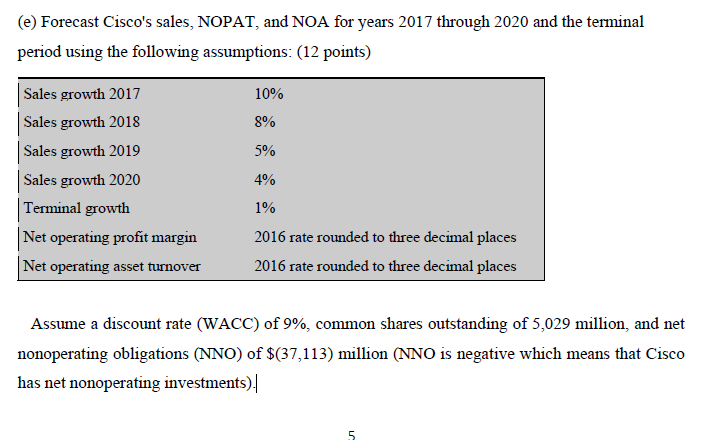

(e) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: (12 points) Sales growth

(e) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: (12 points) Sales growth 2017 10% Sales growth 2018 8% Sales growth 2019 5% Sales growth 2020 4% Terminal growth Net operating profit margin Net operating asset turnover 1% 2016 rate rounded to three decimal places 2016 rate rounded to three decimal places Assume a discount rate (WACC) of 9%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million (NNO is negative which means that Cisco has net nonoperating investments). 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started