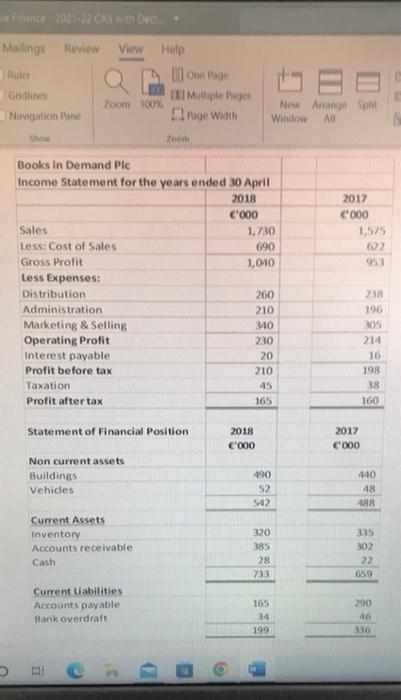

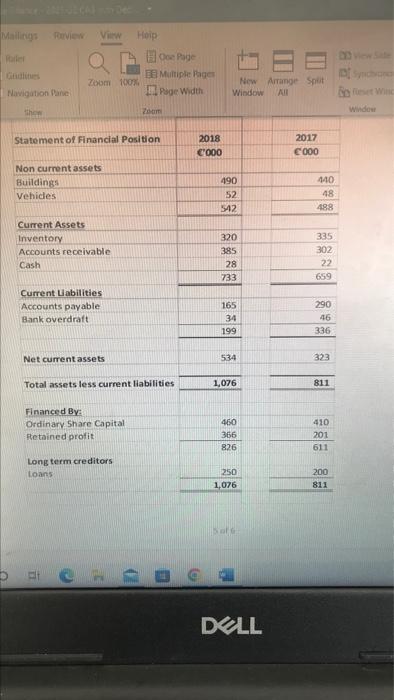

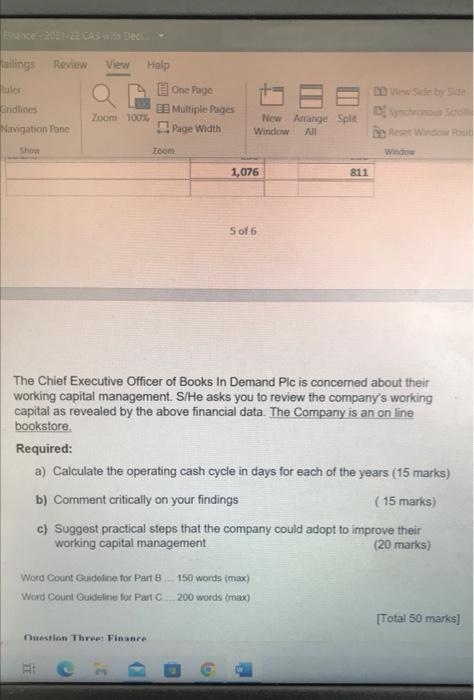

e Finance-2021-22 CA3 with Dec Mailings Review View Help Rules One Page Gridlines Multiple Pages Zoom 100% Navigation Pane Page Width Show Zoom Books in Demand Plc Income Statement for the years ended 30 April 2018 '000 Sales Less: Cost of Sales Gross Profit Less Expenses: Distribution Administration Marketing & Selling Operating Profit Interest payable Profit before tax Taxation Profit after tax Statement of Financial Position Non current assets Buildings Vehicles Current Assets Inventory Accounts receivable Cash Current Liabilities Accounts payable Bank overdraft New Arrange Split Window All 2017 C'000 1,730 690 1,040 260 210 340 230 20 210 45 165 2018 C'000 490 52 542 320 385 28 733 165 34 199 1,575 622 953 238 196 305 214 16 198 38 160 2017 '000 440 48 488 ****** Mailings Review View Help Parker a Zoom 100% Navigation Pane Show 200m Statement of Financial Position Non current assets Buildings Vehicles Current Assets Inventory Accounts receivable. Cash Current Liabilities Accounts payable Bank overdraft Net current assets Total assets less current liabilities Financed By: Ordinary Share Capital Retained profit Long term creditors Loans 17 D) One Page EB Multiple Pages Page Width 2018 '000 New Arrange Split Window All 2017 000 490 52 542 320 385 28 733 165 34 199 534 1,076 460 366 826 250 1,076 Soft DELL 440 48 488 335 302 22 659 290 46 336 323 811 410 201 611 200 811 DO View Sale Byfeset Wind Window Binance-2021-22 CAS with Dec ailings Review View Help Ruler Gridlines Zoom 100% Navigation Pane Show 1,076 811 5 of 6 The Chief Executive Officer of Books In Demand Plc is concerned about their working capital management. S/He asks you to review the company's working capital as revealed by the above financial data. The Company is an on line bookstore. Required: a) Calculate the operating cash cycle in days for each of the years (15 marks) b) Comment critically on your findings (15 marks) c) Suggest practical steps that the company could adopt to improve their working capital management (20 marks) Word Count Guideline for Part 8... 150 words (max) Word Count Guideline for Part C... 200 words (max) [Total 50 marks] Question Three: Finance One Page EB Multiple Pages Page Width Zoom New Arrange Split Window All DDView Side by Side Reset Window Posit Window e Finance-2021-22 CA3 with Dec Mailings Review View Help Rules One Page Gridlines Multiple Pages Zoom 100% Navigation Pane Page Width Show Zoom Books in Demand Plc Income Statement for the years ended 30 April 2018 '000 Sales Less: Cost of Sales Gross Profit Less Expenses: Distribution Administration Marketing & Selling Operating Profit Interest payable Profit before tax Taxation Profit after tax Statement of Financial Position Non current assets Buildings Vehicles Current Assets Inventory Accounts receivable Cash Current Liabilities Accounts payable Bank overdraft New Arrange Split Window All 2017 C'000 1,730 690 1,040 260 210 340 230 20 210 45 165 2018 C'000 490 52 542 320 385 28 733 165 34 199 1,575 622 953 238 196 305 214 16 198 38 160 2017 '000 440 48 488 ****** Mailings Review View Help Parker a Zoom 100% Navigation Pane Show 200m Statement of Financial Position Non current assets Buildings Vehicles Current Assets Inventory Accounts receivable. Cash Current Liabilities Accounts payable Bank overdraft Net current assets Total assets less current liabilities Financed By: Ordinary Share Capital Retained profit Long term creditors Loans 17 D) One Page EB Multiple Pages Page Width 2018 '000 New Arrange Split Window All 2017 000 490 52 542 320 385 28 733 165 34 199 534 1,076 460 366 826 250 1,076 Soft DELL 440 48 488 335 302 22 659 290 46 336 323 811 410 201 611 200 811 DO View Sale Byfeset Wind Window Binance-2021-22 CAS with Dec ailings Review View Help Ruler Gridlines Zoom 100% Navigation Pane Show 1,076 811 5 of 6 The Chief Executive Officer of Books In Demand Plc is concerned about their working capital management. S/He asks you to review the company's working capital as revealed by the above financial data. The Company is an on line bookstore. Required: a) Calculate the operating cash cycle in days for each of the years (15 marks) b) Comment critically on your findings (15 marks) c) Suggest practical steps that the company could adopt to improve their working capital management (20 marks) Word Count Guideline for Part 8... 150 words (max) Word Count Guideline for Part C... 200 words (max) [Total 50 marks] Question Three: Finance One Page EB Multiple Pages Page Width Zoom New Arrange Split Window All DDView Side by Side Reset Window Posit Window