements (if you previously completed Problem 3-1, these are the same February transactions utilized in that problem.) February's transactions and adjusting entry information are shown below. For each item make the required entry in the General Journal. (See the General Ledger tab in the file Problem 4-1 Forms for the accounts in OPJ's accounting system.) Feb 01 Take $4,000 cash out of Big Bank to pay for February's warehouse rent. Feb 04 Sale of inventory to a customer-selling price $62,000 - cost of inventory sold $16,000 - customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer - selling price $88,000 - cost of inventory sold $22,000 - customer will pay in the future. Feb 18 Sale of inventory to a customer - selling price $110,000 - cost of inventory sold $28.000 - customer pays $40.000 cash which is deposited in Little Bank - customer will pay for the remaining amount of the sale in 30 days. Feb 22 Purchase additional inventory - pay $17,000 cash out of Big Bank for the inventory Feb 27 Feb 28 Take $23,000 cash out of Little Bank to pay employees for wages they have earned. Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to Big Bank for February - interest will be paid in June Feb 28 Adjust the Interest Payable-Little Bank account to record the $450 of interest owed to Little Bank for February - interest will be paid in March Requirement 2 Post the entries from the General Journal to the General Ledger accounts Requirement 3 Except for Retained Earnings, compute an ending balance for each General Ledger account For Retained Famingsglase the comment balance in the account venue, Expenses, Income x + a%20Stevens/AppData/Local/Temp/Temp6_SF13eDG_Win.zip/Solid%20Footing%2013%20F- + A Read aloud | Draw Requirement 2 Post the entries from the General Journal to the General Ledger accounts. Requirement 3 Except for Retained Earnings, compute an ending balance for each General Ledger account. For Retained Earnings, place the current balance in the account. Requirement 4 Prepare a Pre-Closing Trial Balance. (Problem 4-1 continues on the next page) Chapter 4 -Using Revenue and Expense Accounts SOLID FOOTING 45 Requirement 5 Prepare an Income Statement for the period February 1 to February 28, 2021 Requirement 6 Calculate the Retained Earnings balance needed for the February 28 Balance Sheet Requirement 7 Prepare OPJ's Balance Sheet as of February 28, 2021 D. o Bia e, Expenses, Income x + 20Stevens/AppData/Local/Temp/Temp6_SF13eDG_Win.zip/Solid%20Footing%2013%20Fall/ + A Read aloud V Draw H Requirements (if you previously completed Problem 3-1, these are the same February transactions utilized in that problem.) February's transactions and adjusting entry information are shown below. For each item make the required entry in the General Journal. (See the General Ledger tab in the file Problem 4-1 Forms for the accounts in OPJ's accounting system.) Feb 01 Take $4,000 cash out of Big Bank to pay for February's warehouse rent. Feb 04 Sale of inventory to a customer-selling price $62,000 - cost of inventory sold $16,000 - customer paid cash which was deposited in Big Bank. Feb 07 Take $10,000 cash out of Little Bank to pay employees for wages they have earned. Feb 15 Sale of inventory to a customer - selling price $88,000 - cost of inventory sold $22,000 - customer will pay in the future. Feb 18 Sale of inventory to a customer - selling price $110,000 - cost of inventory sold $28.000 - customer pays $40.000 cash which is deposited in Little Bank - customer will pay for the remaining amount of the sale in 30 days. Feb 22 Purchase additional inventory - pay $17,000 cash out of Big Bank for the inventory Feb 27 Feb 28 Take $23,000 cash out of Little Bank to pay employees for wages they have earned. Adjust the Interest Payable-Big Bank account to record the $600 of interest owed to Big Bank for February - interest will be paid in June Feb 28 Adjust the Interest Payable-Little Bank account to record the $450 of interest owed to Little Bank for February - interest will be paid in March Requirement 2 Post the entries from the General Journal to the General Ledger accounts Requirement 3 Except for Retained Earnings, compute an ending balance for each General Ledger account For Retained Famingsglase the comment balance in the account venue, Expenses, Income x + a%20Stevens/AppData/Local/Temp/Temp6_SF13eDG_Win.zip/Solid%20Footing%2013%20F- + A Read aloud | Draw Requirement 2 Post the entries from the General Journal to the General Ledger accounts. Requirement 3 Except for Retained Earnings, compute an ending balance for each General Ledger account. For Retained Earnings, place the current balance in the account. Requirement 4 Prepare a Pre-Closing Trial Balance. (Problem 4-1 continues on the next page) Chapter 4 -Using Revenue and Expense Accounts SOLID FOOTING 45 Requirement 5 Prepare an Income Statement for the period February 1 to February 28, 2021 Requirement 6 Calculate the Retained Earnings balance needed for the February 28 Balance Sheet Requirement 7 Prepare OPJ's Balance Sheet as of February 28, 2021 D. o Bia