Answered step by step

Verified Expert Solution

Question

1 Approved Answer

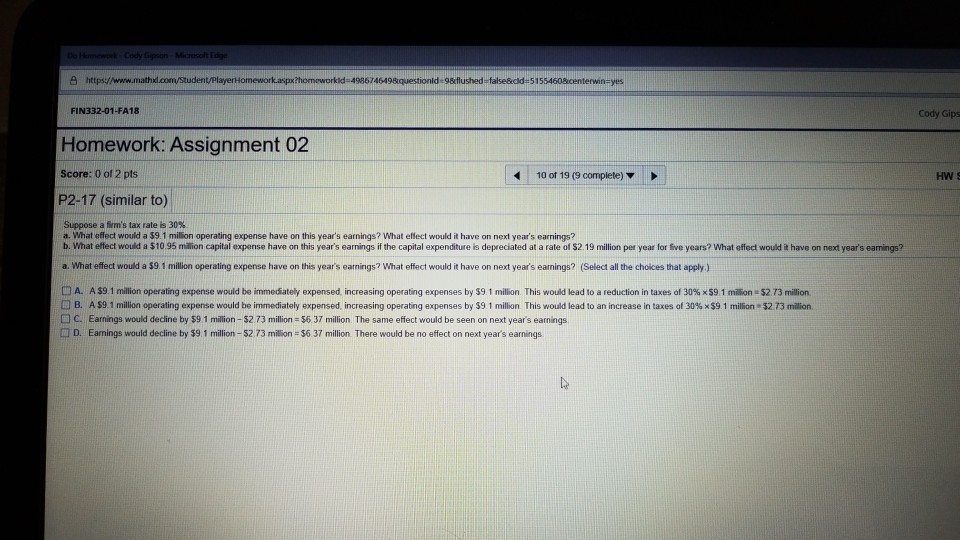

e https:/www.mathdt.com/studentyplayerHomeworkaspo thomeworkid- 4986745498questionid-9aitushed-talsead-s15s460scenterwin-yes FIN332-01-FA18 Cody Gips Homework: Assignment 02 Score: 0 ol 2 pts P2-17 (similar to) Suppose a firm's tax rate 30% b.

e https:/www.mathdt.com/studentyplayerHomeworkaspo thomeworkid- 4986745498questionid-9aitushed-talsead-s15s460scenterwin-yes FIN332-01-FA18 Cody Gips Homework: Assignment 02 Score: 0 ol 2 pts P2-17 (similar to) Suppose a firm's tax rate 30% b. What effect would a $10 95 mlion capital expense have on this year's earmings if the capital expenditure is depreciated at a rate of s2 19 million per year for fve years? What effect would a have on next year's eamings a. What effect would a $9.1 million operating expense have on this years earnings? What effect would it have on next years earnings? (Select all the choices that apply) 10 of 19 (3 compiete)I HW S A AS9 1 million operating expense would be immediately expensed increasing opera in expense s S31 milin. This n ould lead io a reduction races of us s mlS. T 0 B. A S9 1 million operating expense would be immediately expensed, increasing op at g expenses by S9 1 mi on This would lead to a increase in taxes of 30%x501 milion. S273 ma on. C. Earnings would decine by $9.1 milion-$2.73 million- $6 37 million. The same effect would be seen on next years earnings m D. Eamings would decline by $9.1 million-$2.73 milion $6.37 million. There would be no effect on next years earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started