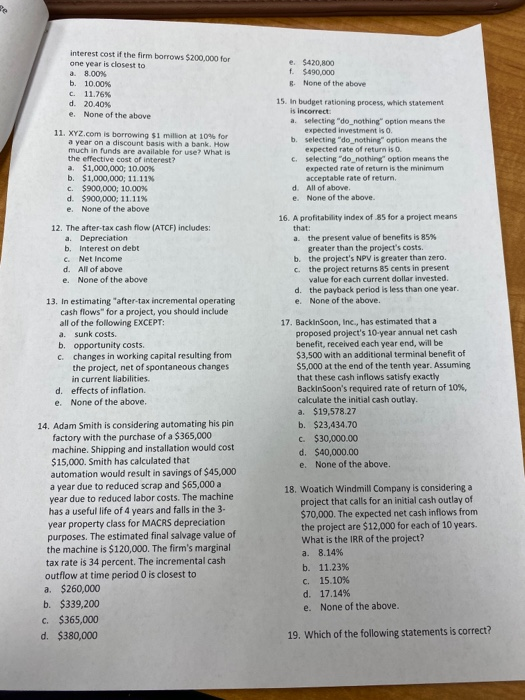

e. f interest cost if the firm borrows $200,000 for one year is closest to a. 8.00% b. 10.00% c. 11.26% d. 20.40% e. None of the above $420,000 $490.000 None of the above 11. XYZ.com is borrowing $1 million at 10% for a year on a discount basis with a bank. How much in funds are available for use? What is the effective cost of interest? a $1,000,000; 10.00% b. $1,000,000; 11.11% c. $900,000; 10.00% d. $900,000: 11.11% e. None of the above 15. In budget rationing process, which statement is incorrect: a. selecting "do nothing" option means the expected investment is b. selecting "do_nothing" option means the expected rate of return is o c. selecting "do nothing option means the expected rate of return is the minimum acceptable rate of return, d. All of above. e. None of the above. 12. The after-tax cash flow (ATCF) includes: a. Depreciation b. Interest on debt C. Net Income d. All of above e. None of the above 16. A profitability index of 85 for a project means that: a. the present value of benefits is 85% greater than the project's costs. b. the project's NPV is greater than zero. c. the project returns 85 cents in present value for each current dollar invested, d. the payback period is less than one year. e. None of the above. 13. In estimating "after-tax incremental operating cash flows" for a project, you should include all of the following EXCEPT: a. sunk costs b. opportunity costs. C. changes in working capital resulting from the project, net of spontaneous changes in current abilities d effects of inflation e. None of the above. 17. BackinSoon, Inc., has estimated that a proposed project's 10-year annual net cash benefit, received each year end, will be $3,500 with an additional terminal benefit of $5,000 at the end of the tenth year. Assuming that these cash inflows satisfy exactly BackinSoon's required rate of return of 10%, calculate the initial cash outlay. a. $19,578.27 b. $23,434.70 C. $30,000.00 d. $40,000.00 e. None of the above. 14. Adam Smith is considering automating his pin factory with the purchase of a $365,000 machine. Shipping and installation would cost $15,000. Smith has calculated that automation would result in savings of $45,000 a year due to reduced scrap and $65,000 a year due to reduced labor costs. The machine has a useful life of 4 years and falls in the 3- year property class for MACRS depreciation purposes. The estimated final salvage value of the machine is $120,000. The firm's marginal tax rate is 34 percent. The incremental cash outflow at time period O is closest to a. $260,000 b. $339,200 C. $365,000 d. $380,000 18. Woatich Windmill Company is considering a project that calls for an initial cash outlay of $70,000. The expected net cash inflows from the project are $12,000 for each of 10 years. What is the IRR of the project? a. 8.14% b. 11.23% c. 15.10% d. 17.14% e. None of the above. 19. Which of the following statements is correct