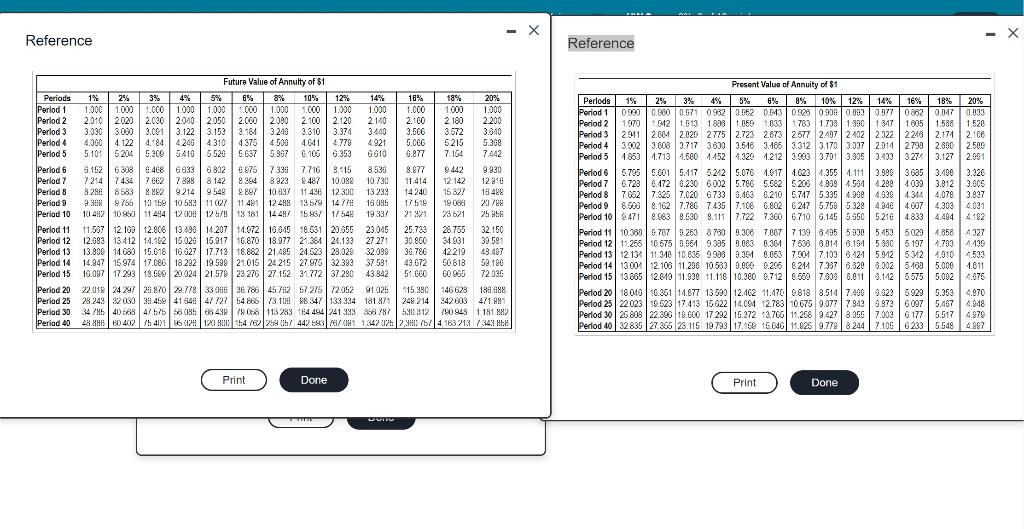

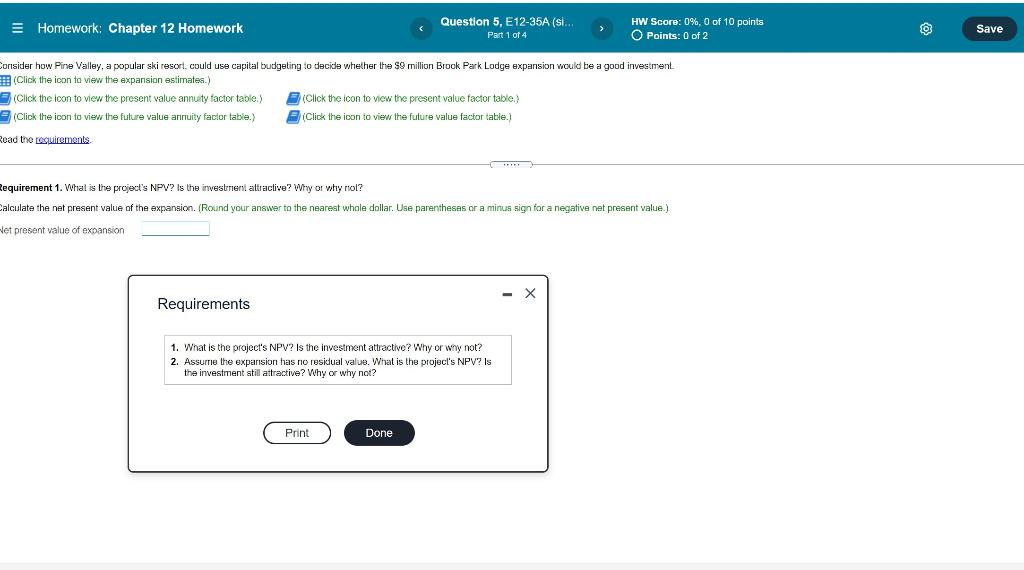

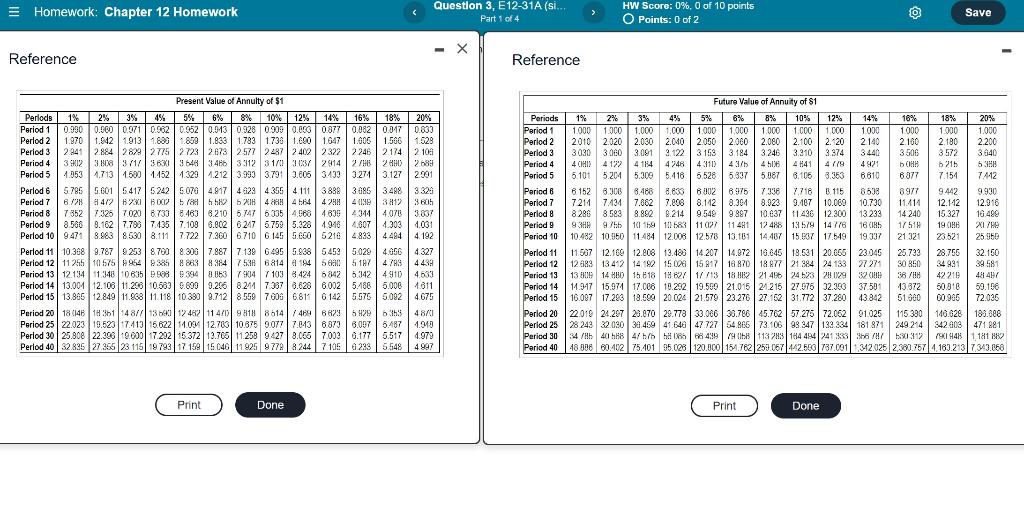

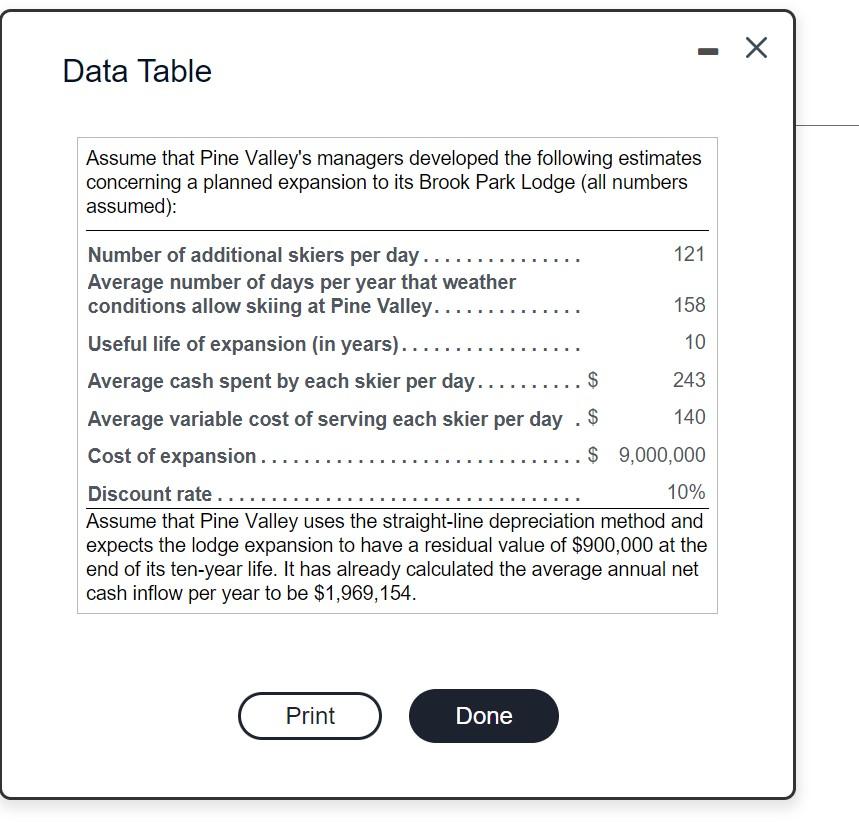

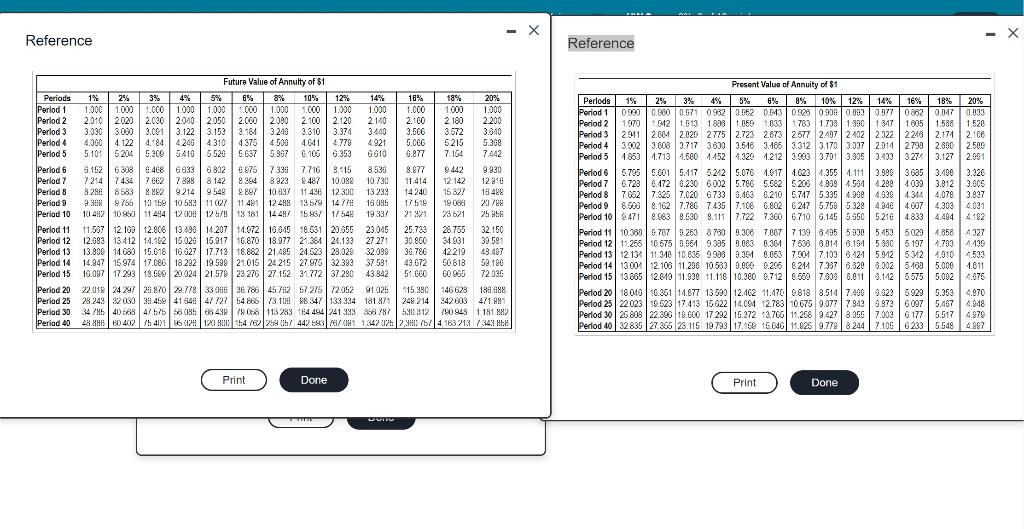

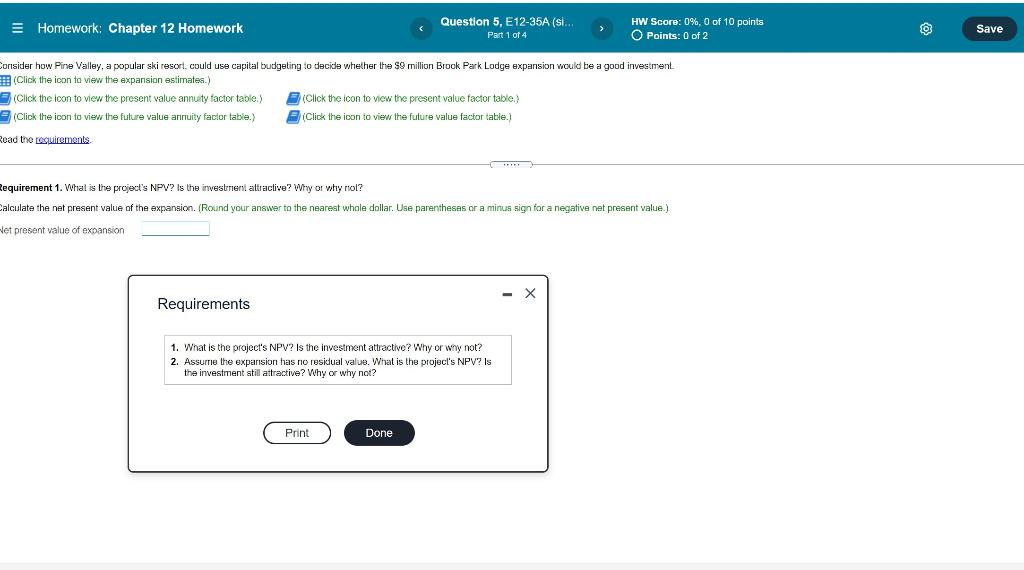

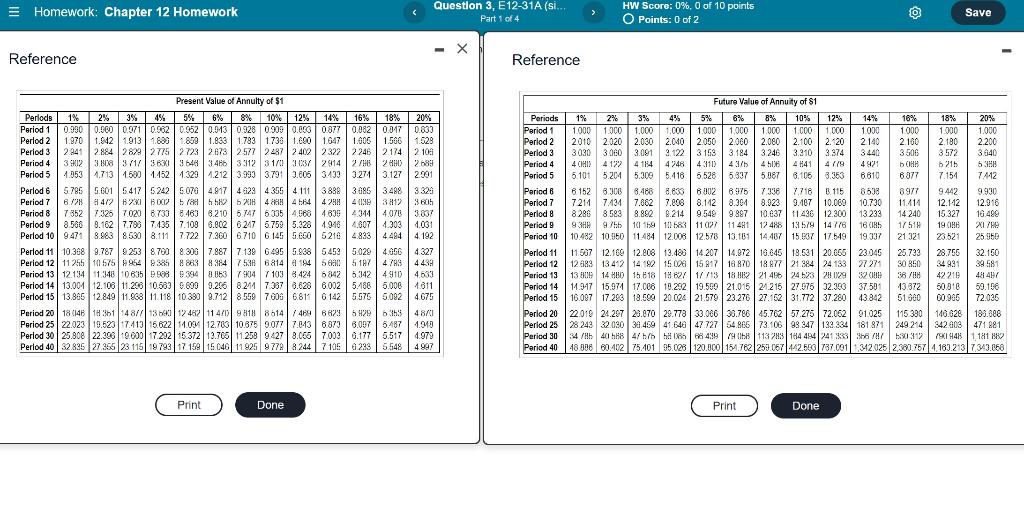

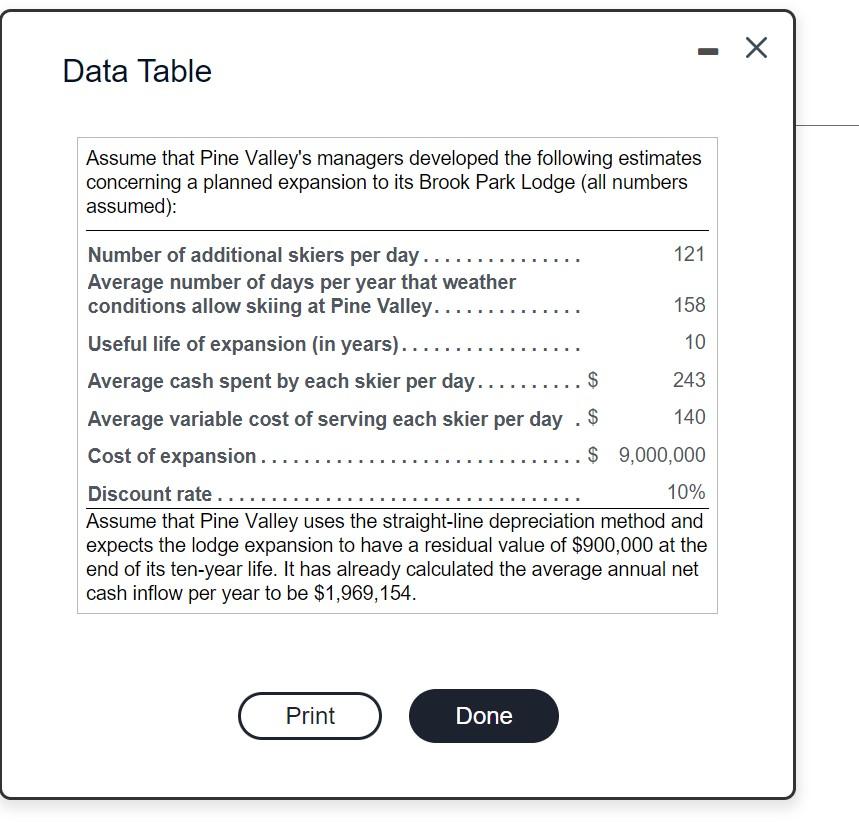

E Homework: Chapter 12 Homework Question 5, E12-35A (si.. Part 1 of 4 HW Score: 0%, 0 of 10 points Points: 0 of 2 Save Consider how Pine Valley, a popular ski resort, could use capital budgeting to decide whether the $9 million Brook Park Lodge expansion would be a good investment (Click the icon to view the expansion estimates.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuity factor table.) Click the icon to view the future value factor table. Read the Locuirements Requirement 1. What is the project's NPV? Is the investment attractive? Why or why not? Calculate the net present value of the expansion. