Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E Mart is considering purchasing a new inventory control system featuring state-of-the-art technology. Two vendors have submitted proposals to supply E Mart with the

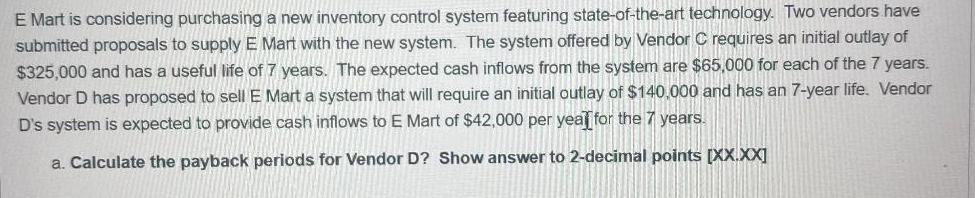

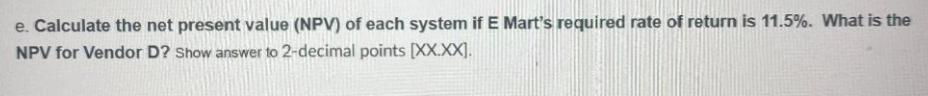

E Mart is considering purchasing a new inventory control system featuring state-of-the-art technology. Two vendors have submitted proposals to supply E Mart with the new system. The system offered by Vendor C requires an initial outlay of $325,000 and has a useful life of 7 years. The expected cash inflows from the system are $65,000 for each of the 7 years. Vendor D has proposed to sell E Mart a system that will require an initial outlay of $140,000 and has an 7-year life. Vendor D's system is expected to provide cash inflows to E Mart of $42,000 per year for the 7 years. a. Calculate the payback periods for Vendor D? Show answer to 2-decimal points [XX.XX] e. Calculate the net present value (NPV) of each system if E Mart's required rate of return is 11.5%. What is the NPV for Vendor D? Show answer to 2-decimal points [XX.XX]. f. Should E Mart accept one or the other, neither or both systems? If one or the other, which one? Explain your reasoning.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the payback period for Vendor D we need to determine how long it takes for the initial investment to be recovered Payback period for Ve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started