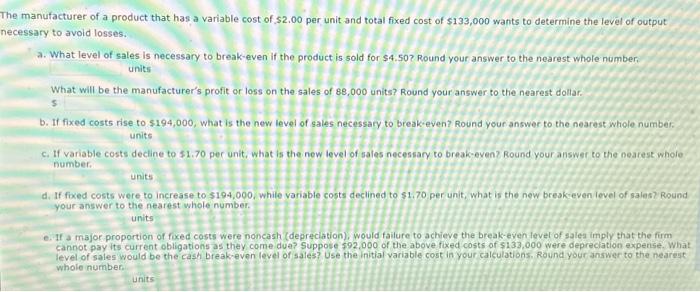

e manufacturer of a product that has a variable cost of $2,00 per unit and total fixed cost of $133,000 wants to determine the level of output cessary to avoid losses. a. What level of sales is necessary to break-even if the product is sold for $4.50 ? Round your answer to the nearest whole number. units What will be the manufacturer's profit or loss on the sales of 88,000 units? Round your answer to the nearest dollar. 5 b. If fixed costs rise to $194,000, what is the new level of sales necessary to break+even? Round your answer to the nearest whole number. units c. If variable costs decline to $1.70 per unit, what is the new level of sales necessary to break-even? Round your answer to the nearest whole number. Units d. If foxed costs were to increase to $194,000, while variable costs declined to $1,70 per unit, what is the new breakceven level of sales? Round your answer to the nearest whole number. units e. If a major proportion of foxed costs were noncash (depreciation), would failure to achieve the break-even level of salea imply that the furm cannot pay its current obligations as they come due? Suppose 592.000 of the above foxed costs of $133,000 were depreciation expense. What level of sales would be the cash break-even level of sales? Use the initial variable cost in your calsulations. Round your answer to the nearast whole number Units e manufacturer of a product that has a variable cost of $2,00 per unit and total fixed cost of $133,000 wants to determine the level of output cessary to avoid losses. a. What level of sales is necessary to break-even if the product is sold for $4.50 ? Round your answer to the nearest whole number. units What will be the manufacturer's profit or loss on the sales of 88,000 units? Round your answer to the nearest dollar. 5 b. If fixed costs rise to $194,000, what is the new level of sales necessary to break+even? Round your answer to the nearest whole number. units c. If variable costs decline to $1.70 per unit, what is the new level of sales necessary to break-even? Round your answer to the nearest whole number. Units d. If foxed costs were to increase to $194,000, while variable costs declined to $1,70 per unit, what is the new breakceven level of sales? Round your answer to the nearest whole number. units e. If a major proportion of foxed costs were noncash (depreciation), would failure to achieve the break-even level of salea imply that the furm cannot pay its current obligations as they come due? Suppose 592.000 of the above foxed costs of $133,000 were depreciation expense. What level of sales would be the cash break-even level of sales? Use the initial variable cost in your calsulations. Round your answer to the nearast whole number Units