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) det present value of expansion Requirements 1. What is the project's NPV? Is the investment attractive? Why or why not? 2. Assume the expansion has no residual value. What is the project's NPV? Is the investment still attractive? Why or why not? Print Done = Homework: Chapter 12 Homework C Question 3, E12-31A (Si... Part 1 of 4 HW Score: 0%, 0 of 10 points Points: 0 of 2 Save Reference Reference Present Value of Annulty of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.960 0971 0.6620.952 0.03 0.928 09090.CCG 0.877 0.082 0.017 Period 2 1.970 1.942 1913 1.8331859 1.833 1783 1738 1.6901.647 1.005 1.566 1.528 Period 3 2941 288428792775 2723 2673 2577 2237 2 40223222246 2 246 2174 2 108 Period 4 3.902 38083 71/363136483455 3312 31/030372914 2/HE 280 288 Period 5 4.953 1.713 1.580145213291.212 3.999 3.799.605 3439 3.274 3.127 2901 Perlod 657855.601 5417 5242 5.070 4.917 4429 4355 4111388830853498 3320 Period 76/788472 BOX 5 X 44.84 428 4199 3812 3805 Period 873527.32570208730 8.463 6.2106747 6335 4.60 4.635 4344 4.076 4.07 3.837 Period 9 8.566 8.1627.7837.4357.109 6.002 6247 5.759 5.328 4.946 | 4.607 4.3031.031 Perlod 10 94718.983 8530 8.111 77227.300 