Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E he cost of capital Comparing projects with unequal economic life. Rollon Inc. is comparing the operating costs of two types of equipm standard model

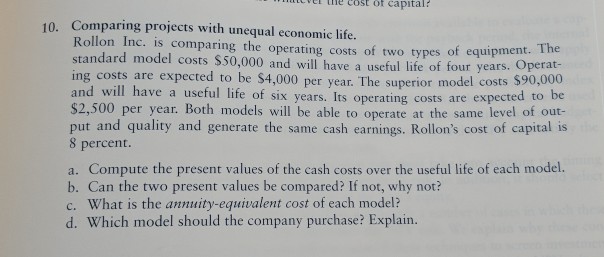

E he cost of capital Comparing projects with unequal economic life. Rollon Inc. is comparing the operating costs of two types of equipm standard model costs $50,000 and will have a useful life of four years. Oper 10. The at- ent. ing costs are expected to be $4,000 per year. The superior model costs $90,000 and will have a useful life of six years. Its operating costs are expected to be $2,500 per year. Both models will be able to operate at the same level of out- put and quality and generate the same cash earnings. Rollon's cost of capital is percent a. Compute the present values of the cash costs over the useful life of each model. b. Can the two present values be compared? If not, why not? c. What is the annuity-equivalent cost of each model? d. Which model should the company purchase? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started