6710 6145 5.660 5210482344944 192 Perlod 11 10.3689.787 9253 8700 8.300 7.887 7.139 6 495 5.938 5452 5.029 4.656 4.327 Period 12 11 255 10.575 996296383847536 6214 a 1945ean 5 1974788 4438 Period 13 | 12.15411948 -0.635 99839394 0.0637 904 7 105 3.42468426.3424.910 4.633 Period 14 13.00 12.108 11.2000.583 9.699 9.266 824 7337 8.6286002 5/865.0061811 Perlod 15 13.845 12.849 11.868 11.118103909.712 8559 7.00: 6.8116 142 5575 5.092 4.675 Period 2018 (148 18 361 1481/135401 12482114/09818 86144798629 6920 48/1 Period 25 22.023 19.52 7.419 16.622 11.09 12.76010875 9077 7.043 88798.0076487 54874340 Period 30 25.808 22.3089.000 7.292 15.372 13.705 11.250 9.427 8.065 7.003 0.1775.517 4.979 Period 40 32825 27 356 23 115 9793 17 158 15.046 11925 9778224471056 233 55484997 Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1000 1.000 1.000 1.000 Period 2 2010 2.020 2.030 2.040 2.050 2.000 2.080 2.100 2. 20 2140 2.100 2.180 2.200 Period 3 3030 3060 3.091 3.1223153 3184 3246 3.210 3.374 3440 3.506 3572 3.640 Period 4 4 IHI. 4192 4184 4241 4310) 4311H 4 508 4 141 4779 4421 5215 53H Period 5 5 101 5.204 5.309 5.416 6.528 5.337 5,087 8.105 3.353 8810 6377 7.154 7.412 Period 8 8 152 3.906 6.488 8.835 8302 8.975 7.13 7.78 8.115 8538 8977 9.442 9.990 Period 7 7.214 7434 7.862 7.806 8.142 8.3042.023 9.487 10.066 10.730 11.414 12.112 12.910 Perlod 8 8 8.286 8.583 8.892 8.214 95489.897 10.63711436 12.300 13 233 14 240 15.327 16.499 Period 9 93H 9 75.5 9755 159 1583 161159 11158811012711 481 1248813579 14776 16 185 17519 19 CHE 217 Period 10 10.482 10.950 11.484 12.008 12.578 13.161 14.487 15.507 17.549 19 137 21.321 23.521 25.950 Period 11 11.507 12.169 12.808 13.486 14.207 14.872 16.045 18.531 20.666 23.045 28.755 32.150 Period 12 12 12 6R3 134 2 1490 15.00 15.817 16.870 18.8772138424 183 27271 SO 850 34931 39 581 Period 13 13 09 14 HBD15618 18 827 11/13 18 HR221.456 24 23 28 1929 38/HH 42219 48 47 Period 14 14.9.17 15.974 17.006 102:2 19.500 21.015 21.215 27.97532.350 37.591 13.372 30.016 59.196 Perlod 15 16.097 17.283 18.000 20.02% 21.579 23.276 27. 62 31.772 37.28043842 51.660 00.965 72.035 Period 20 22.019 24.297 23.870 29.778 33.066 38.786 45.762 57.275 72.062 91.025 115.390 140.628 183.888 Period 25 28 243 32.03034459 416464772754865 73.106 98.347 133 334 18187 249 214 342 008 342 403 471 881 Period 30 S4 / 401 5484/ h/h 1H 185 63499790168113283 184494241x33 36/H/ 1903 991 441 181 Period 40 48.906 60402 75.01 95.023 120.900 151.762 259.067 442.550 737.0911 312.025 2.380.7574161.2 3 7343.868 25 722 Print Done Punt Print Done Data Table Assume that Pine Valley's managers developed the following estimates concerning a planned expansion to its Brook Park Lodge (all numbers assumed): Number of additional skiers per day.. 121 Average number of days per year that weather conditions allow skiing at Pine Valley.. 158 Useful life of expansion (in years)..... 10 Average cash spent by each skier per day.......... $ 243 Average variable cost of serving each skier per day . $ 140 Cost of expansion.... $ 9,000,000 Discount rate .. 10% Assume that Pine Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $900,000 at the end of its ten-year life. It has already calculated the average annual net cash inflow per year to be $1,969,154. Print Done